Bitcoin price testing key $20,000 level ahead of crucial Fed meeting

- Bitcoin price got slaughtered, with its most significant decline for 2022.

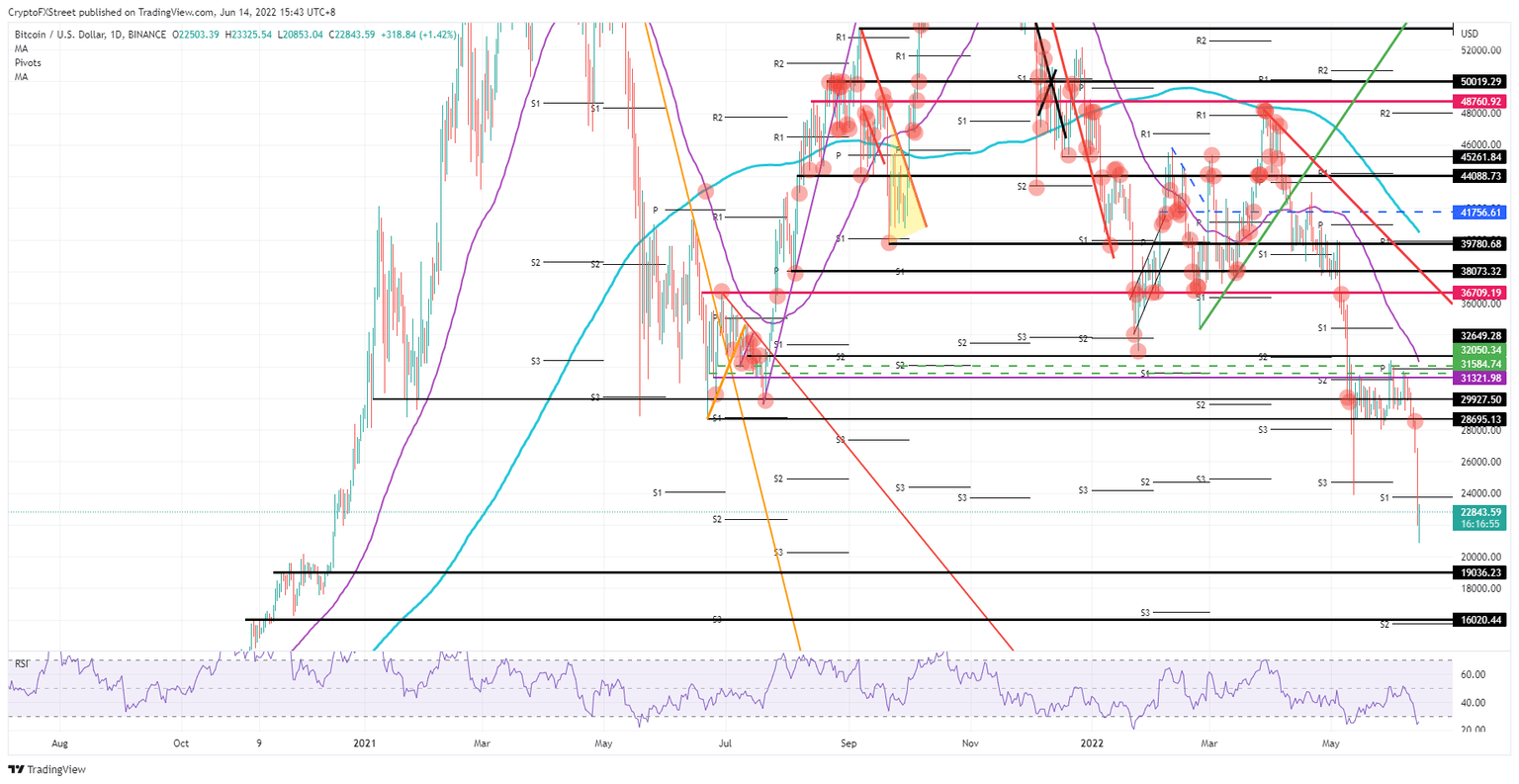

- BTC price saw bears pierce through critical support levels and breaking the backbone of any bullish resistance.

- Expect to see a further drop as the earliest support is sub $20,000.

UPDATE: Bitcoin price has not caught a break in the past week, with Wednesday's dismal price action making it the eighth consecutive day trading in the red. BTC has tested the psychological $20,000 level during the European session, but the bears have not been able to break it in the first attempt. The cryptocurrency bloodbath continues as now giant hedge fund Three Arrows Capital is suffering from the consequences of the Terra and Celsius Network fiascos. Added to the heavy downside pressures from the heavily leveraged cryptocurrency market, the huge risk-off mood dominating financial markets is also penalizing BTC. The Federal Reserve board is meeting on Wednesday, with 50-to-75 basis points rate hikes expected on the menu. More importantly, the Fed will also update its dot plot – its future rate hike projections – and any hawkish changes to (an already pretty hawkish) outlook or any pessimistic words from Chairman Jerome Powell will probably keep decimating high-risk assets like equities and cryptocurrencies.

$BTC owners: Everything you are feeling right now...

— James Lavish (@jameslavish) June 14, 2022

is in here. pic.twitter.com/TRvGL42ML8

Bitcoin (BTC) price is in a tight spot, and subject to some ferocious moves in markets where every asset class has seen outflows of money. Unfortunately, risk assets like cryptocurrencies and stocks have sold off more than bonds and commodities, with only one victory in the forex market: the US dollar. Apart from some dip-buying, which is not likely to be a match for the current bearish pressures dominating markets, price action is likely to simply run further down as the predominant themes are unlikely to fade anytime soon.

Bitcoin’s pain has only just begun

Bitcoin price fell on Monday after dollar strength continued from where it had left off on Friday. The squeeze could not have come at a worse moment as just when people were starting to forget about the Terra LUNA debacle, a new scandal hit the wires after a crypto broker had to report that a blocked order created a backlog and made it unable for traders to exchange cryptocurrencies for dollars. This sparked mayhem and panic in the asset class, with questions quickly raised about whether another LUNA scenario was unfolding or if a default was at hand.

BTC price saw two strong fundamental drivers, therefore, pushing price action to the downside, and broke below $24,000. With the close below the monthly S1, the only possible trade now is a rejection after a retrace back into that S1, and then a drop back to the downside in search of support. The nearest support is $19,036.23, meaning the $20,000 barrier could give way.

BTC/USD daily chart

On the other hand, in the event of a rebound and bulls jumping in at the current low levels, a close back above the monthly S1 and $24,000 could quickly open up more room to the upside. That would mean a return back to $28,695.13 and, with that, an erasing of the move from the past weekend. Should the FED and the BOE help soothe markets by changing their tone on inflation and proving they are doing an excellent job in taming it, expect to see a possible return to $30,000 by next week.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.