This is how Arbitrum and Optimism are dragging users away from Ethereum

- Arbitrum and Optimism are noting twice the monthly user growth than the Ethereum Virtual Machine (EVM) average.

- Ethereum dominates DeFi, but the growing Layer-2 narrative boosts platforms like Arbitrum, challenging its dominance.

- Further facilitating Arbitrum’s growth was the native ARB token launch that put the chain at par with other L2.

Arbitrum became the highlight of the month as the Layer-2 (L2) blockchain launched its native token, ARB. Since then, the L2 narrative that was once the talking point of 2022 has exploded again, with users now jumping to these alternatives over the likes of Layer-1 chains like Ethereum.

Ethereum losses are L2’s gains

Over the last few weeks, L2 blockchains have noted a lot of attention, but the growth in their presence goes back to last year. At the same time, Ethereum, despite having the largest user base, has been noting a decrease in monthly user growth. Binance’s BNB Chain has been reaping the benefits from this as the declining Ethereum user base moved over.

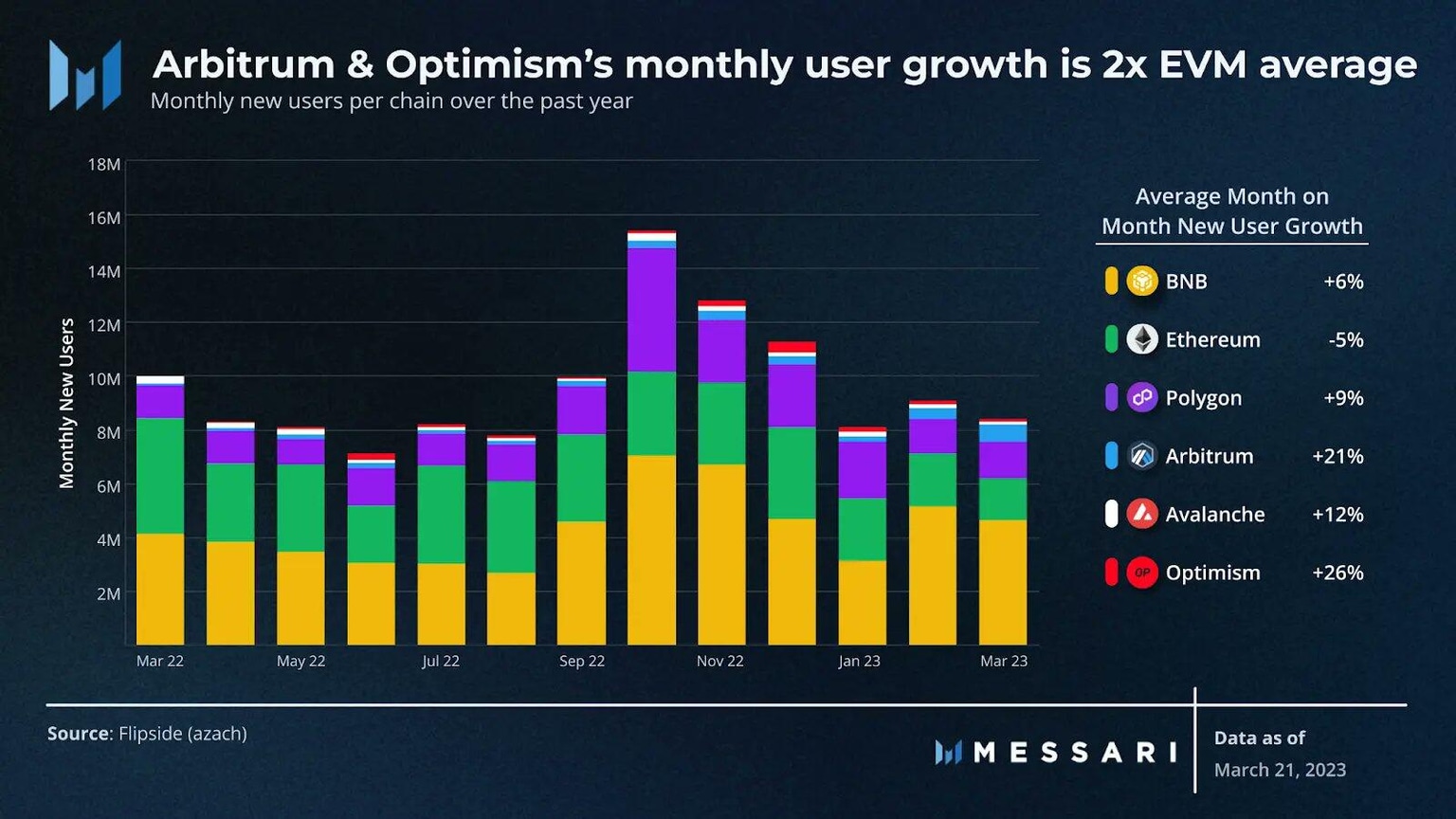

However, the reason behind Ethereum’s declining user base goes back to the rise of L2 demand, which has been enjoyed by Arbitrum and Optimism, the leading Layer-2 blockchains. Over the last 12 months, the average month-on-month new users on Arbitrum have increased to 21%, while for Optimism, the figure stands at 26%. The growth for BNB Chain and Ethereum fell to 6% and -5%, respectively.

Monthly user base growth over the last year

Nevertheless, despite having lower user base growth, Etheruem holds far better user retention. Considering Ethereum is known as the home of Decentralized Finance (DeFi) with over 720 on-chain protocols, and in the DeFi sector, the network has a far better grip than other L1 or L2 chains.

Etheruem monthly user retention (DEXes)

In the Decentralized Exchange (DEX) sector alone, Ethereum has a 5% higher long-term user retention among the likes of BNB Chain and Arbitrum. DEXes is the largest sector in the DeFi space, with over $18 billion locked in total value over 750 protocols. The reason behind Ethereum’s sustained user base here is the deeper liquidity that it offers among its native DEXes.

L2s Arbitrum and Optimism are also catching up by maintaining above-average long-term user retention. This is primarily due to the DeFi space expanding rapidly, providing higher incentives to investors.

ARB token could help Arbitrum’s case

The recent launch of the token was met with mixed reactions as the cryptocurrency noted significant selling immediately after the airdrop first took place. In the week since then, ARB has been maintaining a bearish outlook, with the altcoin falling by 9.2% 24 hours ago.

ARB/USD 1-day chart

For ARB to help Arbitrum’s case, it needs to initiate and sustain a rally that could be achieved with the help of sincere buyers. Although considering the current market conditions, securing profits appears to be the primary motivation of investors, which could change to a long-term bullish stance if the crypto market shows some sustained growth.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.