This indicator suggests the XRP price will get extremely volatile in September

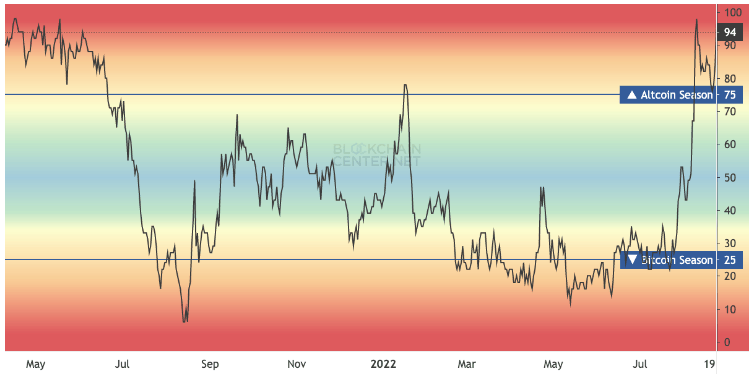

- The Alt-Coin Index witnesses new highs for 2022.

- Ripple price liquidates the $0.32 low established in July

- Invalidation of the bearish thesis is a breach above $0.48.

Ripple’s unpredictable back-and-forth nature signals smart money wants full ownership of the big move to come.

Ripple price is getting out of hand

Ripple price continues to undergo erratic market behavior during the final days of August. The back-and-forth price action is indicative that a big move is coming. Additionally, FXStreet's News Reporter Ekta Mourya noted last week that the Alt-Coin Index reached new highs during 2022.

"The altcoin season is a period where altcoins steadily outperform Bitcoin. While this event does not guarantee profits due to mass volatility, altcoin season is considered the ideal time for traders to diversify their portfolios," explained Ekta Mourya.

Alt-Coin Index

Additionally, Ripple price has witnessed a breach of the $0.32 bottom established in July. The breach of the low came in with a large influx of volume on intra-hour time frames. Bulls were likely aiming for higher targets based on the bullish momentum witnessed in August and are now holding a losing position.

XRP price currently auctions at $0.328. The next bearish targets are $0.28 and $0.24 if the bulls can not prompt an immediate turnaround. Invalidation of the bearish thesis remains at $0.48.

XRP/USDT 4-Hour Chart

In the following video, our analysts deep dive into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.