- LUNA Classic price wicked up to $0.000275, collecting liquidity above all swing highs formed after October 15.

- This move was a second opportunity to add to the short position for LUNC discussed previously.

- Investors can expect the altcoin to slide lower as the market hints at a correction.

LUNA Classic price has been at the mercy of sellers for quite some time, but that changed on October 30. As buyers stepped up, LUNC exploded higher, but the gains were undone just as quickly, leaving this move as a liquidity run before the altcoin continued to slide lower.

LUNA Classic price ready for its second leg

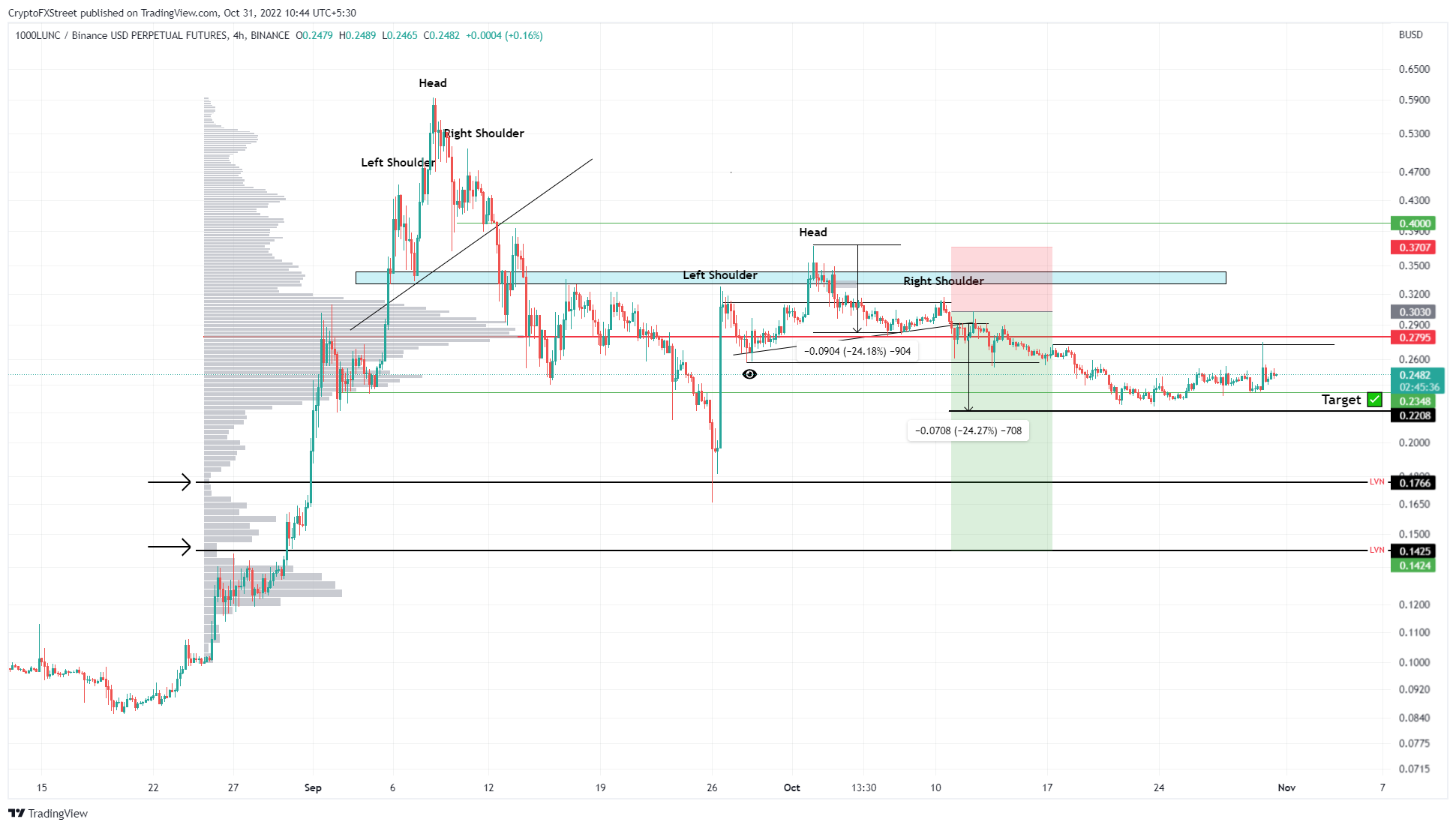

LUNA Classic price has been on a downtrend since it broke out of its head-and-shoulders setup on October 10. Since then, the altcoin has shed roughly 15% to where it currently stands - $0.000248.

Even before the breakdown, a short setup was provided in a previous article and is still in play. LUNA Classic price formed a bottom around $0.000224, just above the head-and-shoulders pattern’s target at $0.000200. A bounce from this makeshift bottom propelled LUNC higher, but on October 15, it spiked higher to collect the buy-stop liquidity. This move was a second opportunity for investors to short the altcoin..

The $0.000220 is the first target for this downswing, but based on the volume profile indicator, there is evidence that LUNA Classic price could slide even lower. The low-volume nodes at $0.000176 and $0.000142 are the stretch targets for this short setup.

LUNCUSDT 4-hour chart

While the outlook for LUNA Classic price seems as bearish as it can get, investors need to note that altcoins are going haywire in light of the recent bullish resurgence. Therefore, a sudden spike in buying pressure that propels LUNC to produce a four-hour candlestick close above $0.000279 will invalidate the bearish thesis.

This development could see LUNA Classic price extend this run-up to $0.000310.

Here's how Bitcoin's moves could affect LUNA Classic price

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC remains calm before a storm

Bitcoin price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as investors absorb the tariff announcements.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

Ethereum Price Forecast: Whales increase buying pressure as developers set April 30 for Pectra mainnet upgrade

Ethereum developers tentatively scheduled the Pectra mainnet upgrade for April 30 in the latest ACDC call. Whales have stepped up their buying pressure in hopes of a price uptick upon Pectra going live on mainnet.

BTC stabilizes while ETH and XRP show weakness

Bitcoin price stabilizes at around $87,000 on Friday, as its RSI indicates indecisiveness among traders. However, Ethereum and Ripple show signs of weakness as they face resistance around their key levels and face a pullback this week.

Bitcoin: BTC remains calm before a storm

Bitcoin (BTC) price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.