Things have suddenly changed for the Shiba Inu price, is the bottom in?

- Shiba Inu price shows off an impressive 40% rally in one day.

- SHIB price has also breached a daily trend line, which should not be taken lightly.

- It may be worth waiting for confirmation of the downtrend invalidation with a break above $0.00001437.

Shiba Inu price may have bottomed but this can only be confirmed if the current rally persists. Traders should be aware of several factors.

Shiba Inu price warrants further investigation

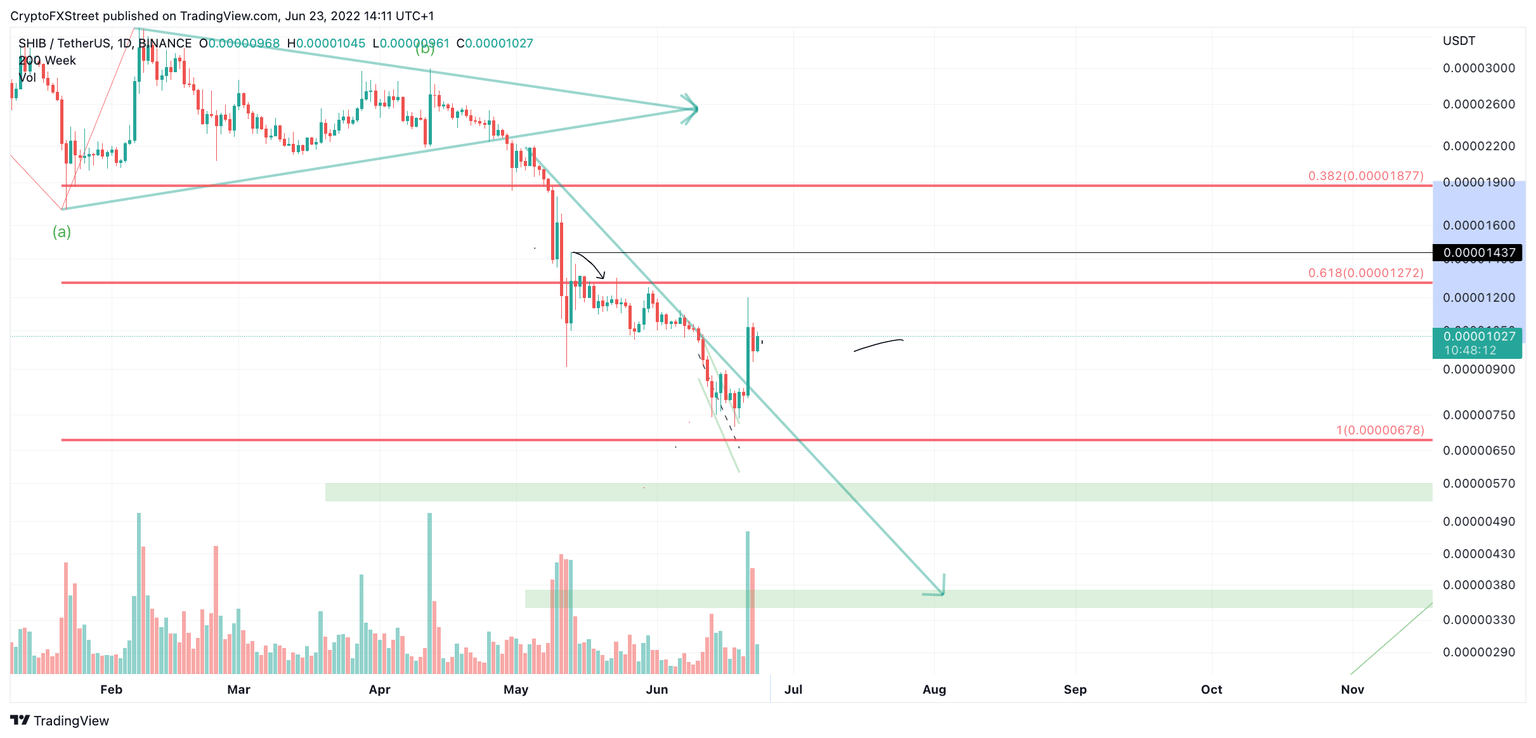

Shiba Inu price has suddenly changed as the bulls have printed a significantly large bullish engulfing candle on the daily chart. The rally that ensued on June 21 conquered 40% of lost gains since the June 11 sell-offs. The newly established candle, which broke through a descending trendline, is now the largest candle within the downtrend. This new piece of evidence could change things immensely.

Shiba Inu price shows an increase in volume accompanied by the optimistic candle. There is, however, an equal amount of volume on June 22, which had little impact on the SHIB price, This subtle piece of evidence warrants patience and further investigation before investing wholeheartedly into the notorious meme token.

SHIB/USDT 1-Day Chart

Shiba Inu price may have produced an X wave or the start of a new bull run, but this can only be confirmed in retrospect. A safe invalidation is essential for traders looking to partake in the next move.

In short, let the top of the previous wave four get breached at $0.00001437 and enter after seeing a three-wave correction. This is a safe way to approach the potential bull run. If $0.00001437 gets breached, the bulls could rally as high as $0.00001900, resulting in a 90% increase from the current Shiba Inu price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.