THETA Price Analysis: THETA gears up for another rally as $10 beckons

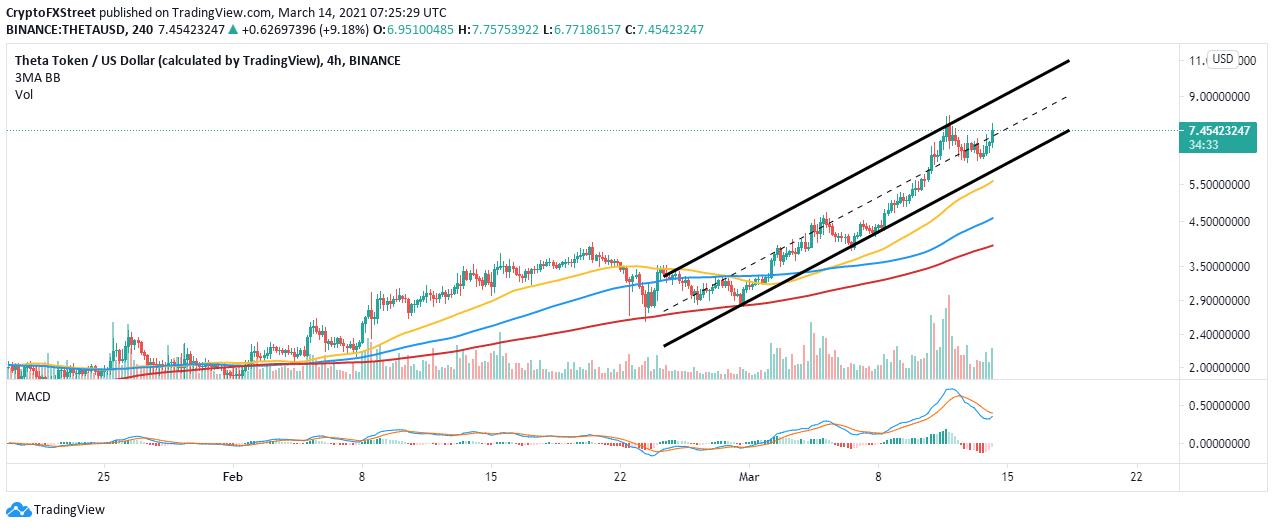

- THETA has just broken above an ascending channel’s middle boundary resistance, restarting the uptrend.

- The uptrend is supported by improving technical levels based on the MACD.

- Resistance at $8 may either stop or delay the upswing and perhaps lead to an increase in selling orders.

THETA has been persistent in the push for new record highs, despite the massive upswing since the beginning of the year. A recently achieved all-time high of $8 marked a temporary halt to the uptrend. A correction came into the picture with THETA testing support at $6.2. At the time of writing, THETA trades at $7.55 after overcoming the technical pattern’s resistance.

THETA’s technical breakout eyes upswing to $10

The price is trading within the confines of an ascending parallel channel. Following the support at $6.2, THETA bulls have been focused on stepping above the hurdle at $8. Meanwhile, the cryptocurrency is trading above the channel’s middle boundary resistance. On the upside, eyes are glued on the hurdle at $8, which, if broken, will pave the way for gains past $10.

THETA 4-hour chart

The Moving Average Convergence Divergence (MACD) had flipped bearish but is currently giving out a bullish impulse. The MACD line (blue) is likely to cross above the signal line, further cementing the bulls’ presence in the market.

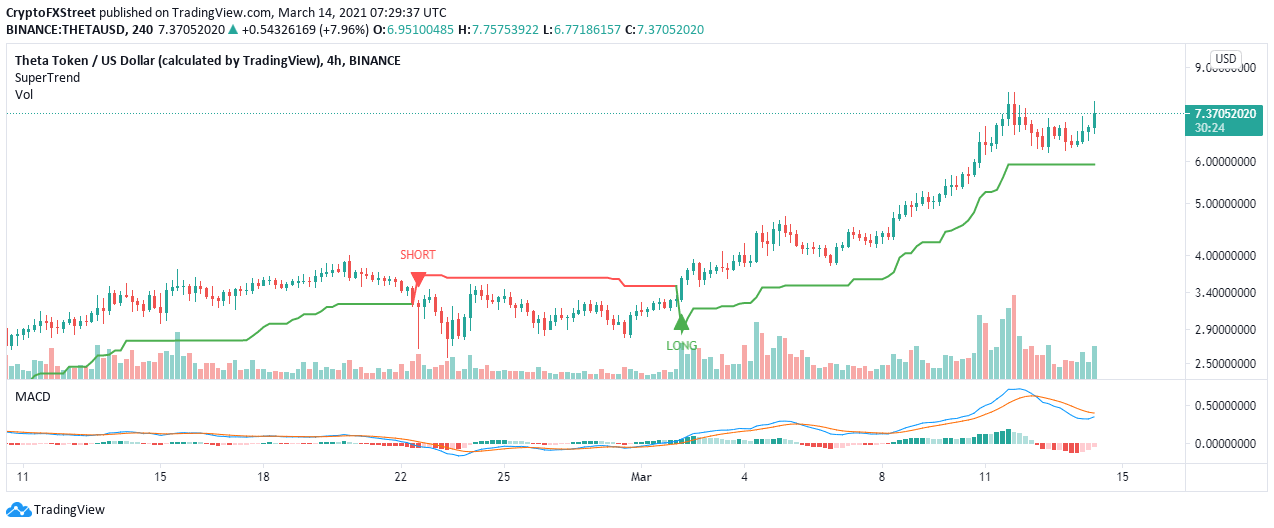

The same 4-hour chart reveals that the SuperTrend indicator is still positive. In other words, the THETA’s rally is intact, and new all-time highs are possible in the coming sessions. The SuperTrend indicator identifies an asset’s general trend and suggests when to take a long or short position.

THETA/USD 4-hour chart

Looking at the other side of the fence

It is worth mentioning that THETA will fail to carry on with the uptrend to $8 and $10, respectively, if the ascending parallel channel’s midline support shatters. The MACD also has to confirm the bullish outlook to reinforce the uptrend. Note that if the indicator resumes the previous downward movement, we can expect THETA to fall appreciably.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren