- Bitcoin price continued its upward trend post US Federal Reserve’s 25 bps interest rate hike.

- Collapse of US banks and decline in US equities is fueling the asset’s price rally to its bullish target of $35,000.

- Macro uncertainty and possibility of future rate hikes has failed to deter market participants from pushing BTC higher.

Bitcoin price has resumed its upward trend post the US Federal Reserve’s 25 basis point (bps) interest rate hike. Experts like BitMEX CEO Arthur Hayes have noted the impact of failure of US banks on Bitcoin’s uptrend.

Also read: GAL, DYDX, APT and BIT token unlocks are lined up in May amidst key macro events

Catalysts driving Bitcoin price higher

Bitcoin price resumed its uptrend towards its $35,000 target with key macro data releases this week. The US Central Bank announced a 25 bps interest rate hike on May 3, in line with the expectations of market participants. Bitcoin and altcoin prices reacted positively to the announcement.

BTC climbed to the $29,000 level, in continuation of its price rally. There were fears of macroeconomic uncertainty and BTC price declining in the event of a higher rate hike, however the Central Bank’s decision fueled the bullish thesis for the risk asset.

The second key catalyst is the collapse of US banks. BitMEX founder Arthur Hayes highlighted that the collapse of the banking system and failures of banks like FRC have paved way for capital to rotate in risk assets.

Hayes told his 377,400 Twitter followers that he is shorting US bank related stocks, in anticipation of gains and further price rally in Bitcoin. Hayes’ thesis points at capital rotation out of declining US equities and into BTC.

A few of these banks won't be around next Monday. Unless the Fed cuts rates and signals more cuts, or #banktermfundingprogram eligible collateral is expanded to any loan on a US federally chartered bank's balance sheet, it's goblin town!

— Arthur Hayes (@CryptoHayes) May 2, 2023

I got some puts last night. Yachtzee! pic.twitter.com/Ahe0fLqQ7C

While Bitcoin and US equities enjoyed a relatively high correlation throughout 2022, it dwindled in the beginning of 2023. Bitcoin price continues its uptrend despite a decline in US equities as the two assets fall out of correlation and BTC yields gains for its holders.

Why Bitcoin price rally to $35,000 is likely

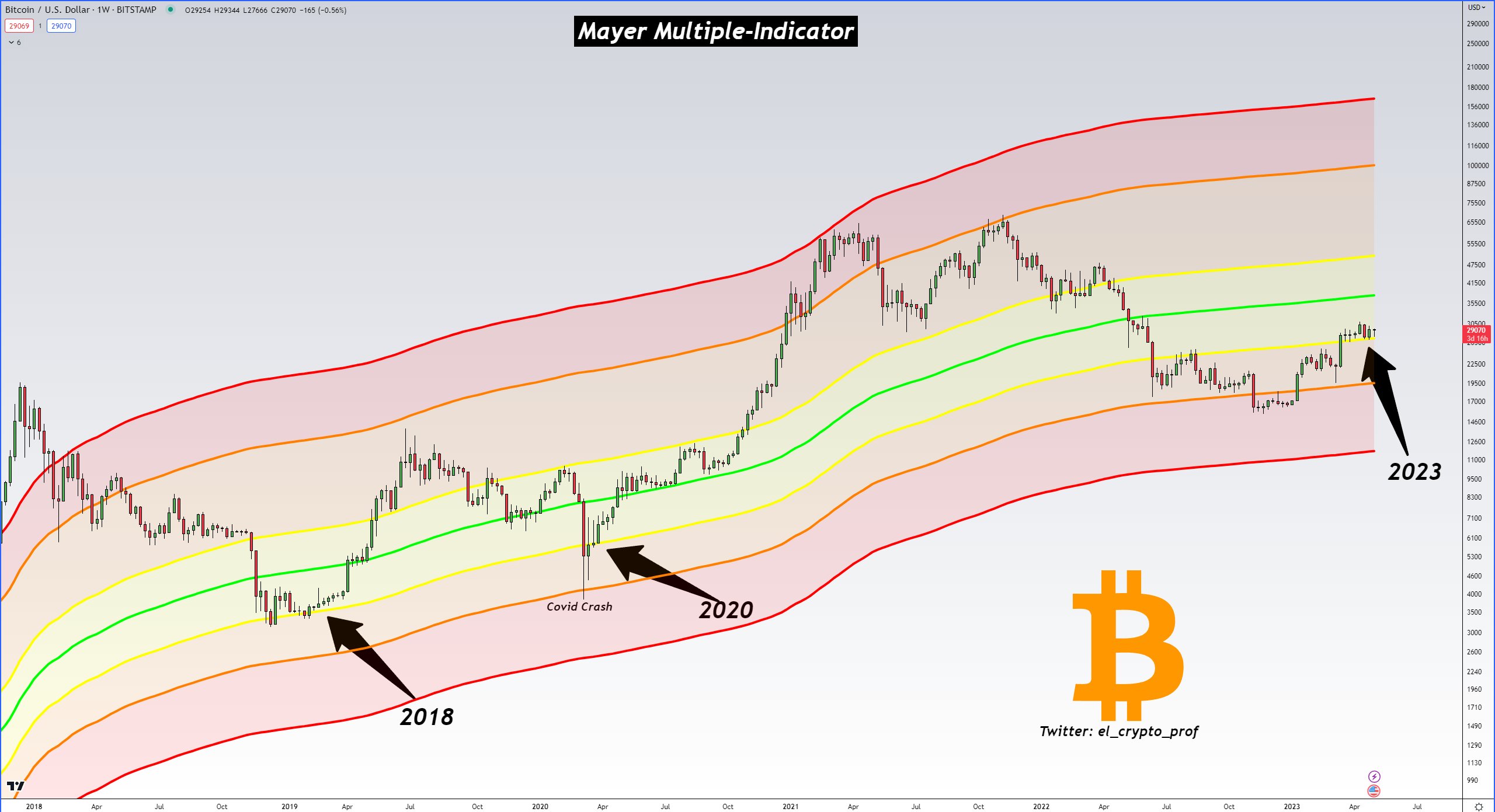

El Crypto Prof, a technical analyst and Bitcoin trader evaluated the BTC chart and applied the Mayer Multiple Indicator to it. The Mayer Multiple is an oscillator that calculates the ratio between price, and the 200-day moving average.

The long-term moving average is widely recognised as an indicator for identifying a macro bull or bear bias among crypto market participants. The expert notes that Bitcoin price stayed above the band in the chart below, and the line plays a key role in BTC’s price trend.

BTC/USD 1W price chart

The expert has identified the next strong resistance for Bitcoin at $37,000. The analyst remains bullish on Bitcoin.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TRUMP token leads $906 million in unlocks this week with over $330 million release

According to Tokenomist, 15 altcoins will unlock more than $5 million each in the next 7 days. Wu Blockchain data shows that the total unlocked value exceeds $906 million, of which the TRUMP token will unlock more than $330 million.

Why Mantra token’s dramatic 90% crash wiped out $5.2B market share

Mantra price hovered at $0.83 during the Asian session on Monday, following a massive 90% crash from $6.33 on Sunday. The crash wiped out $5.2 billion in the token’s market capitalization, quickly drawing comparisons to the infamous collapse of Terra LUNA and FTX in 2022.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC is on the verge of a breakout while ETH and XRP stabilize

Bitcoin price approaches its key resistance level at $85,000 on Monday; a breakout indicates a bullish trend ahead. Ethereum and Ripple found support around their key levels last week, suggesting a recovery is in the cards.

Bitcoin and crypto market sees recovery as Fed official says agency ready to stabilize market if necessary

Bitcoin rallied 5% on Friday, trading just below $84,000 following Susan Collins, head of the Boston Federal Reserve (Fed), hinting that the agency could stabilize markets with "various tools" if needed.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.