These technical indicators paint a positive picture for Binance Coin price

- Binance Coin price remains subdued and the new monthly pivot has its work cut out as support.

- BNB price’s consolidation slightly favours bulls.

- Expect to see a pop higher above $336.5 towards $360.

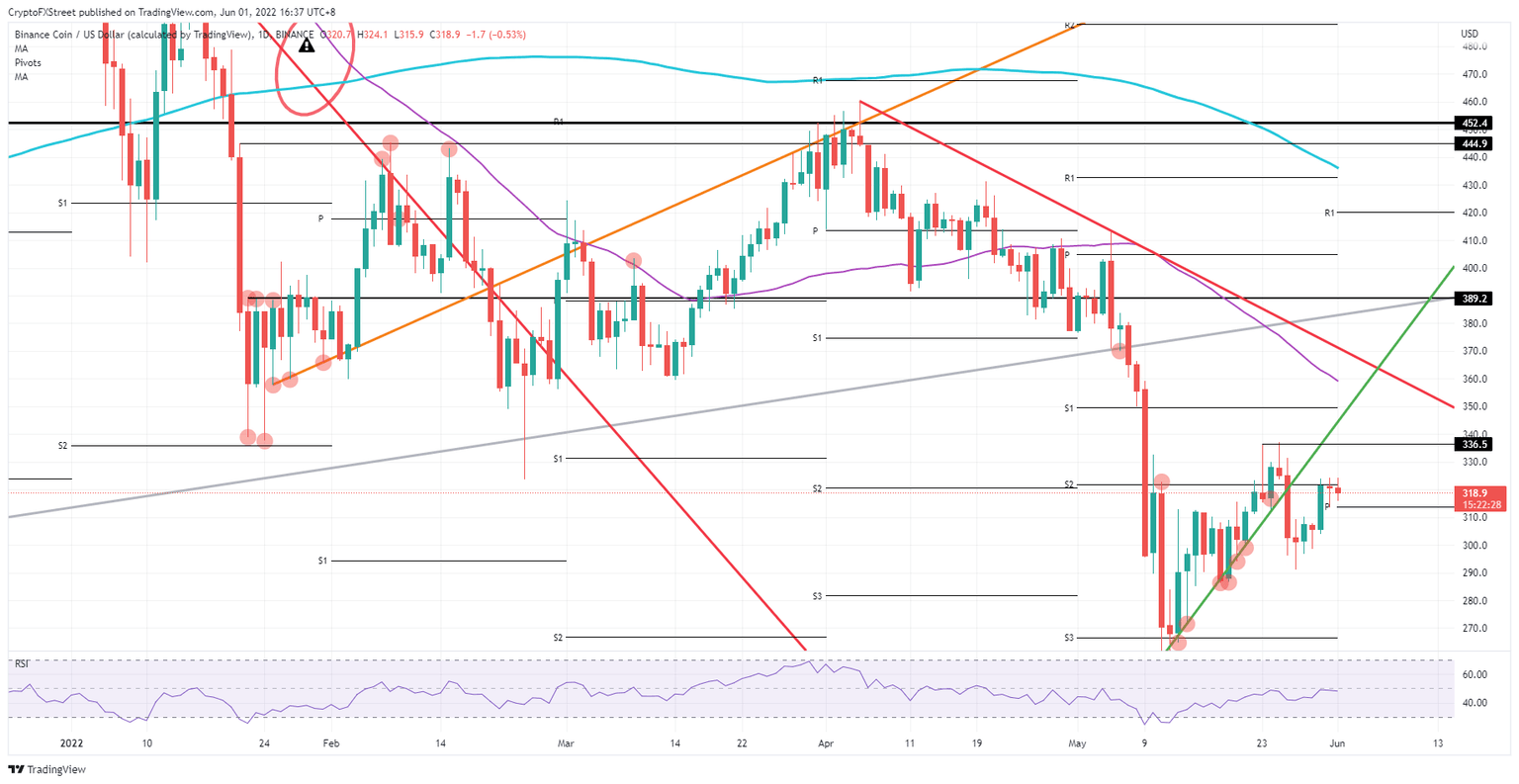

Binance Coin (BNB) price is in consolidation mode, printing lower highs and higher lows for the trading session. To preserve last week’s gains, the new monthly pivot for June at $313.80 will need to step up its game and provide robust support. Expect to see a test and bounce off this pivot and a swing back higher, breaking above $336.50, and afterwards a rally towards the intersection with the green and red trend line at around $360.

BNB price is set to start the new month with at least 15% gains forecast

Binance Coin price has been forming a triple top with price action capped at $324.00. The pattern’s lows are getting higher, however, indicating bears are getting squeezed. Expect to see a breakout soon, certainly if the new monthly pivot at $313.80 can immediately show its strength and provide plenty of support, refraining BNB price from tanking.

BNB Price is thus set to swing back up and hit $336.50, with, once it breaks above, plenty of areas to rally another few dollars. A target looks set at around $360 where the red descending trend line from the downtrend intersects with the green ascending trend line since the beginning of May. As these two trends converge, expect to see a breakout to the upside as the hot crypto summer gets underway.

BNB/USD daily chart

Since Monday, the dollar has made a bit of a comeback against several currencies, as well as for cryptocurrencies. This dollar strength, when continued, could start weighing again on cryptocurrencies overall and could see a global sell-off again within the crypto asset class. That would mean a leg lower for BNB price, which could see it break below the new monthly pivot and slip towards $290.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.