- The Crypto Fear & Greed Index signals fear among market participants as Bitcoin, Ethereum and other top crypto assets suffer a correction.

- Crypto whale activity, institutional involvement, lawsuits and regulatory concerns are the dominant narratives in this cycle.

- PEPE is one of the most dominant meme coins across social platforms, while interest in Dogecoin and Shiba Inu fades.

Crypto markets are going through a tough ride this September so far, with most assets registering hefty losses as investors turn risk-averse. This fear among traders is driven by five key narratives, according to analysts from Santiment, who have examined the role of each of them in shaping the crypto market cycle and their impact on future prices.

The Fear & Greed Index is a key indicator of market sentiment. It is a metric calculated taking into account social media mentions, meaning the dominance of assets in chatter across social media platforms, surveys, trends, volatility and volume.

The Fear & Greed Index shows market participants are currently fearful following the steep correction in crypto prices. Bitcoin (BTC) has slipped to $57,000 and Ethereum (ETH) hovers around $2,400, slowly recovering from the decline earlier this week.

Crypto Fear & Greed Index

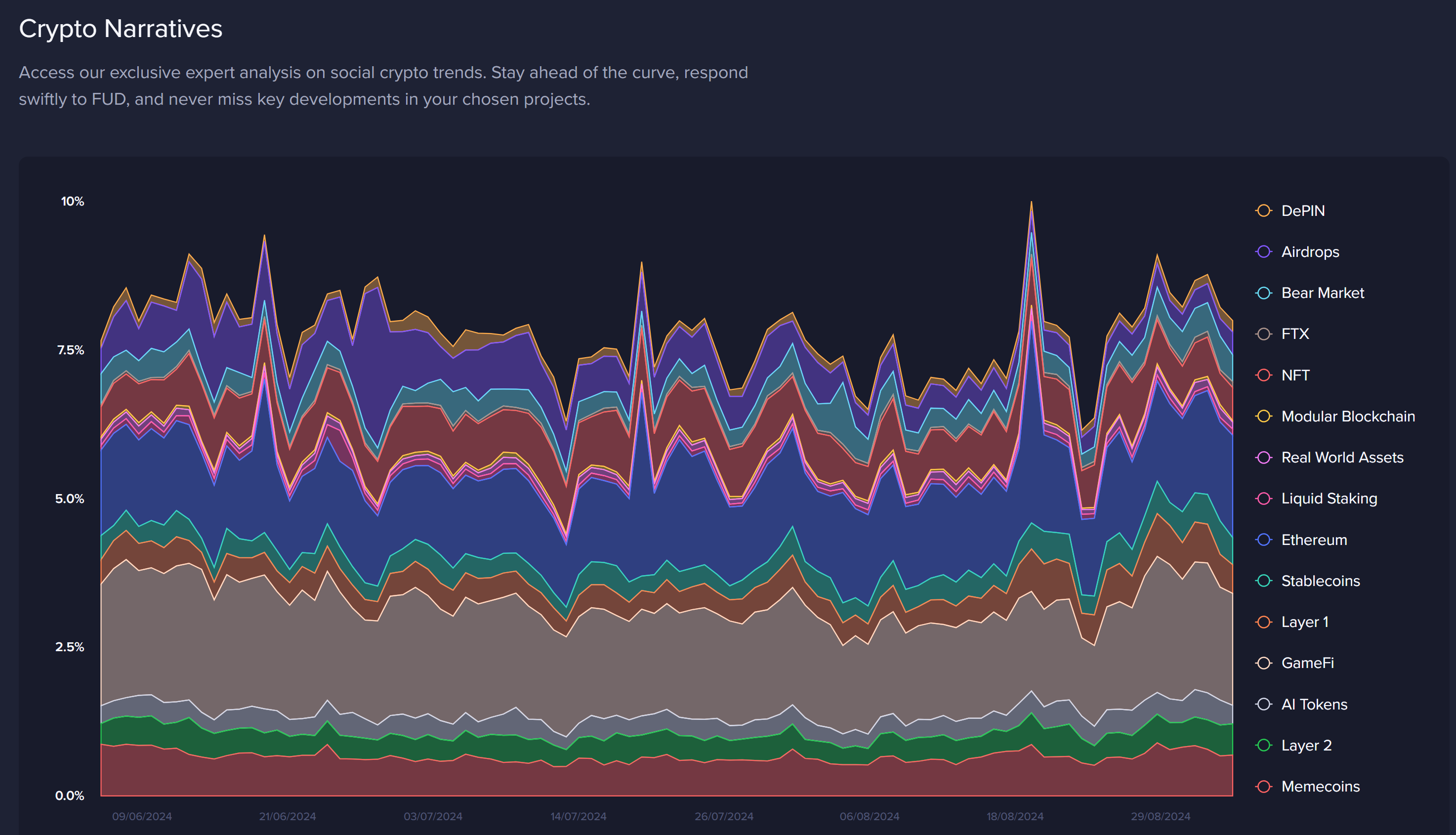

While the meme coin narrative dominated the first half of 2024, the second part of the year has been so far led by other emerging narratives such as institutional investor demand for digital assets, whale activity, and regulatory concerns.

Five key crypto narratives this cycle

-

Crypto’s large wallet investors and their activity

Whale activity influences asset prices, per on-chain data and historical trends. Large wallet investor movements, typically accumulation or large-scale selloffs have had a direct impact on asset prices this cycle.

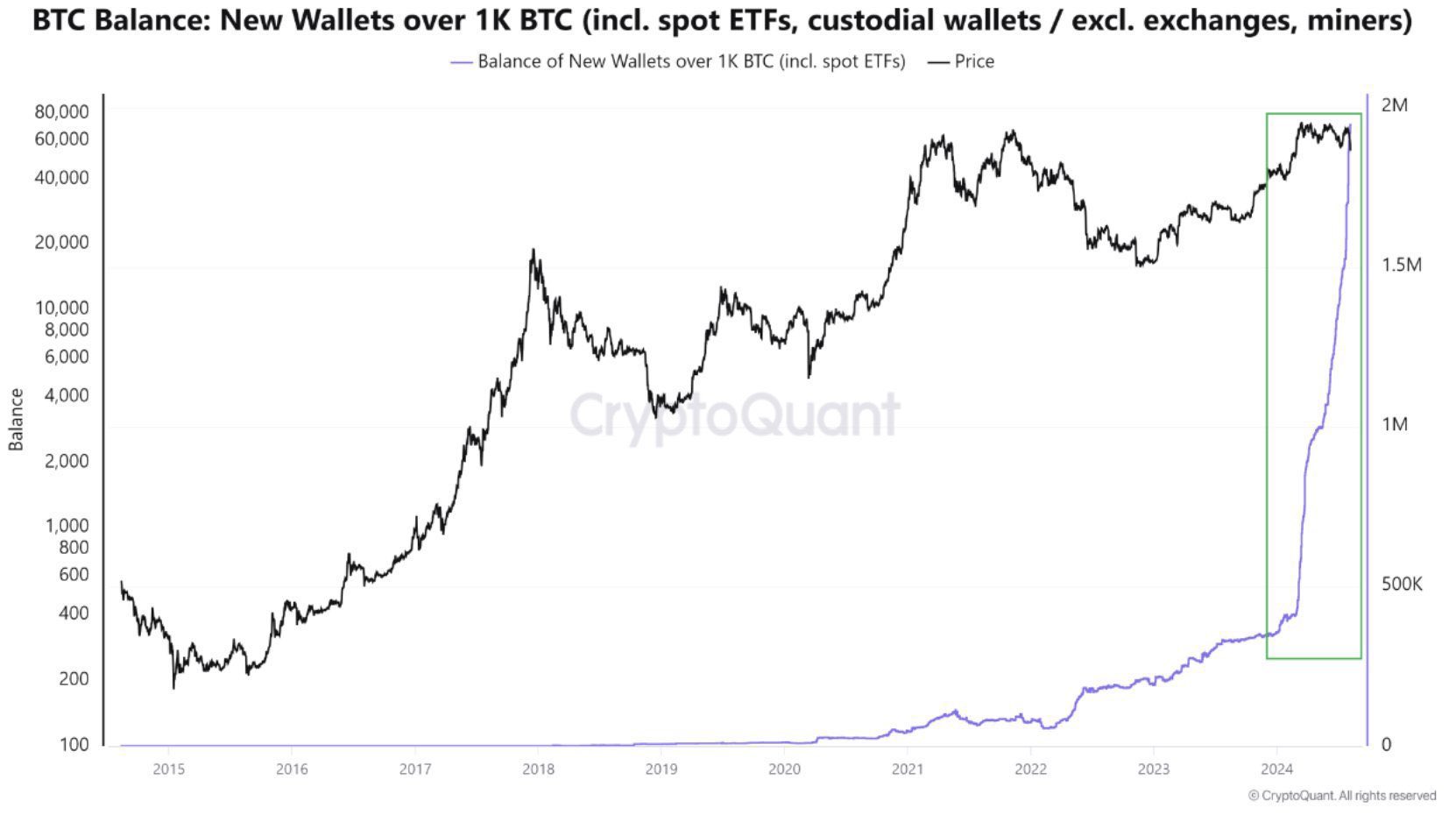

The number of entities holding more than 1,000 Bitcoin has steadied at 1,600 once the hype surrounding Bitcoin ETF settled and price stabilized. Data from Glassnode shows whale activity surged in H1 2024, likely in response to the ETF approvale. This pushed the number of entities holding over 1,000 BTC to 1,600. This number has steadied since then even as the price has fallen to $57,000, down nearly 22% from the all-time high of $73,777, observed on March 14.

Bitcoin number of entities with a balance greater than 1,000 BTC

-

Institutional investors

Institutional investors have consistently fueled demand for Bitcoin. Data from a recent report by River, a Bitcoin Financial Services company shows that institutions hold 587% more BTC in 2024, than they did in 2020.

Apart from Bitcoin, other cryptocurrencies have noted a demand from institutional investors. Santiment analysts said in a recent report that institutional interest in Toncoin (TON) has developed and traders are vigilant for new buy-ins that could shift the market’s direction.

-

Regulatory and legal concerns

Amidst regulatory and legal concerns, the US Securities & Exchange Commission’s (SEC) lawsuit against Kraken, Uniswap, Ripple, and the Wells Notice sent to NFT platform OpenSea have also influenced market sentiment.

The SEC could file an appeal against the final ruling in the Ripple lawsuit. The regulator’s latest enforcement action is the Wells Notice sent to OpenSea, alleging the sale of NFTs violates security laws.

-

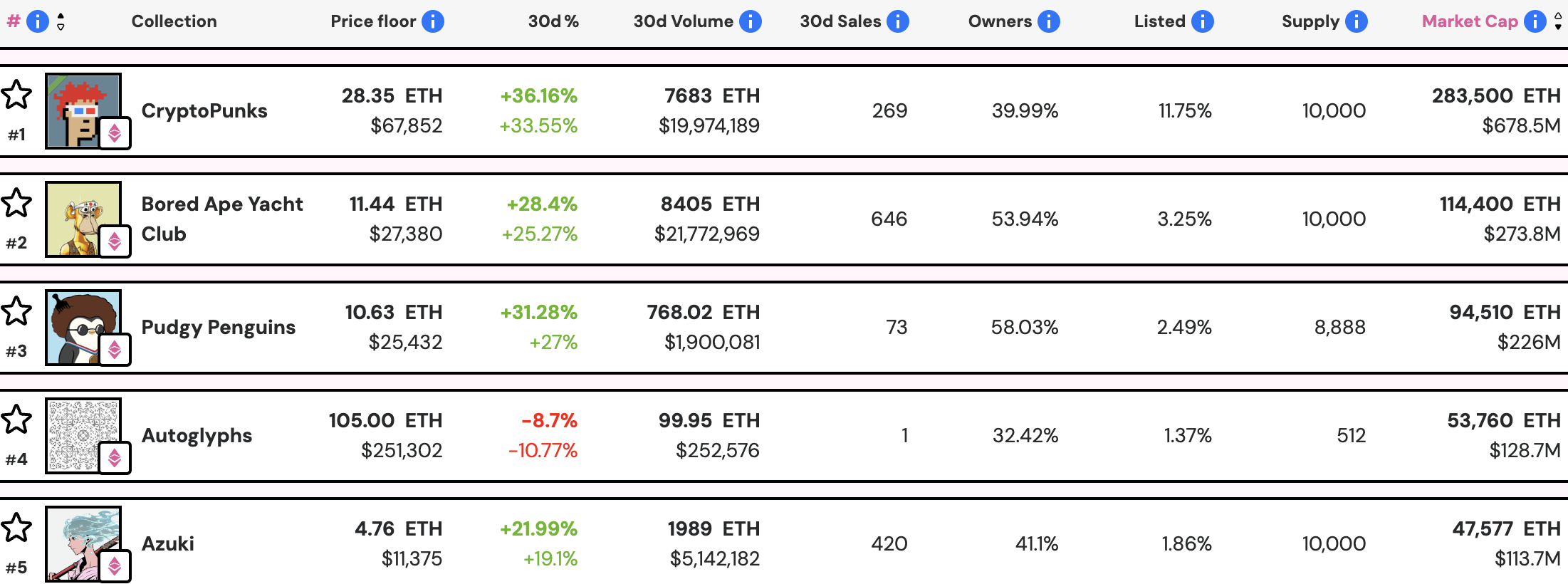

NFT collections

The market for NFTs continues to evolve as artists join the digital art space, amidst legal uncertainty. NFT platforms like OpenSea, Rarible, Axie Infinity, or Mintable gained popularity in August. However, new projects failed to meet expectations and led to price fluctuations in several projects.

NFTPriceFloor shows the top five NFT collections, their floor prices, and changes in the last 30 days.

NFT collections and 30-day changes in floor price, volume and sales

-

Meme coins

The meme coin narrative sustained through the first half of 2024. This asset category yielded the highest returns for traders, per CoinGecko data, amid the frenzy coming from the creation of many coins in the Solana ecosystem such as Dogwifhat (WIF). However, in the second half of the year, the focus shifted to sectors like Real World Asset (RWA) tokenization, Artificial Intelligence (AI) and NFT coins.

The Santiment report shows that PEPE (PEPE) continues to remain dominant among meme coins, while the popularity of dog-themed cryptocurrencies Shiba Inu (SHIB) and Dogecoin (DOGE) has declined.

Analysts compiled a list of narratives for the ongoing cycle in the following chart:

Crypto narratives this cycle

Crypto market capitalization is back above $2.089 trillion on Thursday, following the correction in asset prices early this week. Still, it is 21% below the $2.678 trillion mark seen at the end of H1.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.