$46,000 is on the cards for a bullish uptick, but concerns about lack of buyer support below $30,000 are a real threat for analysts.

Bitcoin (BTC) is working to flip $40,000 to support after a record $10,000 bounce in four hours on May 19 — what are the price levels to watch?

After its stunning recovery from $30,000 lows, BTC/USD has held onto its gains, practically erasing the previous day's carnage.

$46,000: Old support flips to resistance

With spot price still well below expectations, however, analysts are keenly eyeing possible resistance levels — as well as support should a fresh dip take hold of the market.

Bullish signs are everywhere at the time of writing. Funding rates are deeply negative, outflows from exchanges reached sky-high levels in the past 24 hours and leveraged traders have been effectively washed out of the market with $8 billion in liquidations.

Now, attention is turning to two price levels in particular, with these marking a likely floor and ceiling, respectively.

First is $46,000, around $6,000 or 15% above spot price. As noted by on-chain monitoring resource Whalemap, this former support level is apt to act as resistance should Bitcoin see a further impulse move on short timeframes.

$46,000 is also where the significant 20-week weighted moving average (WMA) currently lies. Traditionally during bull runs, weekly candles stay above the rising 20WMA, and a violation of the trend could yet be a bad omen.

"In terms of TA, 33k looks like a support," Whalemap explained alongside charts.

"A very similar set up can be observed at 46k which is shown below. Previous support at 46 should also be resistance if we bounce from 33."

BTC/USD support and resistance areas of interest. Source: Whalemap/ Twitter

While those comments were made before the capitulatory move to $30,000, the appetite for selling remains closer to $50,000 and beyond.

The $19,000 vacuum

On the flipside, Whalemap warns, a comparative lack of buyer support below Wednesday's lows could potentially open up a path to a further capitulation run as low as $19,000.

"We need to hold 29k," the Whalemap team told Cointelegraph.

"Otherwise there is a large gap in supports up until 19k. This means buying 29k-->33k prices is a great risk/reward trade."

Momentary spikes in spot price on exchanges suggested that large trades to the upside were being entered at levels around $40,000 overnight.

"If you buy something because price went up, you will sell as soon as price stops going up or goes down... If you buy something because you believed current price was below fair value or future growth would increase value, when price falls you will buy more...," Mark Yusko, founder, CEO and CIO of Morgan Creek Capital Management, told Twitter followers overnight.

"Remember on days like today, there is always a latter buying from the former..."

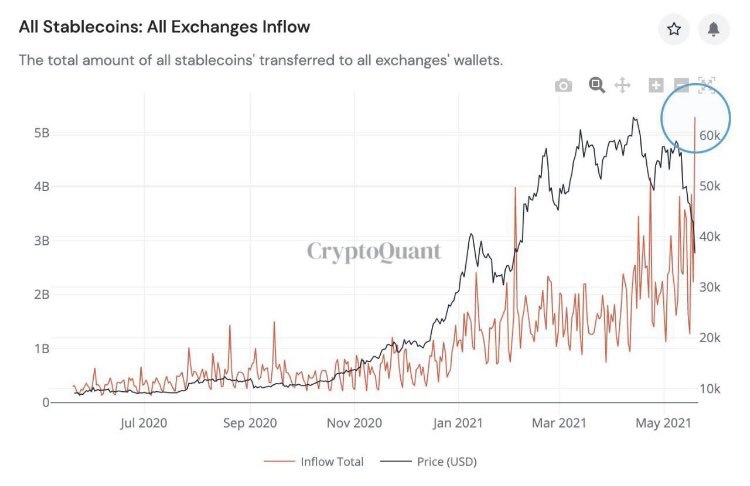

The volume of stablecoins flowing into exchanges stands as testimony to the level of interest in acquiring cryptocurrency in the $30,000. According to data from CryptoQuant, this has reached a new all-time high.

Stablecoin inflows to exchanges. Source: CryptoQuant

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin: Holds $105K mark as MicroStrategy adds 11,000 BTC, Trump pardons Silk Road creator Ulbricht

Bitcoin price trades around $105,000 on Wednesday after rebounding from the $100K support level the previous day. Michael Salyor’s MicroStrategy announced on Tuesday that it has acquired 11,000 BTC worth $1.1 billion, and President Donald Trump pardoned Silk Road creator Ross Ulbricht.

World Liberty Financial adds $47 million of ETH and wBTC each to celebrate Trump’s inauguration

Donald Trump-backed DeFi platform World Liberty Financial (WLFI) added $47 million of wrapped Bitcoin (wBTC) and Ethereum (ETH) each to celebrate Trump’s inauguration as the 47th President of the United States on Monday.

Top 5 made in USA altcoins tackle uncertainty on Trump’s return: XRP, Solana, Cardano, Chainlink, Avalanche

Crypto market capitalization of altcoins developed in the U.S. crossed $544.15 billion on Wednesday, January 22. Among cryptocurrencies trending in the U.S., XRP, Solana, Cardano, Chainlink, and Avalanche have gained in the past 24 hours, per CoinGecko data.

President Donald Trump plans $500 billion in AI infrastructure with OpenAI, SoftBank and Oracle

President Donald Trump announced a “Stargate” project for $500 billion in investment to advance the US AI infrastructure. The project will deploy an initial investment of $100 billion, scaling up to $500 billion, to establish advanced data centers and infrastructure in Texas.

Bitcoin: BTC rallies above $102,000 ahead of Trump’s inauguration

BTC's price continues to trade in the green, trading above $102,000 at the time of writing on Friday after rallying more than 7% this week. Recent US macroeconomic data released this week supported the rise of risky assets like BTC.

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.