These altcoins could yield massive gains in the short term: FTM, ADA and AVAX

- Altcoins have started decoupling from large market capitalization assets, fueling the alt season narrative.

- Experts have identified crypto currencies like Fantom, Cardano and Avalanche that have bullish potential in the short-term.

- FTM, ADA and AVAX could yield massive gains for holders if the alt season narrative heats up.

Bitcoin dominance hit its highest level since June 2022 and BTC price steadied above the $28,000 level. Altcoins like Fantom (FTM), Cardano (ADA) and Avalanche (AVAX) started their recovery with the alt season narrative heating up.

Bullish signals from on-chain metrics and signs of trend reversal in altcoin price charts imply altcoins like FTM, ADA, and AVAX are likely to yield gains for holders in the short-term.

Also read: Why Cardano whales are accumulating ADA tokens, what to expect

Fantom gears up for bullish trend reversal against Bitcoin

Fantom price yielded double-digit gains for holders since Tuesday. The altcoin is exchanging hands at $0.45, up nearly 11% since March 28. FTM price started rallying with the alt season narrative heating up.

The token of the DeFi protocol tested resistance at 0.0001602 against Bitcoin. This is a key area of resistance and FTM price spent a considerable amount of time below this resistance between June 2022 and the beginning of 2023. This makes it a crucial hurdle for FTM price.

Once past this resistance, FTM bulls need to push the altcoin to its bullish target of 0.00002800, a 75.5% upswing from the current price level. 38.2%, 50% and 61.8% Fibonacci Retracement levels stand in the way of FTM’s run up to its 0.00002800 target as seen in the price chart below.

FTM/BTC 1D price chart

Sheldon, an analyst at the YouTube channel Crypto Banter picked Fantom in the list of altcoins that have bullish potential in the heating alt season narrative. The expert believes a move past 0.00001602 can validate the bullish thesis and send FTM price on its way to the bullish targets in the price chart above.

The on-chain metric supporting the bullish thesis for FTM is the declining supply of the altcoin on exchanges. A reduction in FTM reserves on exchanges implies the selling pressure is declining and there is room for a rally in the altcoin. This is typically considered a bullish sign for the asset.

%2520%5B19.18.31%2C%252029%2520Mar%2C%25202023%5D-638157001164458130.png&w=1536&q=95)

FTM supply on exchanges v. Price

As seen in the Santiment chart above, the supply has dwindled consistently since the beginning of March 2023.

Is Ethereum-killer Cardano’s price rally just getting started?

In his latest YouTube video, Sheldon explains why Cardano’s price rally is just getting started. After yielding nearly 9% gains overnight for holders, ADA is likely on track for a bullish breakout in the short-term.

There are two key drivers of the current rally in the Ethereum-killer: The uncertainty surrounding Ethereum’s token unlock and Shanghai hard fork and the updates in the Cardano ecosystem that further decentralize the smart contract network’s blockchain.

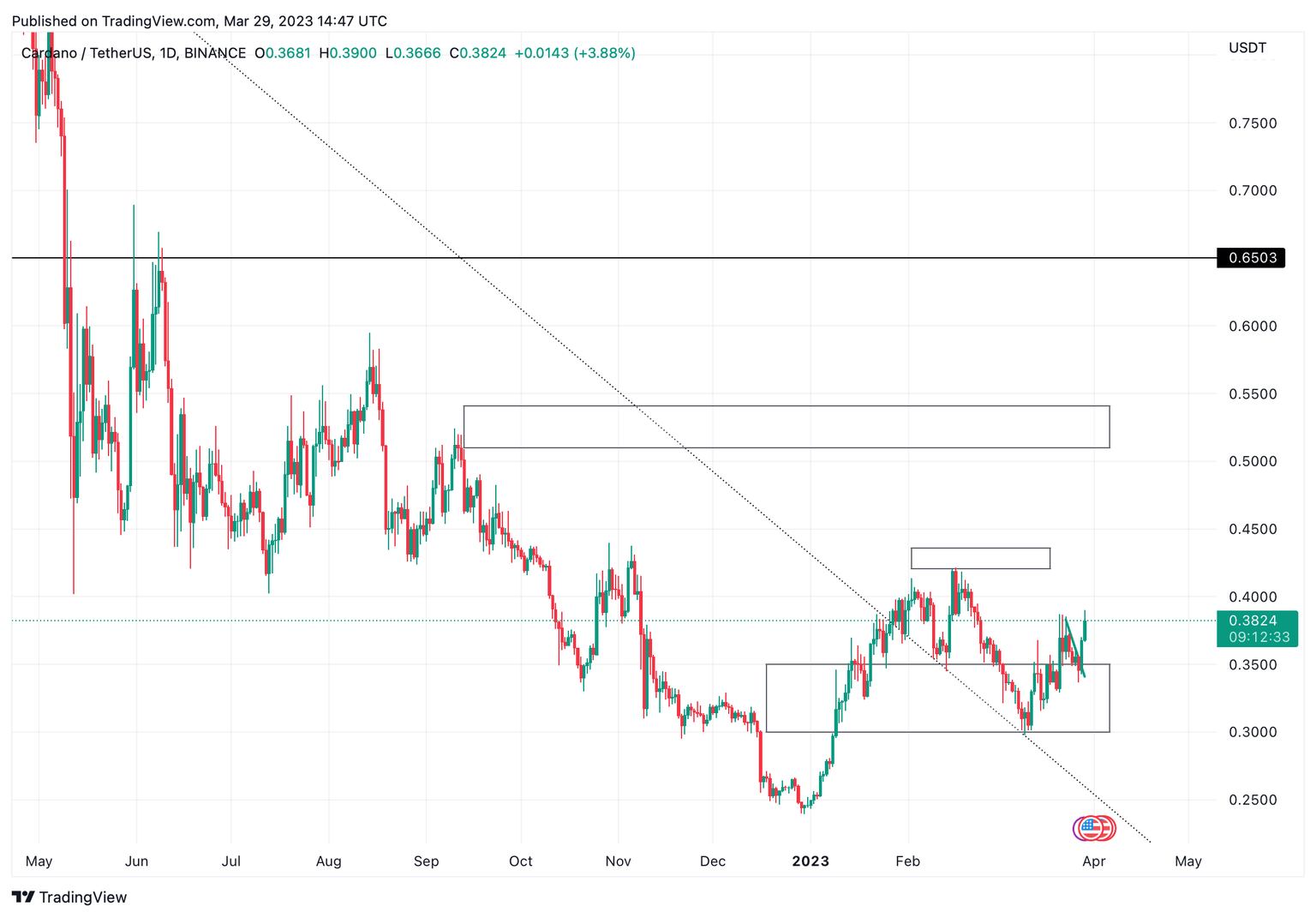

As seen in the Cardano/USDT price chart below, once ADA crosses its previous highs at $0.41, the Ethereum alternative could gear up for a massive rally to $0.65 in the short-term.

ADA/USDT 1D price chart

Cardano reversed its multi-month downtrend in mid-February 2023, and jumped out of the support zone between $0.30 and $0.35 in a swift move over the past week. Once ADA price crosses key resistance zones between the $0.42 and $0.44 level, Sheldon argues that the bullish thesis for the altcoin is validated.

The altcoin struggled with the resistance zone between $0.42 and $0.44 in October and November 2022. This makes it a critical hurdle for the altcoin to cross on its path to a breakout.

Sheldon has set a target of Cardano’s June 2022 high of $0.65 for the altcoin. This is a level that the asset has not tested for nearly nine months now. With the rising relevance and demand for the altcoin, the $0.65 level could come into play for ADA bulls if the bullish thesis is validated.

The accumulation of ADA tokens by whales and sharks in three different segments, holding between 10,000 and 10,000,000 tokens is a bullish on-chain signal for the smart contract asset.

%2520%5B19.22.26%2C%252029%2520Mar%2C%25202023%5D-638157002075564817.png&w=1536&q=95)

ADA whale accumulation

As seen in the whale accumulation chart from Santiment, since March 7 there has been a consistent increase in the volume of ADA held by large wallet investors in the Cardano network.

Avalanche is breaking out of a multi-month downtrend, what to expect

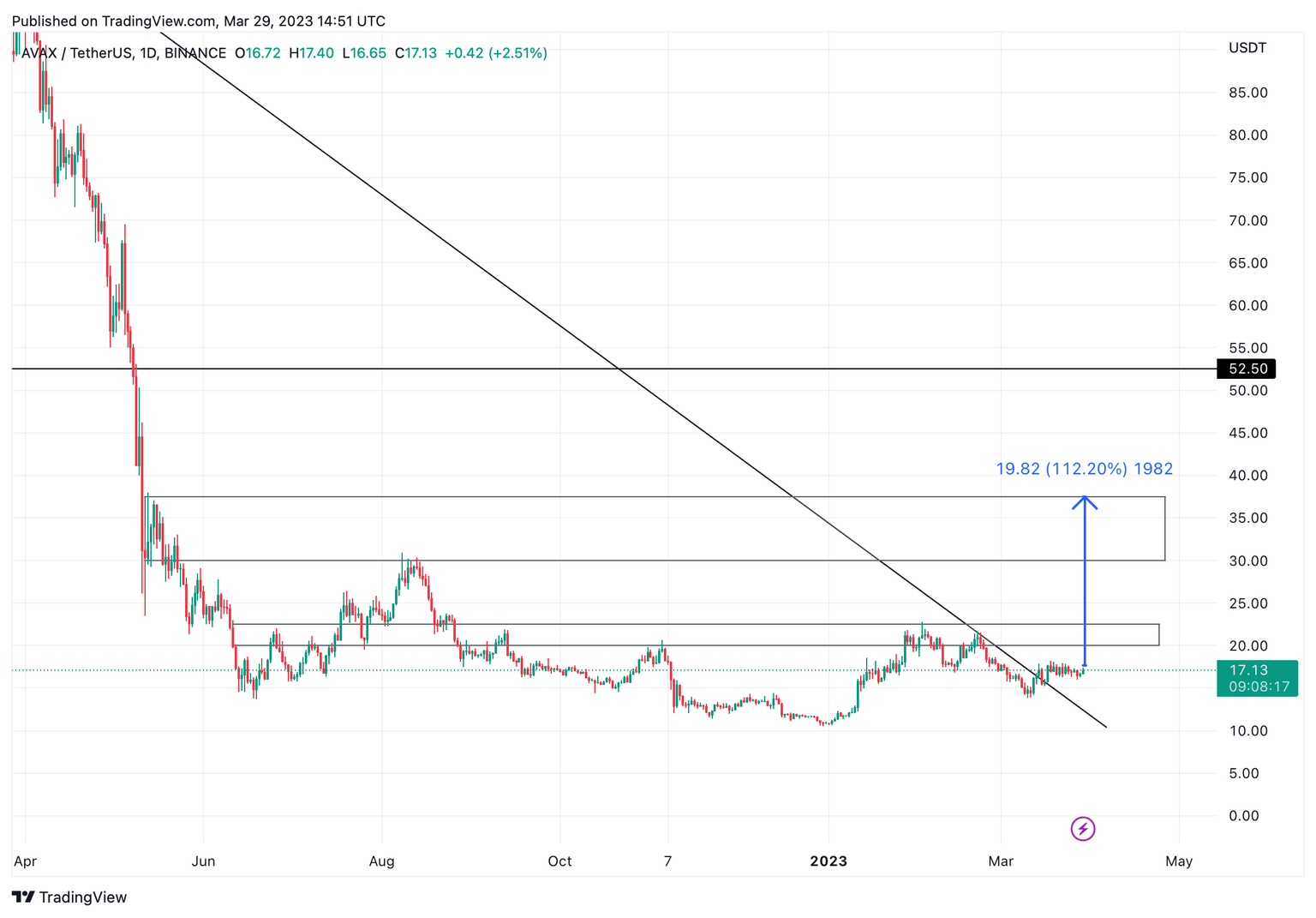

Avalanche, one of the most reliable smart contract platforms and a competitor for Cardano and Ethereum recently broke out of its multi-month downtrend. AVAX price was in a downtrend for the past 14-16 months, and the smart contract token, alongside other assets from its ecosystem started its recovery from the decline.

While AVAX price continues to trade nearly 88% below its all-time high, it has yielded nearly 4% gains for holders since Tuesday. The technical expert Sheldon argues that once price crosses the altcoin’s previous high at $22.50, it would invalidate the analyst’s bullish thesis for the Ethereum competitor.

The AVAX/USDT price chart below shows key resistance zones that AVAX bulls need to tackle before hitting the bullish target zone between $30 and $37.50.

The target zone marks 112% upswing from the current price level on the chart below.

AVAX/USDT 1D price chart

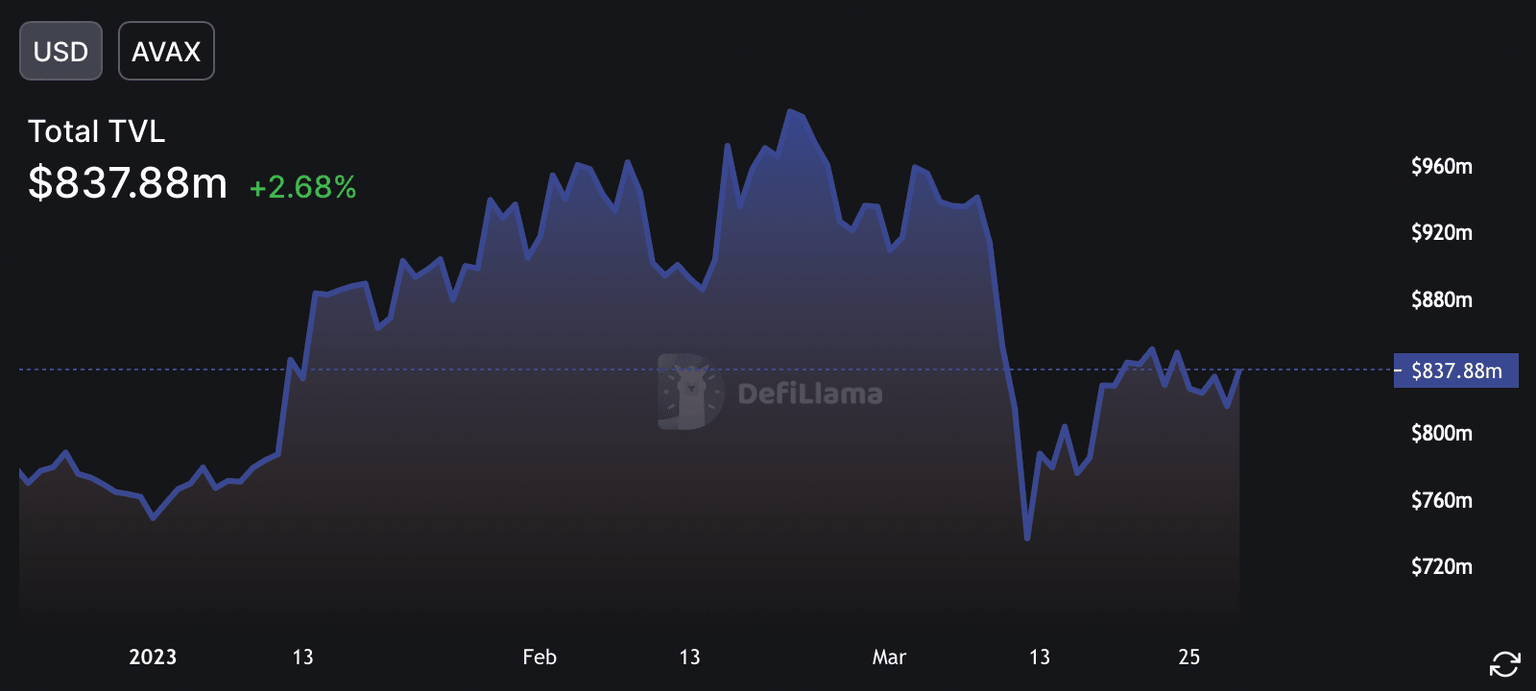

Avalanche’s bullish thesis will be validated once bulls push Avalanche past two key resistance zones. The Total Value Locked in the AVAX network supports the bullish thesis.

TVL climbed from $736.7 million to $837.88 million from March 12 to March 28.

AVAX TVL

AVAX network’s rising TVL is bullish for the token of the smart contract network as it signifies the value of assets locked in the ecosystem by users. Rising TVL over the past two weeks is therefore bullish for AVAX.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.