- The supply shock caused by the recent halving keeps impacting Bitcoin price.

- As the scarcity increases, more billionaires are starting to buy BTC as they see it as an inflationary hedge.

- Technical indicators further support the bullish price action.

The last halving has undoubtedly caused a significant supply shock to the Bitcoin in circulation, leading to increased scarcity. It appears the race to own BTC is growing as more wealthy individuals want to have a piece of the pie, and the billionaires seem to be ahead.

The massive increase in buying pressure may push Bitcoin price further into a new all-time high.

Not everyone will have access to a full Bitcoin

Only 21 million Bitcoin can ever be mined, with the last few tokens scheduled to be put into circulation by 2140. Once all tokens have been mined, no more can be created due to the core economic principles of the network.

Thus far, roughly 18.5 million BTC have been minted, leaving less than three million for the next 120 years.

When taking into consideration that there are about 47 millionaires in the world, with a cumulative wealth of approximately $158.3 trillion, only a handful of wealthy investors may be able to add Bitcoin to their portfolios. Indeed, if they were to buy all the BTC, each one of these individuals would be able to only purchase less than 0.5 BTC, without counting all the lost coins.

I've said this before but it bears repeating. There are 46.8 million millionaires in the world. There are only 21 million #Bitcoin — less than half will ever be able to own 1 bitcoin. Don't miss the revolution.

— Cameron Winklevoss (@cameron) November 17, 2020

Such a scenario shows the high levels of scarcity that Bitcoin possesses against any other asset, making it a very attractive store of value.

Billionaires flock into the cryptocurrency industry

Given Bitcoin’s deflationary model, interest is rising amongst some of the most prominent billionaires around the planet. Many of them believe that BTC will emerge as a hedging asset against inflation.

Hedge fund manager Paul Tudor Jones has even compared buying Bitcoin to investing in early tech stocks, like Apple and Google. This digital asset is going to be the best of inflation trades, according to Jones.

Along the same lines, the second-richest person in Mexico, Ricardo Salinas Pliego confirmed that he has 10% of his liquid portfolio in Bitcoin because it helps prevent his wealth from being eroded.

Other high-profile billionaires, like Bill Miller, are adding to the list of bullish investors as he allocated 30% of his $154 million fund into Bitcoin.

With the increasing attention on the flagship cryptocurrency amongst billionaires and its fixed supply, it seems like prices have more room to go up.

#Bitcoin: All-Time Highs in Sight, This Time Without the Hype. Public interest, as measured by mentions of bitcoin in media articles, is at a low despite rally. Another big bull run could have far further to run if/when public reaches euphoric #FOMO stage. https://t.co/dB3YAkhucT pic.twitter.com/PcDWYIyT4Z

— Holger Zschaepitz (@Schuldensuehner) November 19, 2020

New all-time highs on the horizon

As buying pressure keeps building up, Bitcoin price may have the strength to slice through December 2017’s all-time of nearly $20,000.

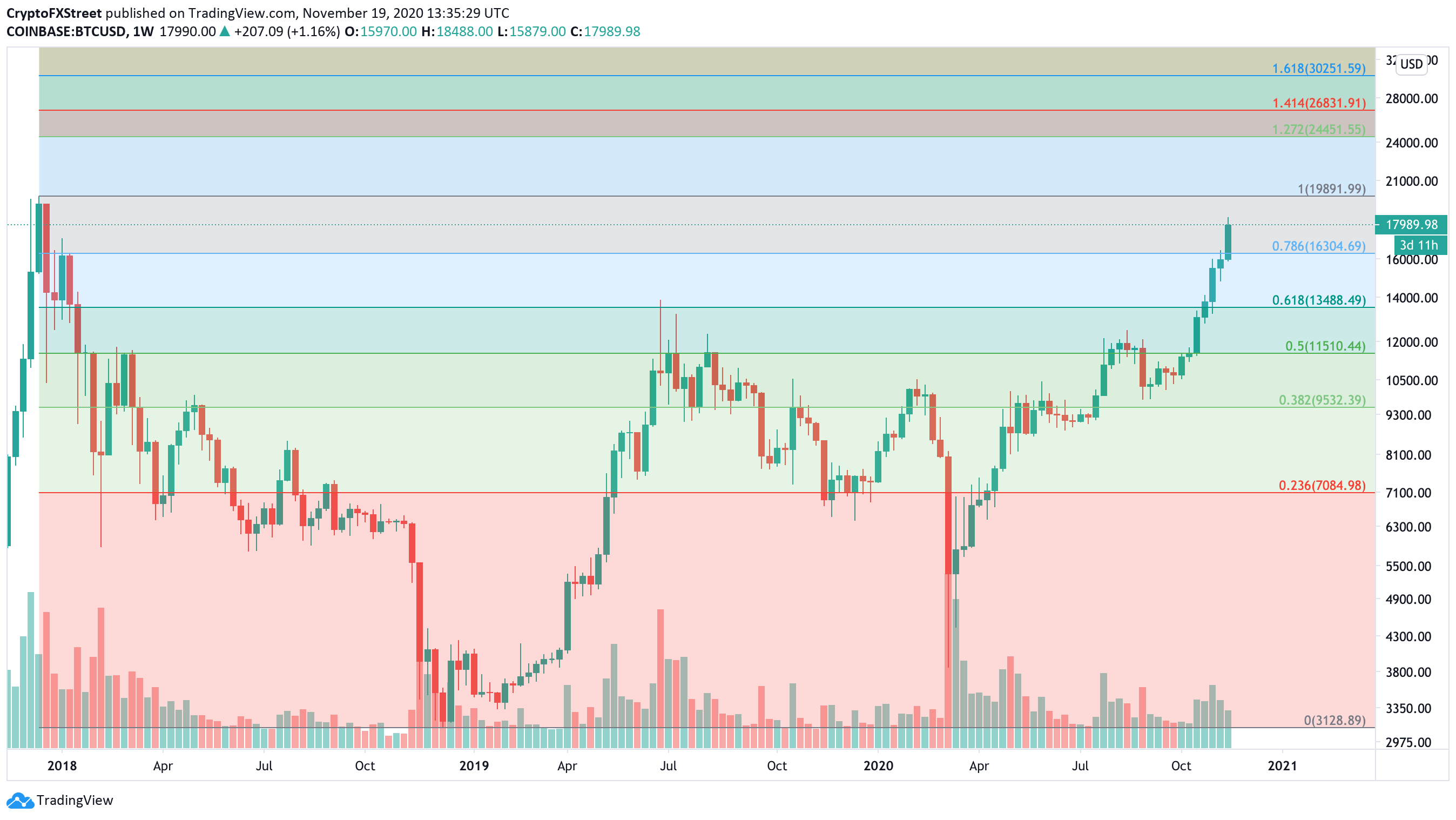

The Fibonacci retracement indicator breaking above $19,892 could see BTC surge towards the next threshold at $24,451, which corresponds with the 127.2% level. But if the buying pressure is strong enough, prices may even rally towards the next potential area of interest around $30,000.

BTC/USD weekly chart

Regardless of the optimistic outlook, the 2015-2017 bull market reveals that Bitcoin tends to take steep nosedives before rising to new all-time highs.

It is imperative to pay close attention to the current price levels. Failing to rise above $19,892 could see a possible correction to $16,300 or $13,500. These price points tally with the 78.6% and 61.8% Fibonacci retracement levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 gainers Supra, Cosmos Hub, EOS: Supra leads recovery after Trump’s tariffs announcement

Supra’s 25% surge on Friday calls attention to lesser-known cryptocurrencies as Bitcoin, Ethereum and XRP struggle. Cosmos Hub remains range-bound while bulls focus on a potential inverse head-and-shoulders pattern breakout.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin price remains under selling pressure around $82,000 on Friday after failing to close above key resistance earlier this week. Donald Trump’s tariff announcement on Wednesday swept $200 billion from total crypto market capitalization and triggered a wave of liquidations.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker is back above $1,300 on Friday after extending its lower leg to $1,231 the previous day. MKR’s rebound has erased the drawdown that followed United States President Donald Trump’s ‘Liberaton Day’ tariffs on Wednesday, which targeted 100 countries.

Gold shines in Q1 while Bitcoin stumbles

Gold gains nearly 20%, reaching a peak of $3,167, while Bitcoin nosedives nearly 12%, reaching a low of $76,606, in Q1 2025. In Q1, the World Gold ETF's net inflows totalled 155 tonnes, while the Bitcoin spot ETF showed a net inflow of near $1 billion.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.