The secret sauce behind AVAX price explosion

- AVAX price exploded in the post-FOMC crypto rally, posting double-digit gains overnight.

- Stablecoin native USDC on Avalanche’s network hit an all-time high, crossing $1.6 billion.

- Analysts predicted AVAX would continue its rally and revealed a bullish outlook on the altcoin.

Avalanche price exploded with double-digit gains in the post-FOMC crypto rally. AVAX price posted 10.4% gains overnight, breaking out of its downtrend.

Also read: Top US consumer watchdog watches crypto payments with intense scrutiny

Native USDC balance on Avalanche crossed $1.6 billion

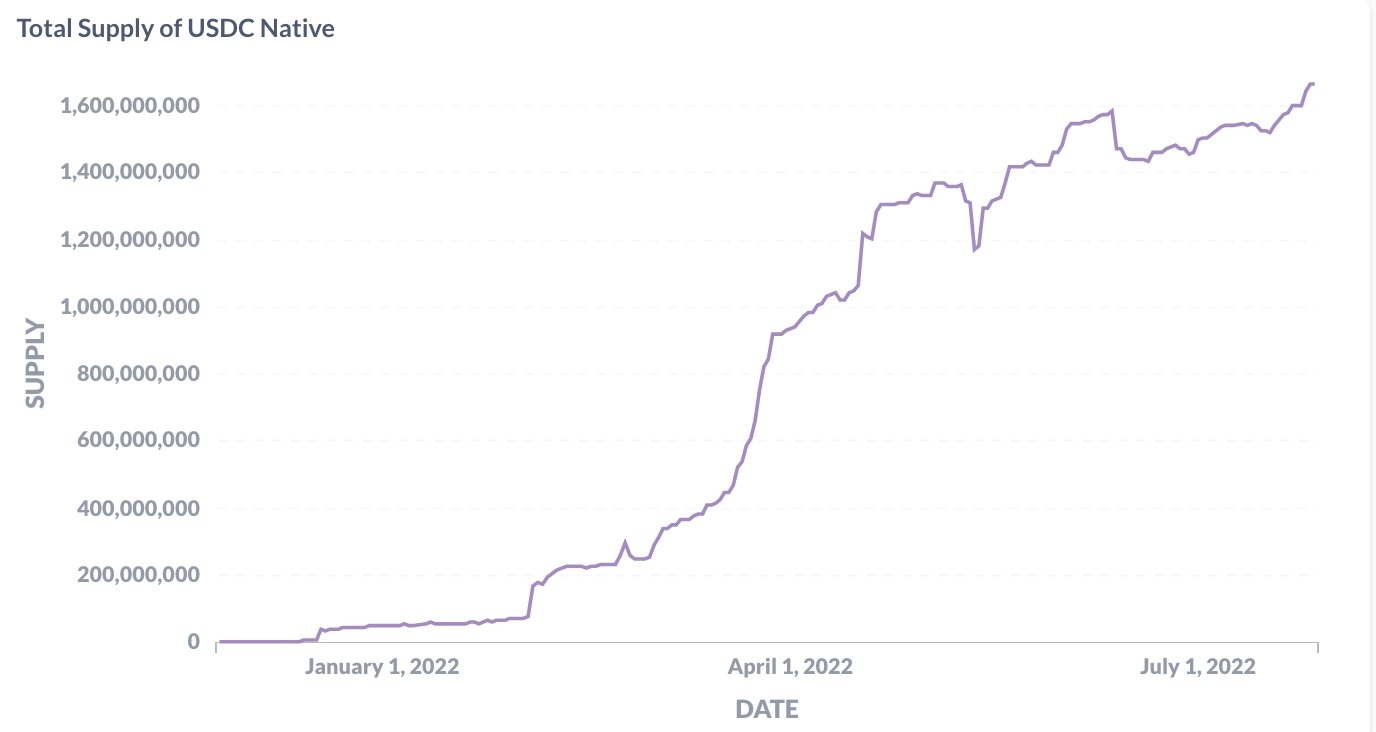

Luigi Demeo, head of DeFi at AvaLabs, announced that the native USDC balance on Avalanche had exceeded $1.6 billion, hitting an all-time high. Native USDC is the stablecoin on Avalanche that is not dependent on the Ethereum network, empowering the AVAX network against competitor Ethereum.

The defining feature of native USDC is that it does not carry any bridge risk, making it ideal. ‘Bridge risk’ stems from the vulnerability of cross-chain bridges – used to transfer different cryptocurrencies – to hacking. The availability of USDC is a bullish sign for the AVAX network as the stablecoin could be exchanged for AVAX.

Decentralized finance (DeFi) and other applications on the Avalanche network have access to native USDC liquidity, eliminating the need for costly token bridges and unsupported wrapped tokens. USDC liquidity helps fuel the rapid growth of the Avalanche ecosystem as part of the broader network of blockchains and businesses that take advantage of fast and low-cost USDC transactions every day.

Total Supply of USDC Native

Gamestar recently confirmed an official partnership with blockchain developer Ava Labs. This bullish development will allow Gamestar to bring iconic entertainment brands to web3 with play-to-earn features.

The partnership leverages Ava Lab’s blockchain development experience and boosts the network’s utility.

Avalanche unveils a new look

Avalanche has offered users a new look explorer, that makes search and navigation of the primary network easier. The network announced that the release is the growing number of Avalanche subnets launched on the chain.

ICYMI, the #Avalanche Explorer has a new look ✨

— Avalanche (@avalancheavax) July 28, 2022

Easily search and navigate both the primary network and now all of Avalanche’s subnets right from the homepage ✅

Learn more about the new Explorer updates here: https://t.co/GWG9weRiI0 pic.twitter.com/wptYBh8Fg2

It has become key for users and builders to be equipped with quality tools and data to aid their growing ecosystem and showcase their products. Avalanche has empowered subnet builders with guarantees of technical support and web-3 ready tools, offering them “Subnet Builder’s Bill of Rights”.

Head to https://t.co/S2OukIv7xx to check out multiple new feature releases!

— Avalanche (@avalancheavax) July 28, 2022

Analysts are bullish on Avalanche price

Analysts evaluated Avalanche’s price trend and revealed a bullish outlook on the asset, arguing that once Avalanche price breaches $26.3, a run up to $28, $30 and the bullish target of $33.5 is possible.

The recent dip in Avalanche’s price was an impulsive move, they argue, and the altcoin is ready to rebound, breach $26.3 and enjoy an extended rally. In the next wave, Avalanche could extend its gains to $33.5.

For more information, price levels and details, check the video below.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.