Robinhood, a no-fee trading app for millennials founded in 2013, came under fire recently for blocking its users from purchasing shares in Gamestop. The company faced mass political and customer backlash for doing so, despite citing significant market volatility as a reason for its actions.

The controversial decision was made after users on the r/WallStreetBets forum attempted to drive up prices of stocks that had been shorted by traditional hedge funds.

Robinhood also halted trades for AMC, Blackberry, Nokia and other stocks that had been driven up by Reddit. Interactive Brokers followed suit by placing limits on certain stocks amid a buying frenzy.

Initially, Robinhood limited purchases to one share per user, then loosened the restrictions to allow for more shares.

GameStop Shares Plunge

GameStop is the world’s largest video game retailer and in the 2000s, the company enjoyed mass success, opening thousands of stores worldwide. GameStop’s stock more than doubled in 2007 as the retail chain became well-known for its business model of selling games on discs.

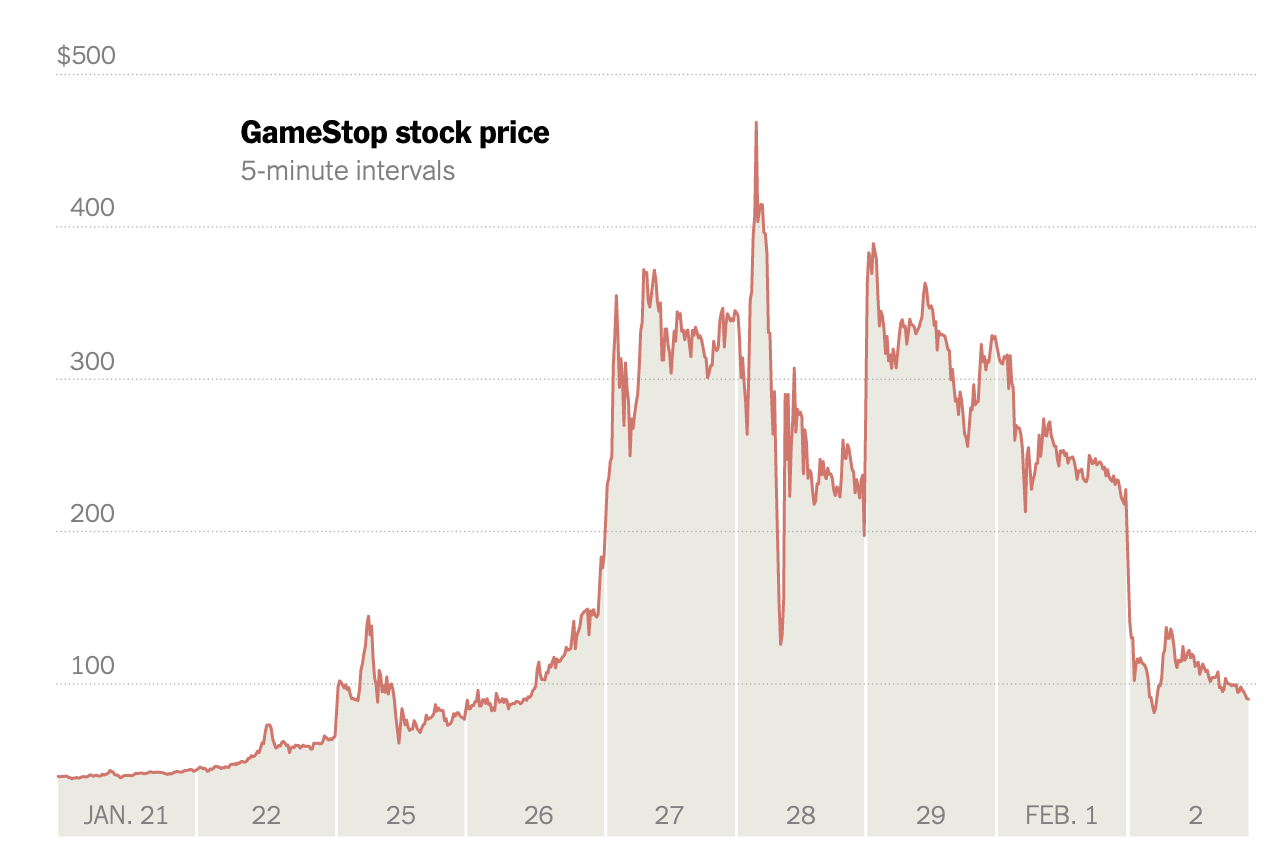

Following rapid surges, GameStop’s stock collapsed by 62% in January 2021 with prices falling from $347.51 to $193.60 on the day of Robinhood’s trading halt announcement. AMC Entertainment was down 67% and Nokia was down 30%.

(Image: The New York Times)

GameStop has been known as the favourite stock for hedge funds to short as its shares have been declining in value. Redditors saw this as an opportunity to start buying, thus driving the price of the stock up. This essentially created a “short squeeze”, as those betting against GameStock had to buy stock to cover their shorts.

Redditors then encouraged buyers of GME shares to prohibit their shares from being lent to short sellers. This, in turn, created a feedback loop that led to the price of GameStop to climb up quickly.

As a result, Robinhood shut down trades on January 28 2021, preventing buyers from buying in.

Robinhood’s statement explaining its actions read: “We continuously monitor the markets and make changes where necessary. In light of recent volatility, we are restricting transactions for certain securities to position closing only”. Shares of GameStop had risen by more than 1,800% in January 2021 and the price fluctuated by hundreds of dollars per share in a single day of trading.

Robinhood Backlash

Wall Street hedge funds were taken by surprise and suffered enormous losses following the surge. What started as a coalition of small, individual investors betting against GameStop’s stock, ended with extremely well-funded financial firms losing billions of dollars.

Robinhood, which recently announced its upcoming IPO, has claimed that it was acting to protect its customers through SEC regulations, many expressed concerns that the broker may have been attempting to protect Wall Street insiders from losses rather than its customer base.

When the company stopped independent users from buying shares after the surge in investment by independent traders, they still remained available to large, professional traders elsewhere. Users felt betrayed and accused Robinhood of protecting big investors and manipulating the stock market.

Robinhood co-founder Vladimir Tenev stated: "To be clear, this decision was not made on the direction of any market maker we route to or other market participants. Starting tomorrow, we plan to allow limited buys of these securities. We’ll continue to monitor the situation and make adjustments as needed”.

However, users were quick to express their frustration, flooding Google Play Store with tens of thousands of negative Robinhood reviews. Google has since removed the one-star reviews. According to 9to5Google, over 100,000 reviews were purged from the Play Store.

Platforms like Robinhood have been viewed by many as the main gateway for young investors to access the markets. However, in the wake of this backlash, retail investors have been turning to the likes of Freedom24, E*TRADE and TD Ameritrade. All of these offer similar possibilities when it comes to buying stocks.

Overall, the chaos has forced Robinhood to seek emergency funding from investors who poured in $2.4bn, over and above the $1bn raised prior.

Robinhood Lifts All Trading Restrictions

Some have blamed Robinhood for suspending the trading of GameStop stock and causing a buying frenzy. However, in reality, the company has provided solid justification for shutting down trades. Robinhood is a single player in a public securities market that has been established over decades.

Robinhood may not have had much choice in the matter as control continues to remain in the hands of a single centralised custodian, the Depository Trust and Clearing Corporation (DTCC). Clearinghouses are intermediaries which ensure the completion of a stock trade even if one of the deals goes bust.

In the public securities market, when a settlement occurs, the DTCC acts as an intermediary facilitating the delivery of the stock to the buyer and the funds to the seller.

It was reported that Treasury Secretary Janet Yellen had met with regulators in the wake of the GameStop surge to discuss market volatility.

The Securities and Exchange Commission and the Commodity Futures Trading Commission are currently reviewing whether trading practices are consistent with investor protection.

Many users will be pleased to know that Robinhood has now lifted all trading restrictions, allowing the buying of shares in Reddit-promoted companies following January’s financial tumult. There are currently no temporary limits to increasing one’s positions.

Robinhood clients can now buy 100 shares of GameStop, up from the previous limitation of 20. However, investors who own more than 100 shares cannot buy one more share of the stock.

Despite the company blocking its users from purchasing certain shares, Robinhood’s user growth, brand recognition and valuation appear to be stronger than ever. The company was left with little choice but to act in the face of significant market volatility and it continues to cooperate with investigations by a number of regulatory bodies including the SEC, FINRA and the New York Attorney General’s Office.

All views and opinions expressed in this article are the opinions of the author and not FXStreet. Trading cryptocurrencies or related products involves risk. This is not an endorsement to invest in or trade any of the cryptocurrencies, stocks or companies mentioned in this article.

Recommended Content

Editors’ Picks

Crypto Today: BTC, ETH, and XRP lead $1.4B capitulation on Black Monday as FTX denies $2.5B claims

Cryptocurrencies nosedived over the weekend, shedding over $300 billion since Friday. What some traders on social media are terming crypto’s Black Monday, losses come after an initial positive decoupling on Thursday, when US stocks crashed after China announced 34% retaliatory tariffs.

Bitcoin hits new yearly low below $75,000 as global trade war escalates

Bitcoin price extends its fall by 4% on Monday after correcting near 5% the previous week. The global trade war escalated, wiping out 452,976 leveraged traders and causing a total liquidation of $1.39 billion from crypto markets in the last 24 hours.

Dogecoin shatters $0.15 support as ‘Black Monday’ bloodbath fears surge

Dogecoin tumbles over 10% on Monday, slashing $3.73 billion from its market capitalization to $19.78 billion. CNBC host Jim Crammer warns of global markets’ bloodbath if US President Donald Trump stays intrasigent.

Solana Price Forecast: Bears gain momentum as SOL falls below $100

Solana (SOL) extends its loss by over 7% and falls below the $100 mark at the time of writing on Monday after crashing 15.15% last week. Coinglass data shows that SOL’s leveraged traders wiped out nearly $70 million in liquidations in the last 24 hours.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.