The Graph Price Prediction: GRP breakdown to $1.3 seems imminent as technicals flip bearish

- The Graph’s uptrend hit a barrier just before $3, paving the way for the ongoing retreat.

- GRT whales are on a selling spree, a situation that is adding to the bearish technical outlook.

- The uptrend to new record highs will be secured if The Graph closes the day above the channel’s middle boundary.

The Graph seems to have hit its top after more than 600% gains accrued from the beginning of the year. A new all-time was recently achieved at $2.9, leaving the $3 level tested but unbroken. A retreat is underway from the highs, whereby The Graph is trading at $2.28. Since technical levels are turning bearish, the losses are likely to continue.

The Graph’s breakdown in the cards

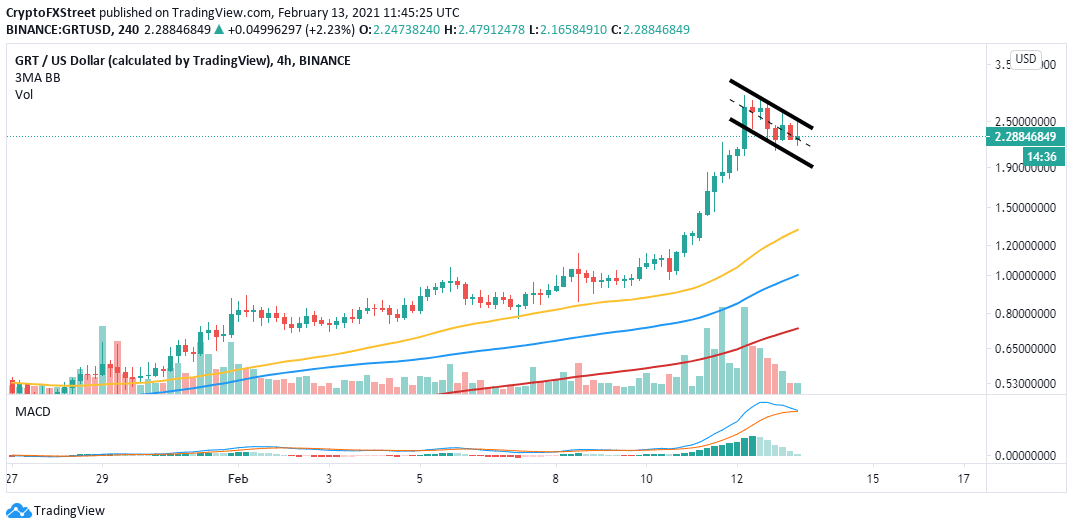

Following the rejection from the record high, GRT is holding at the descending channel’s middle boundary. The bearish outlook may worsen if the price closes the day under this zone. Note that the Moving Average Convergence Divergence (MACD) is likely to add credibility to the pessimistic outlook.

Currently, the MACD indicator is in the positive region. However, if the MACD line (blue) crosses below the signal line, The Graph would breakdown towards the 50 Simple Moving Average (SMA) on the 4-hour chart around $1.3. The channel’s lower edge is in line to offer support that could stop the bearish leg from extending further.

GRT/USD 4-hour chart

According to Santiment, the increase in selling pressure can be explained by the drop in the number of addresses holding large volumes of The Graph. For instance, the whales containing between 100,000 and 1 million GRT topped out at 912 on January 22. However, the decline has been consistent since then, and the addresses hold at 395, representing a 65.9% drop. This departure by the whales could significantly influence the ongoing retreat.

The Graph holder distribution

Looking at the other side of the fence

The vivid bearish outlook will be invalidated if GRT holds the support at the descending parallel channel. A rebound from this support zone will place The Graph on a trajectory towards new all-time highs. Moreover, stepping above $3 will confirm to the investors that this token is yet to hit its global top.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B14.52.51%2C%252013%2520Feb%2C%25202021%5D-637488150840491600.png&w=1536&q=95)