- TheGraph price is facing a strong resistance level at $2.03.

- The digital asset got listed on HitBTC in the past 24 hours.

- The number of GRT whales has significantly declined in the past week.

TheGraph price has been under consolidation since its new all-time high of $2.88 established on February 12. The digital asset now seems prepared for a new leg up, but it is facing a critical resistance barrier. HitBTC has just announced the support for GRT against two trading pairs, BTC and USDT.

TheGraph price must climb above $2.03 to shift the momentum in favor of the bulls

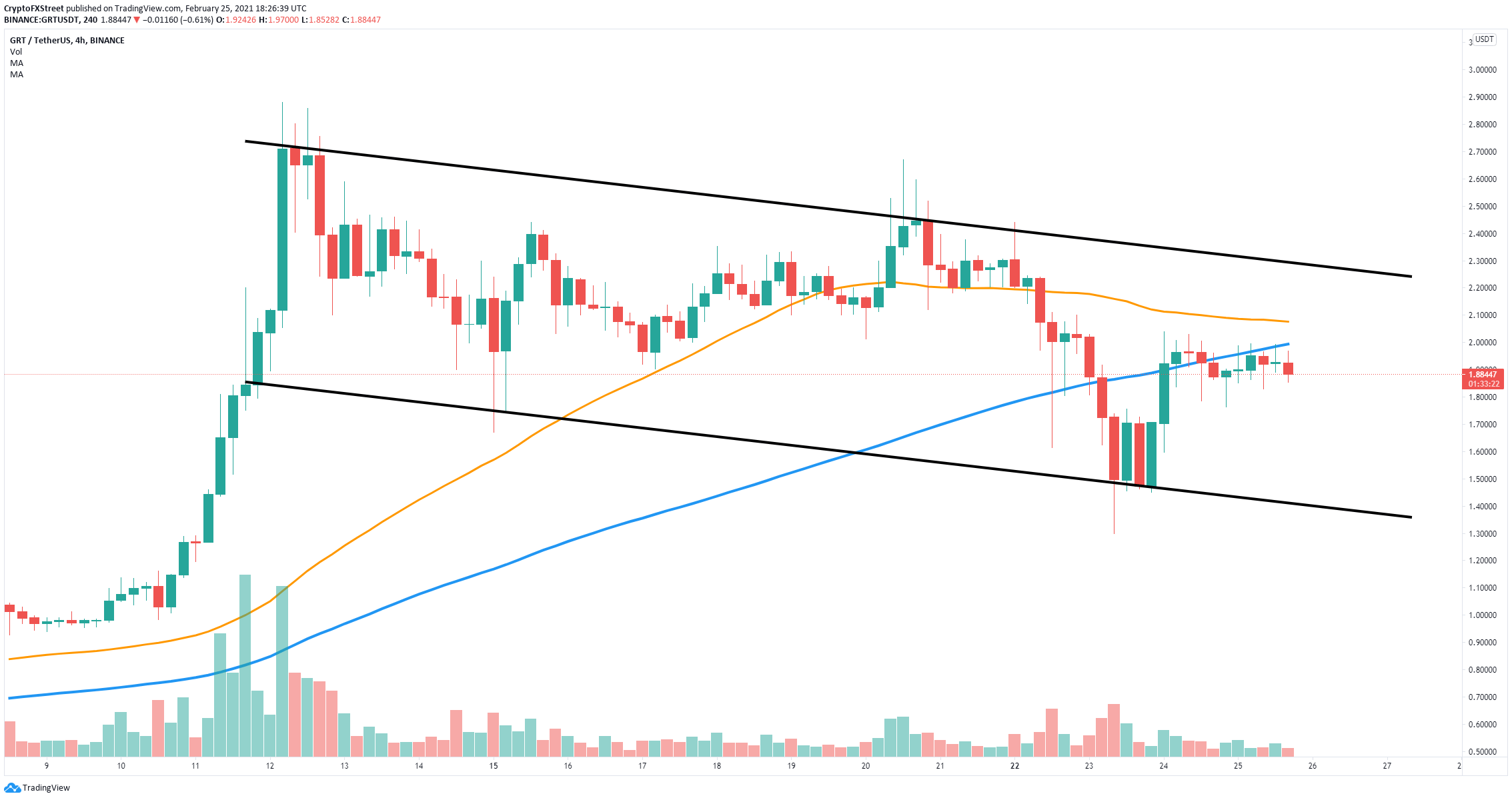

On the 4-hour chart, GRT has been trading inside a descending parallel channel since February 12. The digital asset faces a crucial resistance point at around $2.03 which coincides with the 50-SMA and the 100-SMA.

GRT/USD 4-hour chart

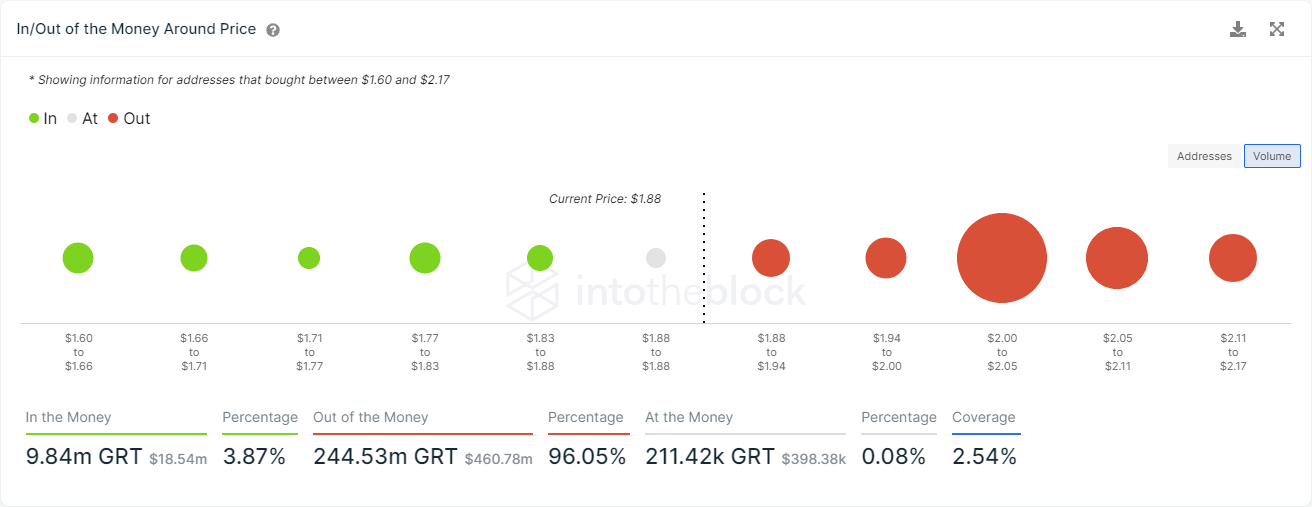

The In/Out of the Money Around Price (IOMAP) chart indicates that the strongest resistance area is located between $2 and $2.05 which perfectly coincides with the 50-SMA and the 100-SMAs.

GRT IOMAP chart

A breakout above this point should be able to push TheGraph price towards the upper boundary of the pattern at $2.3. Bulls seem to have the upper hand after the most recent listing of GRT on HitBTC. However, a rejection from this level would be notably bearish.

GRT Holders Distribution

When it comes to the number of whales holding GRT, things aren’t looking so good for the bulls. Since February 16, about six large holders with at least 10,000,000 coins have exited the network or at least partially sold their holdings.

Additionally, the IOMAP model also shows extremely weak support below $1.88 which means that a breakdown from this point could send TheGraph price down to the lower boundary of the channel at $1.4.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Litecoin Price Prediction: LTC tries to retake $100 resistance as miners halt sell-off

Litecoin price grazed 105 mark on Monday, rebounding 22% from the one-month low of $87 recorded during last week’s market crash. On-chain data shows sell pressure among LTC miners has subsided. Is the bottom in?

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin price struggles around $95,000 after erasing gains from Friday’s relief rally over the weekend. Bitcoin’s weekly price chart posts the first major decline since President-elect Donald Trump’s win in November.

SEC Commissioner Hester Pierce sheds light on Ethereum ETF staking under new administration

In a Friday interview with Coinage, SEC Commissioner Hester Peirce discussed her optimism about upcoming regulatory changes as the agency transitions to new leadership under President Trump’s pick for new Chair, Paul Atkins.

Bitcoin dives 3% from its recent all-time high, is this the cycle top?

Bitcoin investors panicked after the Fed's hawkish rate cut decision, hitting the market with high selling pressure. Bitcoin's four-year market cycle pattern indicates that the recent correction could be temporary.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

%20[18.32.04,%2025%20Feb,%202021]-637498743720061866.png)