The Cryptocurrency Market Update: Bitcoin bulls try to regain control

- Bitcoin (BTC) returned to the previous range after a bout of volatility.

- Altcoins are moving in sync with the first digital currency.

The cryptocurrency market has calmed down after a short period of wild volatility on Wednesday. Bitcoin and all major attempt a recovery after a sharp sell-off. The total cryptocurrency market capitalization increased to $196 billion from $194 billion this time on Wednesday; an average daily trading volume stayed reached $67 billion. Bitcoin's market share settled at 66.9%.

Top-3 coins price overview

BTC/USD hit the area above $7,700 on Wednesday; however, the upside movement proved to be unsustainable as the coin has returned to $7,300 by the time of writing. The local support is created by the lower boundary of the recent consolidation channel at $7,100. It is followed by a psychological $7,000. The recovery may be limited by $7,330 (a confluence of SMA50 (Simple Moving Average), SMA100 and the middle line of the Bollinger Band on 1-hour chart).

BTC/USD, 1-hour chart

Ethereum spiked to $153.15 on Wednesday only to return to the area below $146.00 on Thursday. The second-largest digital asset, with the current market capitalization of $15.7 billion, has barely changed in recent 24 hours. The initial support awaits us on approach to $143.00 (the lower line of 1-hour Bollinger Band), the resistance is created by $147.30 ( SMA50 and the middle line of the Bollinger Band on 1-hour chart).

ETH/USD, 1-hour chart

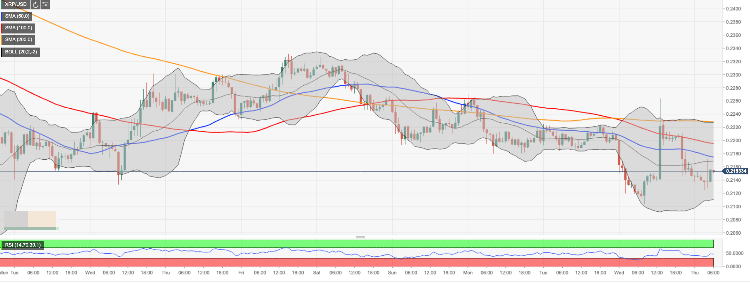

Ripple's XRP topped at $0.2263 amid wild Wednesday rally on the cryptocurrency markets, At the time of writing, XRP/USD is changing hands at $0.2150, unchanged in recent 24 hours. A strong support is created by psychological $0.2100. This area is reinforced by the lower line of the Bollinger Band on 1-hour chart. A sustainable move below $0.2100 may lead to a sell-off towards November 25 low at $0.2014.

XRP/USD, 1-hour chart

Author

Tanya Abrosimova

Independent Analyst