The cryptocurrency market update: Bitcoin bears hit the pause button

- Bitcoin (BTC) has settled close to $8,000 on Wednesday.

- Altcoins retain bearish bias during early Asian hours.

The cryptocurrency market is range-bound with bearish bias after a sharp sell-off at the beginning of the week. Bitcoin and all major altcoins are nursing lose from 1$ to 4% on a day-to-day basis with NEO being a notable exception. The coin has gained over 5% since this time on Tuesday.

The total cryptocurrency market capitalization stayed at to $223, mostly unchanged from this time on Tuesday; an average daily trading volume is registered at $77 billion. Bitcoin's market share settled at 66.1%.

Top-3 coins price overview

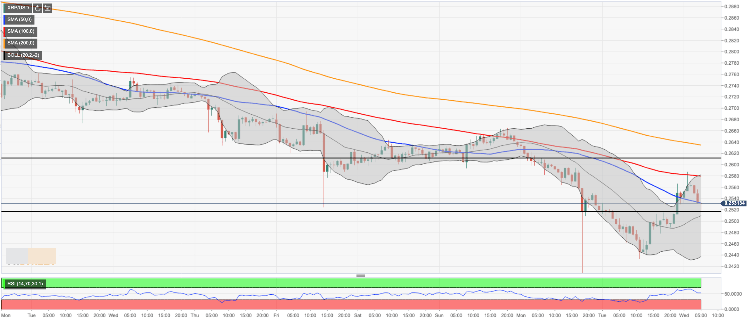

BTC/USD tested area below $8,000 on Tuesday. While thee price managed to recover to $8,150 by press time, the market is still controlled by bears. The first digital asset has lost about 1% of its value in recent 24 hours and stayed unchanged since the beginning of the day. Looking technically, the $8,060-$8,000 area creates a strong initial support that may limit the further downside in the short run.

BTC/USD, 1-hour chart

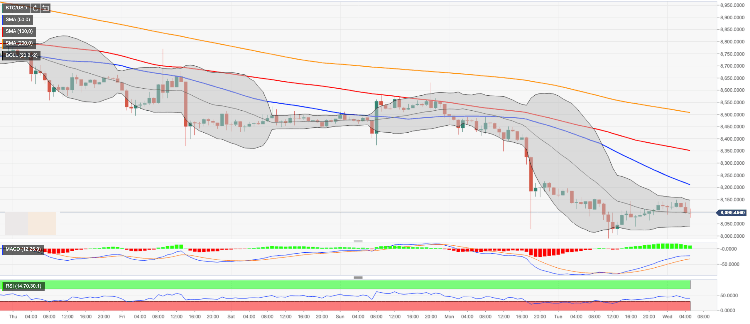

Ethereum, the second-largest digital asset with the current market capitalization of $19.2 billion, has settled above $175.00 after a short-lived sell-off to $172.75 on Tuesday. ETH/USD has over 1% on a day-to-day basis and stayed unchanged since the beginning of Wednesday. At the time of writing, ETH/USD is changing hands at $175.75, while the initial support is created by the middle line of 1-hour Bollinger Band.

ETH/USD, 1-hour chart

Ripple’s XRP touched $0.2408 on Monday amid global sell-off on the cryptocurrency market, but managed to recover to the area above $0.2500 by the time of writing. XRP/USD, the third digital coin with the current market value of $11.0, has gained 1% of its value since this time on Tuesday. The support is created by psychological $0.2500. At the time of writing, XRP/USD is changing hands at at $0.2515

XRP/USD, 1-hour chart

Author

Tanya Abrosimova

Independent Analyst