- Bitcoin (BTC) breaks to new multi-month lows in Asia.

- Altcoins retain downside bias, following the lead of the first digital currency.

The cryptocurrency market has resumed the sell-off during early Asian hours after a short consolidation on the weekends. Bitcoin and all major altcoins are nursing losses on a day-to-day basis. The total cryptocurrency market capitalization crashed to $2180 billion; an average daily trading volume is increased to $113 billion. Bitcoin's market share settled at 66.3%.

Top-3 coins price overview

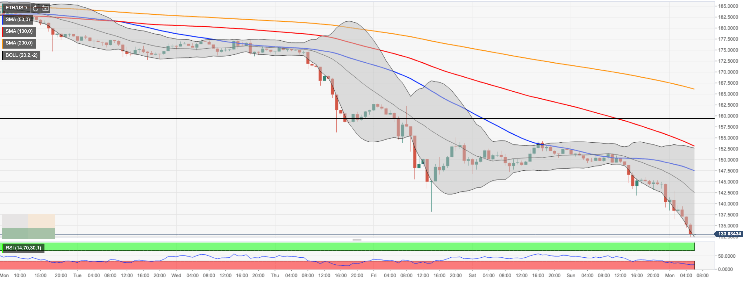

BTC/USD dropped below $6,600 to trade at $6,570 at the time of writing. The first digital asset has lost over 9% on a day-to-day basis and 5% since the beginning of Monday. The next important support is located on the approach to $6,500. A sustainable move below this barrier will trigger the sell-off towards $6,000.

BTC/USD, 1-hour chart

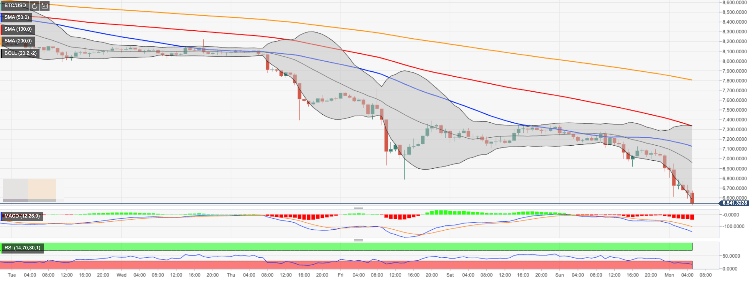

Ethereum's bearish trend is gaining speed. The second-largest digital asset with the current market capitalization of $14.5 billion, has settled at $133.00 after a recovery attempt towards $143.00 during early Asian hours. At the time of writing, ETH/USD down 11% on a day-to-day basis and 5% since the beginning of the day.

ETH/USD, 1-hour chart

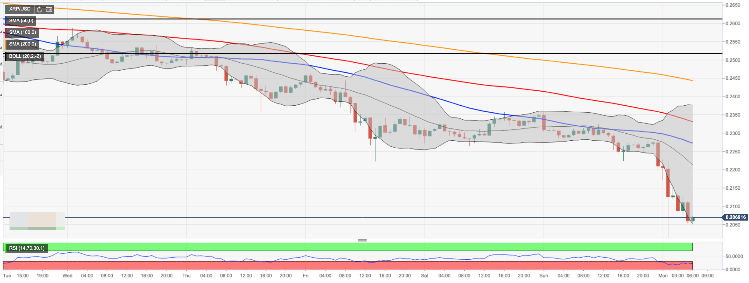

Ripple's XRP has come dangerously close to $0.2000 during early Asian hours. At the time of writing, XRP/USD is trading at $0.269, down 10% in recent 24 hours. The recovery above $0.22 (the middle line of 1-hour Bollinger Band) will mitigate the initial bearish pressure. The critical support is created by a psychological $0.2000.

XRP/USD, 1-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs.

Binance Coin price nears $600 breakout as CZ reacts to BNB listing on Kraken

Binance Coin price posted considerable gains on Thursday, fuelled by investor optimism tied to its upcoming listing on the U.S.-based crypto exchange Kraken.

Binance CEO affirms company's involvement in advising countries on Bitcoin Reserve

Binance CEO Richard Teng shared in a report on Thursday that the cryptocurrency exchange has advised different governments on crypto regulations and the need to create a strategic Bitcoin reserve.

Slovenia moves to impose 25% tax on crypto traders

Slovenia has become the latest European Union member state to crack down on untaxed crypto gains, unveiling a proposal to impose a 25% tax on personal profits from digital asset disposals starting in 2026.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.