The cryptocurrency market update: Bitcoin and major altcoins consolidate losses

- Bitcoin (BTC) has settled below $8,700 amid increased bearish pressure.

- Altcoins are mostly range-bound during early Asian hours.

Bitcoin and all major altcoins have recovered from the recent losses; however, the majority of coins are still in the red zone on a day-to-day basis. The total cryptocurrency market capitalization dipped to $240 billion from $245 the day before; the worth of the digital asset of $68 billion change hands daily on average. Bitcoin's market share dropped to 66.1%.

Read also: ABey co-creator keynote speech at the Malta Blockchain Summit 2019

Top-3 coins price overview

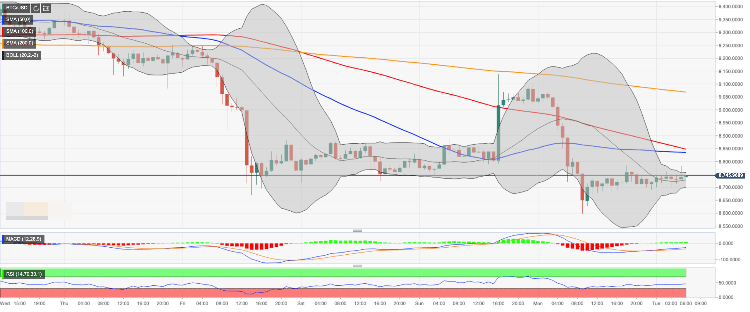

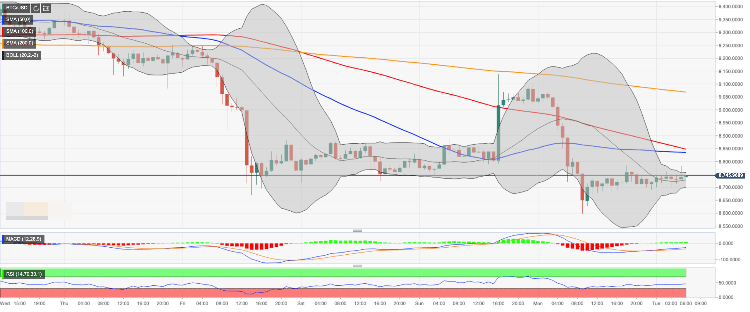

BTC/USD has lost over 1.56% in recent 24 hours and stayed unchanged since the beginning of Tuesday. On the intraday charts, the coin is locked in a tight range limited by SMA50 (Simple Moving Average) 1-hour at $8,835 on the upside and $8,650 on the downside. a sustainable move in either direction is needed to clarify the trend.

BTC/USD, 1-hour chart

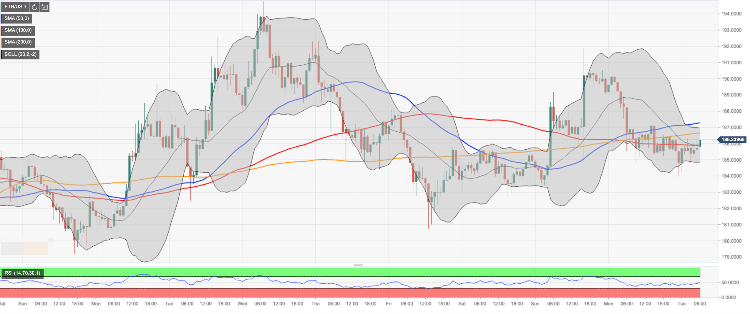

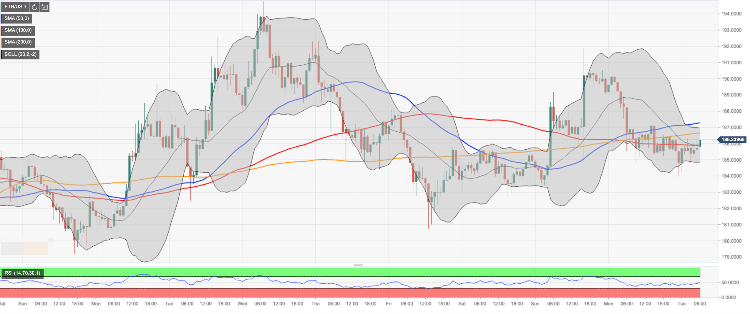

Ethereum, the second-largest digital asset with the current market capitalization of $20.5 billion, is changing hands at $186.10, down about 1 % since this time on Monday. Looking technically, ETH/USD has recovered from the recent low of $183.96 and may extend the upside towards $186.70 (SMA200 1-hour chart) and $187.00.

ETH/USD, 1-hour chart

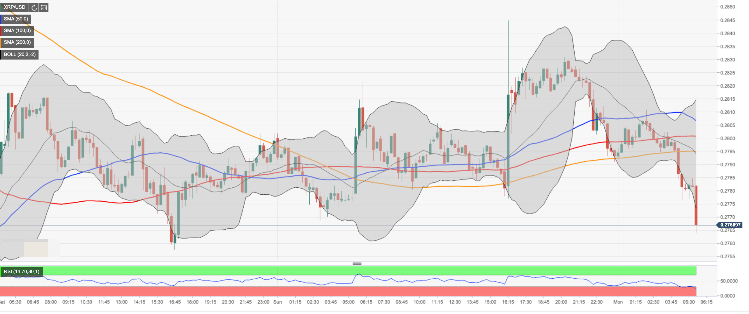

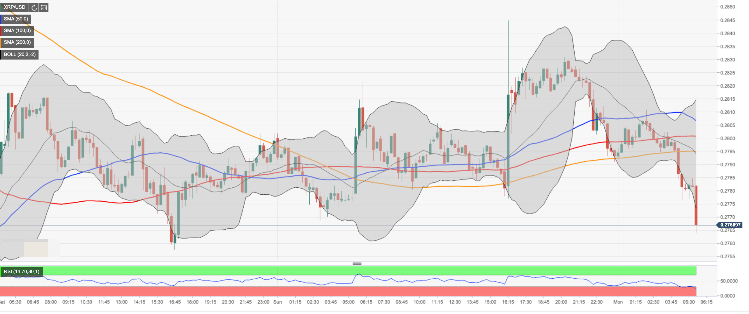

Ripple’s XRP moved below $0.2700 handle on Monday, but managed to recover to $0.2734 by the time of writing. The third digital coin with the current market value of $12.1 is moving within a tight range. The recovery is initially capped by the middle line of a one-hour Bollinger Band.

XRP/USD, 1-hour chart

Author

Tanya Abrosimova

Independent Analyst