- Bitcoin (BTC) has settled below $8,800 after a failed breakthrough attempt.

- Altcoins are mostly range-bound with bearish bias during early Asian hours.

The cryptocurrency market is a mixed picture on Wednesday. Bitcoin and all major altcoins are range-bound with bearish bias amid decreasing trading activity. The total cryptocurrency market capitalization dropped to $239 billion from $240 the day before; the worth of the digital asset of $67 billion change hands daily on average. Bitcoin's market share dropped to 66.0%.

Top-3 coins price overview

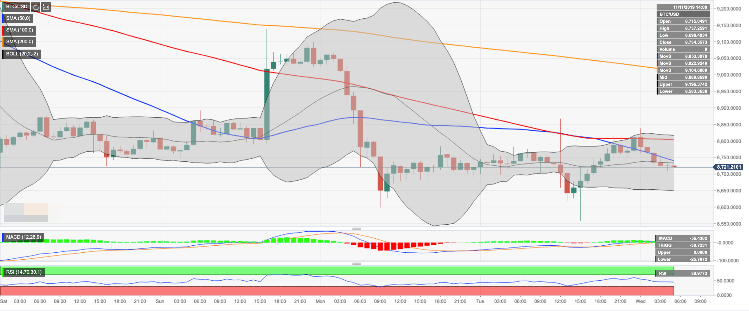

BTC/USD has stayed mostly unchanged both on a day-to-day basis and since the beginning of Wednesday, changing hands at $8,730. On the intraday charts, the coin has peaked at $8,838 in Asia before reversing back below $8,800 handle. This resistance is strengthened by SMA100 (Simple Moving Average) on a daily chart. Once it is out of the way, the upside is likely to gain traction with the next focus on $9,000.

BTC/USD, 1-hour chart

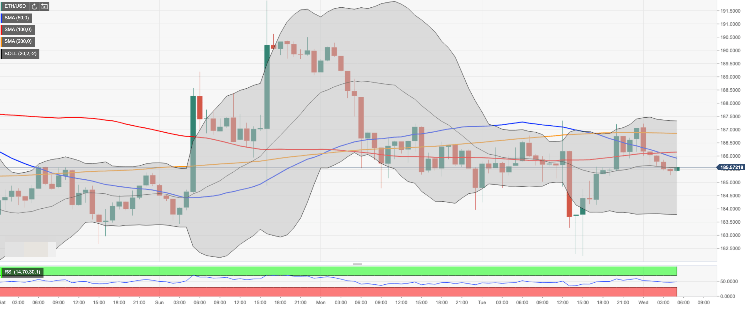

Ethereum, the second-largest digital asset with the current market capitalization of $20.2 billion, is moving within a short-term bearish bias within the recent range. The coin dropped below $186.00 to trade at $185.60 at the time of writing. Looking technically, ETH/USD has recovered from the recent low of $182.30, but the further upside is limited by $186.00 with SMA50 1-hour located on approach.

ETH/USD, 1-hour chart

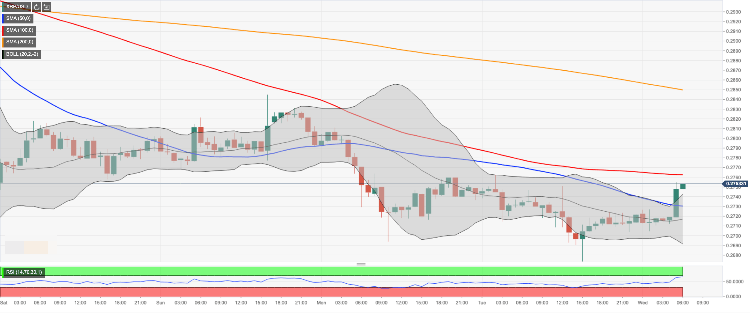

Ripple’s XRP has gained 1.2% since the beginning of Wednesday to trade at $0.2750 by the time of writing. The third digital coin with the current market value of $11.8 is moving within a tight range. The coin jumped above SMA50 (Simple Moving Average) and by the upper line of the Bollinger Band on a 1-hour chart. However, further recovery may be limited by SMA100 at $0.2760.

XRP/USD, 1-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto Gainers WIF, SPX, HYPE: Meme coins soar with Bitcoin’s recovery to $106K

Crypto market bounces back as Bitcoin (BTC) reclaims the $106,000 level at press time on Tuesday, resulting in a refreshed rally in top meme coins such as Dogwifhat (WIF) and SPX6900 (SPX), and Pepe (PEPE).

Meta shareholders turn down Bitcoin treasury reserve proposal as its stock soar on AI plans

Meta (META) shareholders opposed a proposal to adopt Bitcoin as a treasury asset, with more than 95% voting against the idea, according to a filing with the Securities & Exchange Commission (SEC).

Ripple price forecast: XRP price could hit $1.76 this week amid potential 20% correction

Ripple (XRP) faces legal uncertainty in its battle with the United States Securities and Exchange Commission, and the XRP price continues to slide. At the time of writing, XRP is trading at $2.1540, down 1.20% in the day.

Bitcoin: BTC dips as profit-taking surges, but institutional demand holds strong

Bitcoin (BTC) is stabilizing around $106,000 on Friday, following three consecutive days of correction that have resulted in a near 3% decline so far this week. The correction in BTC prices was further supported by the profit-taking activity of its holders, which has reached a three-month high.