- Research shows that institutional investors are more inclined to invest in Bitcoin.

- The industry hopes the involvement of large institutions will foster mass adoption.

- The price crypto enthusiasts will have to pay may be too high.

Institutions are coming, surely but slowly

According to the recent survey conducted by the crypto asset insurance company Evertas, about 90% of institutional investors with nearly $80 billion of aggregated assets under management plan to increase their exposure to the cryptocurrency market within the next five years.

The team surveyed pension funds and insurance companies in the US and UK. The overwhelming majority confirmed that they considered increasing their allocation of digital currencies if the regulatory and liquidity conditions improve.

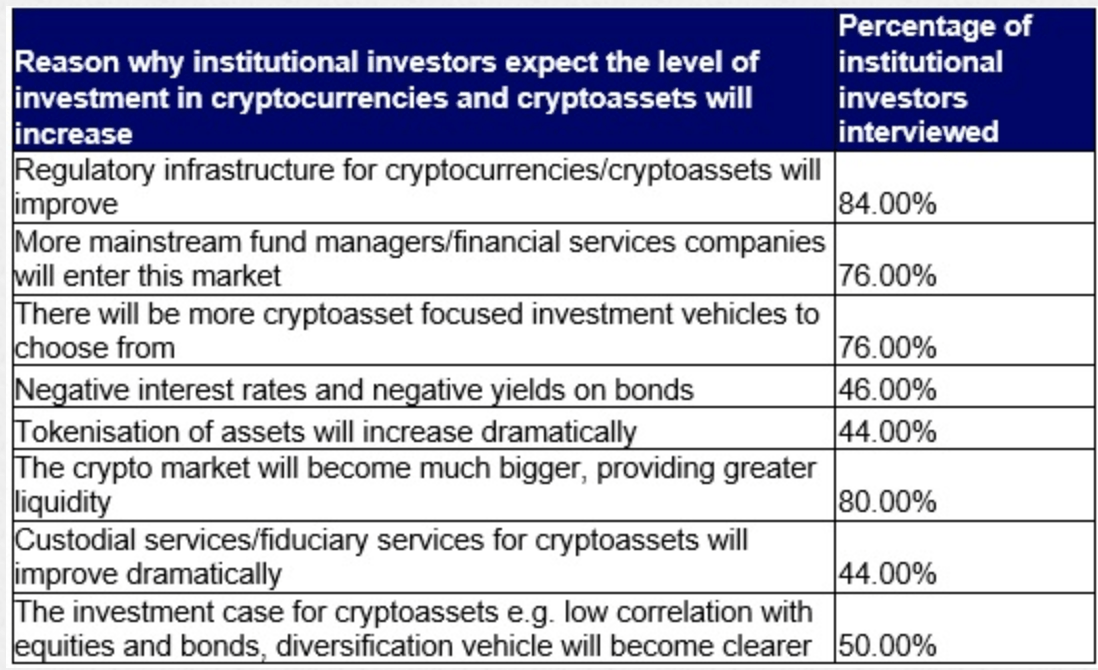

The results of Evertas survey

Source: Evertas

Moreover, 50% of the respondents believe that the cryptocurrencies' investments will become a diversification vehicle due to the low correlation with equities and other types of assets.

The industry takes note each time a high-profile investor announces support for digital assets. Thus recently, the CEO of MicroStrategy, Michael Saylor, revealed that the company had been buying bitcoins to protect the assets from inflation. Moreover, in the latest Bloomberg interview, he said that Bitcoin is less risky than cash and gold at this stage.

We feel pretty confident that Bitcoin is less risky than holding cash, less risky than holding gold," Saylor said. "Once the real yield on our treasury got to more than negative 10%, we realized that everything we are doing on P&L is irrelevant. We really felt we were on a $500 million melting ice cube.

The shares of the company jumped after the announcement. Another famous investor Paul Tudor Jones also recently announced that he holds 1% of its portfolio in BTC.

Waiting for Godot

The cryptocurrency market has been fixated on the institutional involvement in the industry for quite some time now. In 2018 Bitcoin enthusiasts put stakes on Bitcoin futures launched on CME and CBOE. The event was supposed to become a significant milestone for the industry and create a powerful mass adoption impulse.

However, BTC futures went live, but nothing happened. Bitcoin continued moving down and hit bottom on approach to $3,000 before the recovery started.

Then the focus shifted to Bakkt. The subsidiary of Digital Asset Custody Company, backed by the Intercontinental Exchange (ICE), promised Bitcoin futures with physical delivery. The company hoped to entice hesitant investors into the cryptocurrency trading. After a series of delays, Bakkt launched its bitcoin futures contracts in September 2019.

A year has passed, but the results leave much to be desired. According to the Arcane Research data, the amount of BTC contracts held to expiry surpassed the previous record and reached 356 BTC in September. This trend is in line with an uptick on the trading activity as daily trading volumes pushed above $170 million. However, the platform is still far below the market leaders.

As FXstreet previously reported, Bakkt trading activity has little impact on BTC price movements as these stats say nothing about the direction of the trade. Also, the total open interest (OI) has been decreasing in September. After a sharp growth in August, it is now 60% down.

Bakkt Bitcoin Futures

Source: Arcane Research

Now Bitcoiners tout the launch of ETFs as a new pivotal event. The Brazillian fund manager Hashdex is set to launch Bitcoin ETF on the Bermuda Stock Exchange (BSX) in partnership with the American stock exchange Nasdaq. And now that's the real trigger that will unlock the cryptocurrency industry for the institutional investors.

However, the truth is that the industry is just waiting for Godot, someone who will eventually set things right: bring the bullish trend back on track, foster cryptocurrency mass adoption, and make Bitcoin great.

Be careful with what you wish for

The large investors' involvement in the cryptocurrency market will signal that the market is getting more mature. They will help weave the new type of asset in the fabric of the traditional financial markets and, potentially, make it a part of the existing system.

But this coin has a flip side as well. Making Bitcoin a part of the system will deprive it of independent asset status, not controlled by any government or regulator. This may be the price the industry will have to pay for the mass adoption.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Dogecoin and Bitcoin Cash Price Prediction: Funding rates decrease indicate weakness in DOGE and BCH

Dogecoin and Bitcoin Cash registered 3% and 8% losses on Tuesday following increased selling pressure from the futures market. The decline comes amid large-cap cryptos like Bitcoin, Ether and XRP, holding still with slight gains.

XRP could sustain rally amid growing ETF and SEC vote prospects

Ripple flaunted a bullish outlook, trading at $2.1505 on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move triggered by the swift decision by US President Donald Trump to suspend reciprocal tariffs for 90 days.

VeChain Price Forecast: VET bulls aim for a double-digit rally

VeChain price hovers around $0.023 on Tuesday after breaking above a falling wedge pattern the previous day; a breakout of this pattern favors the bulls. Bybit announced on Monday that VET would be listed on its exchange. Moreover, the technical outlook suggests rallying ahead, targeting double-digit gains.

Dogecoin, Shiba Inu and Fartcoin price prediction if Bitcoin crosses $100K this week

The meme coin market fell sharply on Monday, shedding 4.8% in market capitalization to settle at $49.25 billion, according to data compiled from CoinGecko. The sell-off coincided with increased volatility across broader crypto markets while investors rotated funds into Bitcoin briefly tested $85,000.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.