-

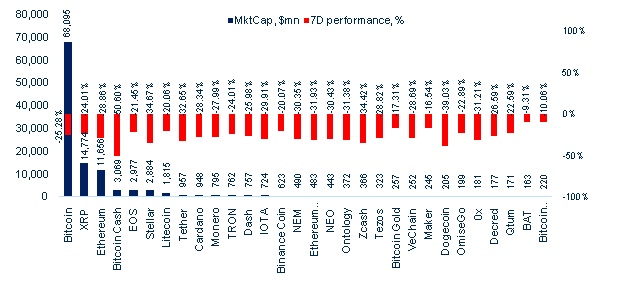

Bitcoin’sdominancerose to 53.9% from 53.4% a weekago. ThetotalCryptoMarketfell by almost27%, andoverallvolumehas increased32%. Bitcoinisdown bymore than25%, Ethereumlost 29%, XRP isdown by24%, and EOS isdownby 21%. Best performersamong top-40 cryptowereBitcoinDiamond (-10.4%) and Dogecoin (-16,3%).

-

US Justice Department Tether Investigation

-

European Commission Launches Blockchain Association

-

UK Considers Banning Crypto Derivatives

-

Major OTC Desks Creates OTC Sport Index

-

Bakkt Moves BTC Futures Launch

-

ICOs Liquidated 172,000 ETH Over Past 2 Months

-

Bitcoin Merchant Payments Down by 80%

-

Auditor Claims USDC Stablecoinis Fully Backed

-

Ethereum Development Plan Acceleration Singapore Authority Approves Digital Security Exchange

Market Momentum

The crypto sell off continues as last week wiped out almost another 34% off the total market cap, bottoming at $115 million. Bitcoin has fallen to its 420-day low at around $3,500 representing a 36% weekly loss. Although this Monday will bring Americans back from the holidays, which has helped to push the price towards $4,200, BTC is currently back below $4,000 and continues to fight its support. Ethereum is no different, more than a 37% intra-week loss has brought ETH towards two digits at $99 on Sunday, and the same as BTC, ETH has slightly recovered and currently sits at $114. The sell-off has no particular trigger, although some may argue with the increased negative activity of the SEC, Bitcoin Cash and Bakkt launch delay, experienced traders called sub $4k and BTC is most likely bottoming at ~$3k from August via historical BTC charts.

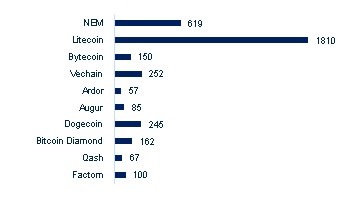

Figure 1. The performance and market capitalisation of top-30 cryptocurrencies (by MktCap)

Source: Coinmarketcap.co, As Of 26th Of November 2018 As Of 10:00 AMBST

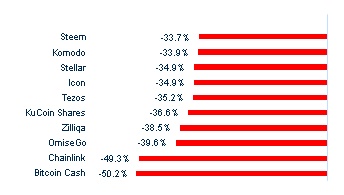

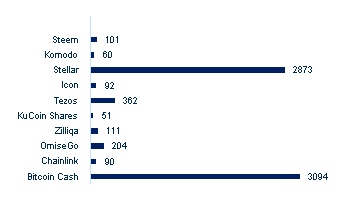

Figure 2. Worst performing digital assets* (7 days)

Source: Coinmarketcap.com, *) MktCap>=$50m

Figure 3. MktCap of worst performing digital assets*

Source: Coinmarketcap.com, *) MktCap>=$50m

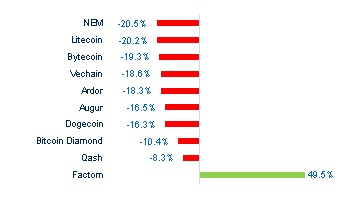

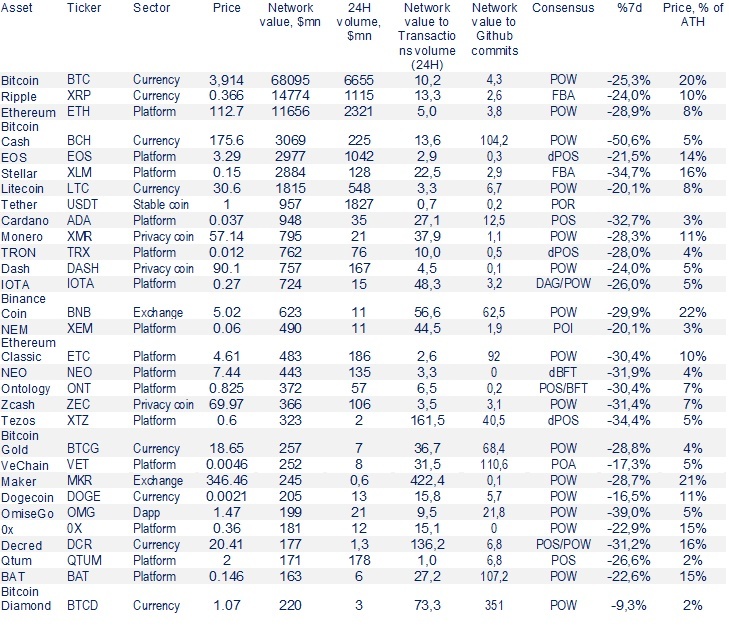

Figure 4. Best performing digital assets (7 days)

Source: Coinmarketcap.com, Mkt Cap >=$50m

Figure 5. MktCap of best performing digital assets

Source: Coinmarketcap.com, Mkt Cap >=$50m

Figure 6. Top-30 digital assets by MktCap valuation

Source: Coinmarketcap.com, NKB Research *As Of 26th Of November, 11:30 BST

Regulatory News

U.S. Justice Department Investigates Tether Ties with December Rally

The U.S. Justice Department has joined CFTC’s investigation of Tether ties to last year’s Bitcoin rally. Tether, which is directly linked to crypto exchange Bitfinex, received subpoenas last year from the CFTC, however neither Tether nor Bitfinex has yet been accused of wrongdoing. Investigators are looking into specific trading strategies such as spoofing (faking market orders), how the tethers are created, why they enter the market predominantly through Bitfinex and most importantly, whether for every digital coin issued, it has $1 in the bank.

European Commission is Launching Blockchain Application Association in 2019

The International Association for Trusted Blockchain Application (IATBA), which aims to develop guidelines, protocols and strategy for the blockchain industry in Europe, will be launched by The European Commission next year and they have already signed major banks such as BBVA as members.

UK Considers Banning Crypto Derivatives

Speaking at crypto regulation event in London, (where NKB’s Head of Brokerage, Ben Sebley, was a panelist) FCA executive Christopher Woolard, expressed FCA concerns around specific crypto derivates being sold to retail investors. “The FCA will … consult on a prohibition of the sale to retail consumers of derivatives referencing certain types of crypto assets (for example, exchange tokens), including CFDs, options, futures and transferable securities”. The FCA also plans to consult on which digital assets fall within its existing regulations by the end of the year, Woolard added.

Singapore Stock Exchange Clarifies Rules for Public Firms Issuing Tokens

The Singapore Exchange (SGX) has published guidelines for companies already publicly listed, and which are considering an ICO. Every firm is required to consult token issuance with an SGX regulatory subsidiary, provide a legal opinion on the nature of tokens, auditor’s opinion on how the ICO should be treated from an accounting perspective, and, if tokens are securities, they should be properly registered and SGX RegCo expects issuers to be “ultimately responsible for maintaining a robust system of risk management and internal controls”. Finally, companies are also required to make certain disclosures such as the risk involved, raised funds allocation and KYC/AML checks.

Gibraltar Blockchain Exchange Officially Approved by Regulators

The Gibraltar Financial Services Commission (GFSC) has officially granted a license to The Gibraltar Blockchain Exchange (GBX), subsidiary of The Gibraltar Stock Exchange (GSX). GSX is therefore claiming to be the first stock exchange which owns a regulated blockchain exchange.

Crypto market news

Three Major OTC Desks Create OTC Spot Index

VanEck subsidiary MV Index Solutions, has launched Bitcoin OTC Spot Index (MVBTCO) in collaboration with Genesis, Cumberland and Circle, which will provide price feeds. Director of VanEck’s digital asset strategy ,Gabor Gurbacs, said that “the index may pave the way for institutionally oriented products, such as ETFs, as well as provide further tools to institutional investors to execute institutional size trades at transparent prices on the OTC markets.”

Bakkt Moves BTC Futures Launch on January 2019

The highly anticipated launch of Intercontinental’s Exchange Bitcoin futures trading platform has been postponed until 24th January 2019, according to the company’s blog post. Originally intended for launch on 12th December, Bakkt is on hold due to the “volume of interest” and “work required to get all the pieces in place” as Bakkt CEO Kelly Loeffler writes.

ICOs Liquidated 172,000 ETH over Past 2 Months

Interesting research conducted by Larry Cermak, who went through ICOs’ ETH treasuries and found out that combined, ICOs hold over 3.57m ETH (3.5% of ETH supply), ICOs liquidated 172,000 ETH (4.6% of total treasury holdings) from September and in aggregate, ICOs have moved/liquidated 64% of all ETH they raised. This report thus indicates that the sell-off has not been as drastic as has been generally thought. Yet.

Silvergate Capital Files for IPO

Silvergate Capital Corporation, holding company of Silvergate bank which has more than 480 crypto-related customers, has filed S-1 form for an IPO. Among Silvergate’s clients were names like Gemini, Kraken and Paxos. Importantly, The Digital Currency Group has participated in Silvergate’s $114 million funding round.

Mining Farm Giga Watt Files for Bankruptcy

Giga Watt, Bitcoin cloud mining start up, founded by well-known BTC miner Dave Carlson, has filed for bankruptcy according court filings. Giga Watt, who originally planned to build a crypto mining facility in the state of Washington via its $20 million ICO in July 2017, has previously been sued for conducting an unregistered securities offering.

Bitcoin Merchant Payments down by 80%, Hashrate Dropped by 44%

According to Chainanalysis, the use for commercial payment in Bitcoin has dropped by nearly 80%. Chainanalysis surveyed 17 BTC payment processors and found that payments fell from $427 million in December 2017 to $96 million in September. On Wednesday, BTC hashrate (mining difficulty measurement) dropped by almost 44% compared to its ATH in August, and as of Sunday, the hashrate is recovering with a 38% rise from Wednesday.

Auditors Claim USDC Stablecoin is Fully Backed

Major auditing firm Grant Thornton LLP, reported that Circle, the company behind dollar-pegged coin USDC, has $127.5 million in their bank account, which is sufficient to cover every issued token. USDC joined the “stable coin army” of previously audited Gemini’s TrueUSD and PaxosStandart Token.

Ethereum Development Plan Acceleration

Key Ethereum developers, including V.Buterin, G.Colvin, J.Lubin, D.Ryan, and others, had a private meeting to discuss the acceleration of the development to boost the platform capabilities in the short term. The minutes were published on Github by an engineer of the Ethereum virtual machine, Greg Colvin. The Ethereum developers are under pressure to amend the public roadmap. The changes discussed include a system-wide upgrade or hard fork (targeted for June 2019), also the replacement of Ethereum’s virtual machine, storage fees for smart contracts and some other smaller updates.

Last Week Investments

Binanceinvest $3 million in OTC trading desk Koi Trading via its venture arm Binance Labs.

SECURITY TOKEN NEWS

Monetary Authority of Singapore Approves Digital Security Exchange

The Monetary Authority of Singapore has approvedClearBridge Accelerator and its fundraising platform CapBridge, to run their own digital security exchange called 1exchange, in order to help companies raise funds and enabling investors to buy and sell digital assets.

Overstock Retail Business for Sale

Overstock’s shares have surged by 26% after CEO Preston Byrne announced that he will sell the retail business selling home furniture and jewellery to fully shift his focus to blockchain development. Byrne’s plans for the blockchain space will be realized through Overstock’s subsidiary Medici Ventures, where Byrne has invested $175 million. One of the most famous start-ups backed by Byrne, is digital securities exchange tZERO, which has not yet launched despite having raised more than $130 million in August.

Tokenestate Executes First Security Token Transaction

Swiss-based security token issuer Tokenestate, has executed its first equity transaction on blockchain, selling its own shares in exchange for a payment in Swiss francs.

Digital Security Insights

Jesus Rodriguez has been very active so far in creating thoughtful and challenging content for everyone involved/interested in digital security space. His two recent blog posts clear the hype in the security token world as well as pointing out the lack of promised liquidity.

This report is for informational purposes only and should not be construed as a recommendation or investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. All market prices, data and other information contained in this report have been prepared from sources believed to be reliable, but we give no representation or warranty that the information is complete, accurate or current. Past performance is not a reliable indicator of future performance. Future returns are not guaranteed and a total loss of principal may occur. This report may not be reproduced, redistributed, or copied in whole or in part for any purpose without NKB GROUP AG’s prior express consent and may not be distributed in jurisdictions where digital assets are prohibited.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.