The crypto market cap dips to $2.44 trillion while Mt. Gox moves 11,833 BTC worth $932 million

- Crypto market capitalization reaches a low of $2.44 trillion on Tuesday, levels not seen since early November.

- The recent price correction triggered a wave of liquidations worth over $937 million in the last 24 hours.

- Defunct crypto exchange Mt. Gox raises concern in the market as it moves 11,833 BTC worth $932 million.

The crypto market continued its ongoing downleg as the week started, as its market cap capitalization reached a low of $2.44 trillion on Tuesday, levels not seen since early November. This price crash has triggered a wave of liquidations of over $937 million in the last 24 hours while the defunct crypto exchange Mt. Gox raises concern in the market as it moves 11,833 BTC worth $932 million.

Crypto market cap reaches lower levels not seen since November

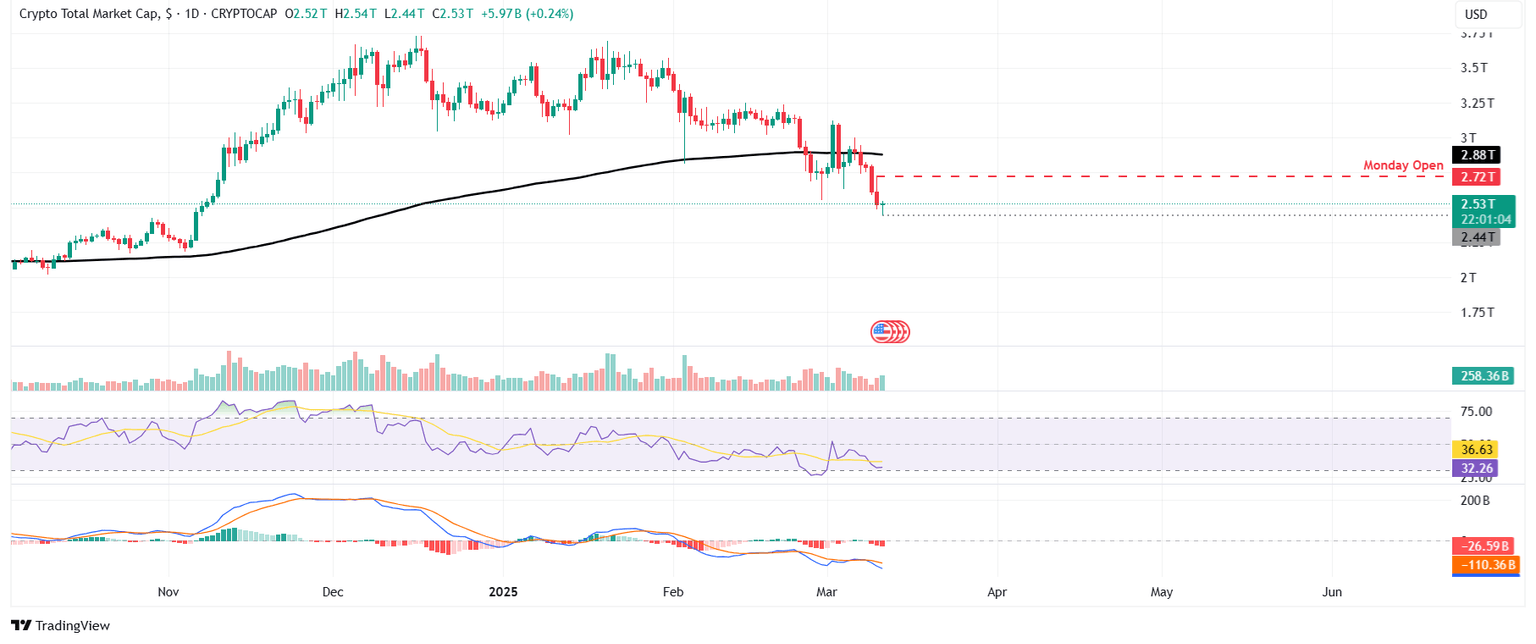

The crypto market continued its ongoing downleg as the week started. Its total market capitalization chart shows that it dipped from $2.72 trillion on Monday to $2.44 trillion on Tuesday, reaching a level not seen since early November.

Total crypto market capitalization chart.

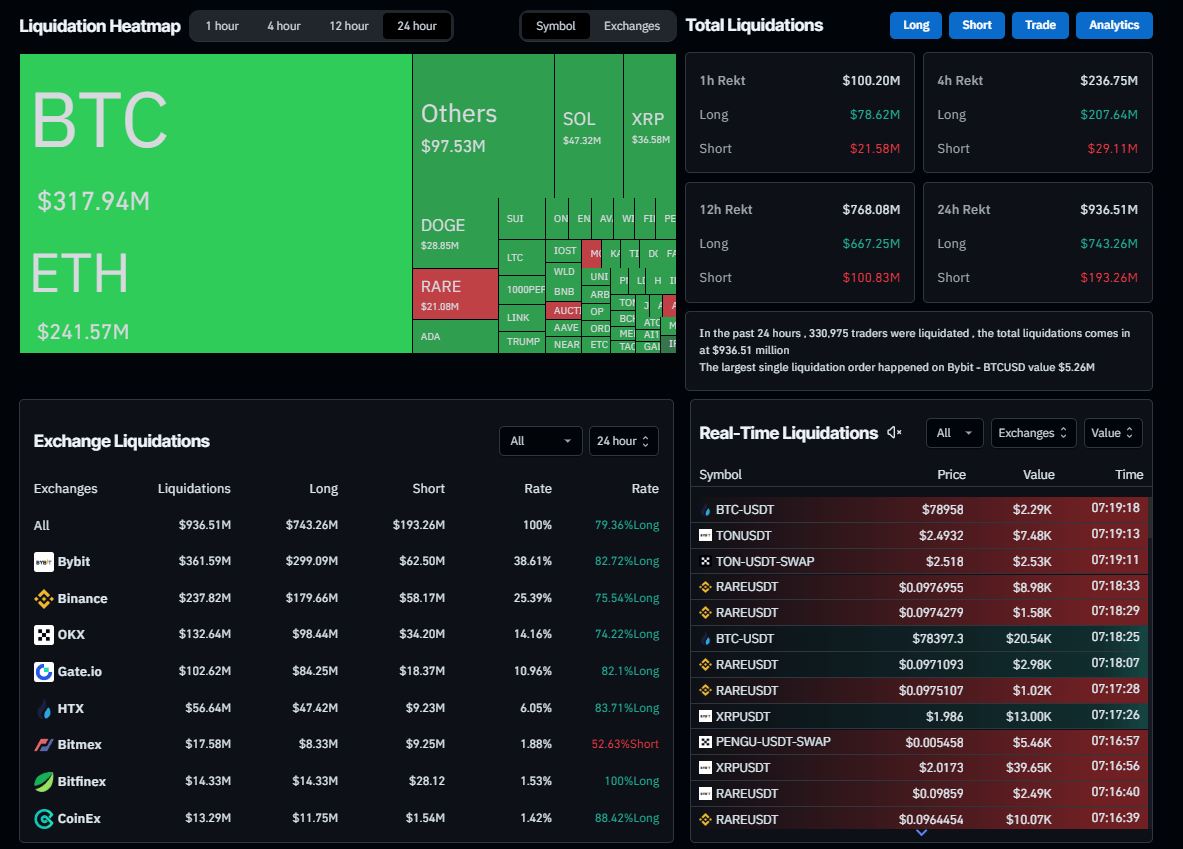

This price crash triggered a series of liquidations across the crypto market, totaling $936.51 million in the past 24 hours. The largest single liquidation order happened on Binance- BTCUSDT, valued at $5.26 million, according to Coinglass data.

Liquidation Heatmap chart. Source: Coinglass

Mt. Gox transfer could generate FUD in the market

Lookonchain data shows that the defunct cryptocurrency exchange Mt. Gox moved another 11,833.6 BTC worth over $932 million on Tuesday after last week’s transfer of 12,000 BTC worth over $1 billion. During Tuesday’s transfer, 11,501.58 BTC ($905.06 million) was sent to a new wallet, and 332 BTC ($26.13 million) was moved to a warm wallet.

Traders should be cautious as transferring such a large amount of Bitcoin to wallets often signals an intent to sell or distribute and can create bearish sentiment as market participants anticipate increased supply.

Mt. Gox transferred another 11,833.6 $BTC($931.19M) 30 minutes ago, of which 11,501.58 $BTC($905.06M) was transferred to a new wallet and 332 $BTC($26.13M) was transferred to a warm wallet.https://t.co/vPjUIke8d2 pic.twitter.com/489R4MXcSc

— Lookonchain (@lookonchain) March 11, 2025

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.