The Bitcoin bear growls

S2N spotlight

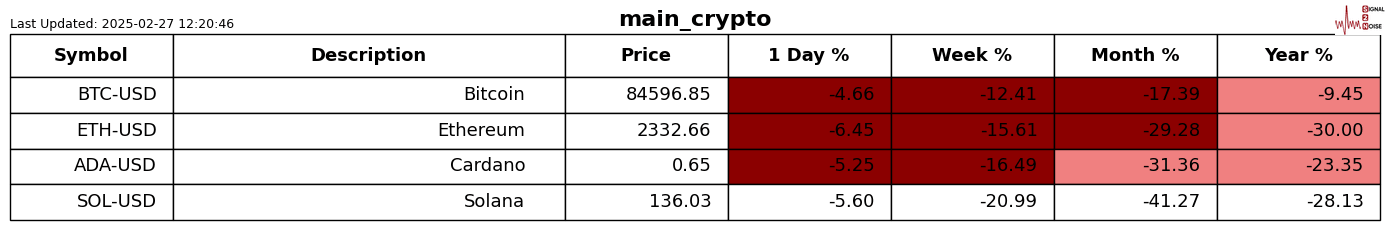

Today I am going to focus on Bitcoin for the simple reason that I think this is the best window into the current level of “animal spirits” in the market. Nothing in my 25 years of trading the markets for a living matches the intensity of the crypto crowd. The dot.com era was mild compared to the irrational exuberance associated with this creed.

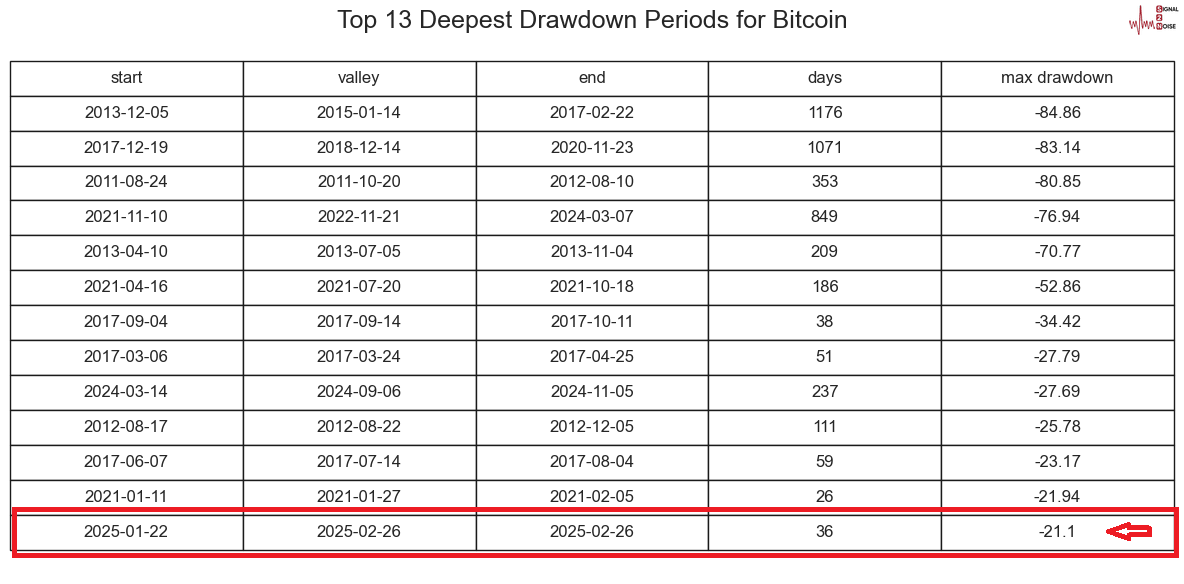

First things first, we are in a bear market, i.e. a -20% drawdown. I have added a table that shows we are in the 13th largest drawdown of all time.

I wanted to also highlight that the Average True Range (ATR) has started to become noticeable. This is a really good measure of volatility, as it incorporates the highest and lowest price range of the day into its calculation. I include the $ and % ATR in my charts. You can see that the price range was 8.6% yesterday versus a price drop of -4.92%.

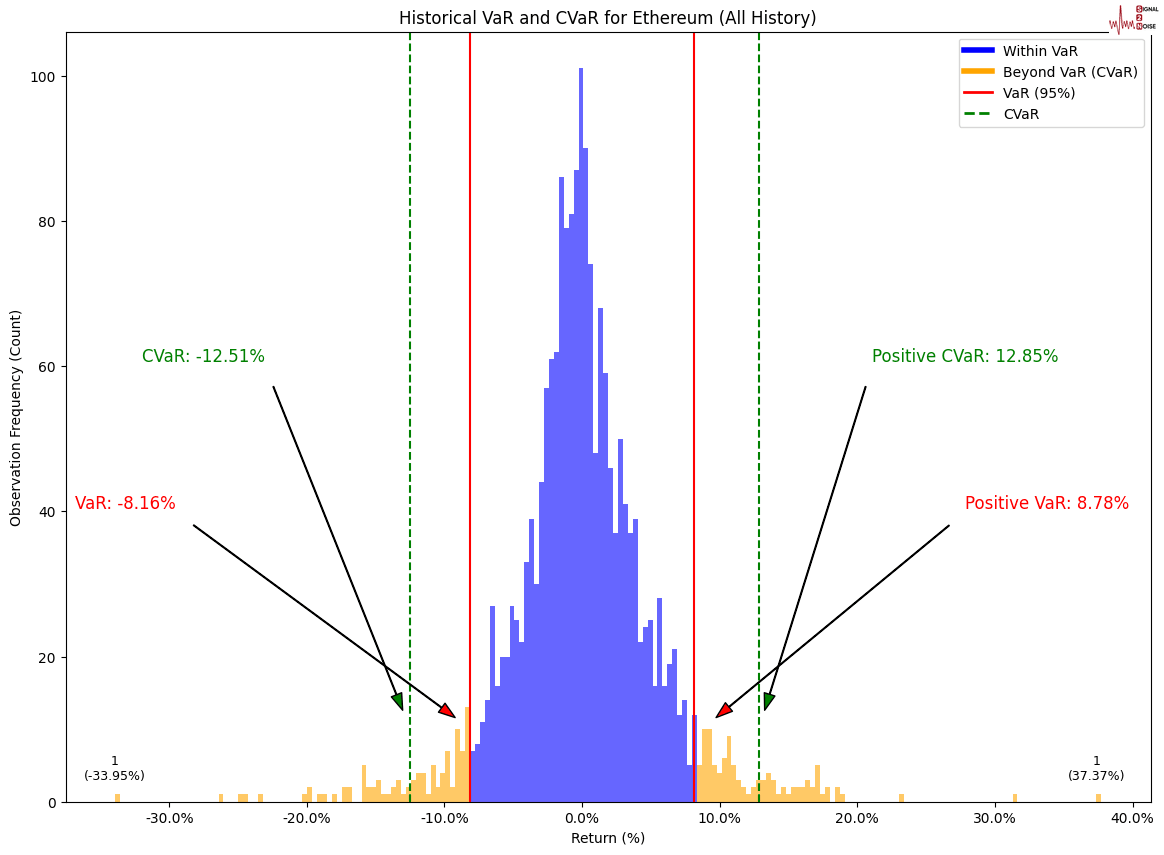

Final pitstop on this trip. I must say this is one of my prettier charts. The value at risk (VaR) measure means that 95% of the time the move won’t be greater than the -7.16%, and +7.23% VaR calculated. But that is only part of the story. What happens with the 5% of the time that moves are worse than VaR? The average of those 5% is calculated in the CVaR. Remember, you will never know when a black swan is coming because it is a black swan; otherwise, it would have been called a white swan. I like to always factor the CVaR into the equation.

I am not anti-crypto, I am anti-irrational exuberance and get rich quick schemes. There are many new hands holding their bags at the moment. Not too sure how many diamond hands there are when it comes to the new institutional allocators.

Many of today’s crypto investors have bought in because of FOMO. Soon there will be many suffering from FOHO (fear of holding on), I just made that up, I hope you thought it was as good as I did. Perhaps I will re-enter when MicroStrategy trades at a discount to Bitcoin.

S2N observations

I thought I would share a VaR and CVaR look at Ethereum. Wild enough to make a grown man cry.

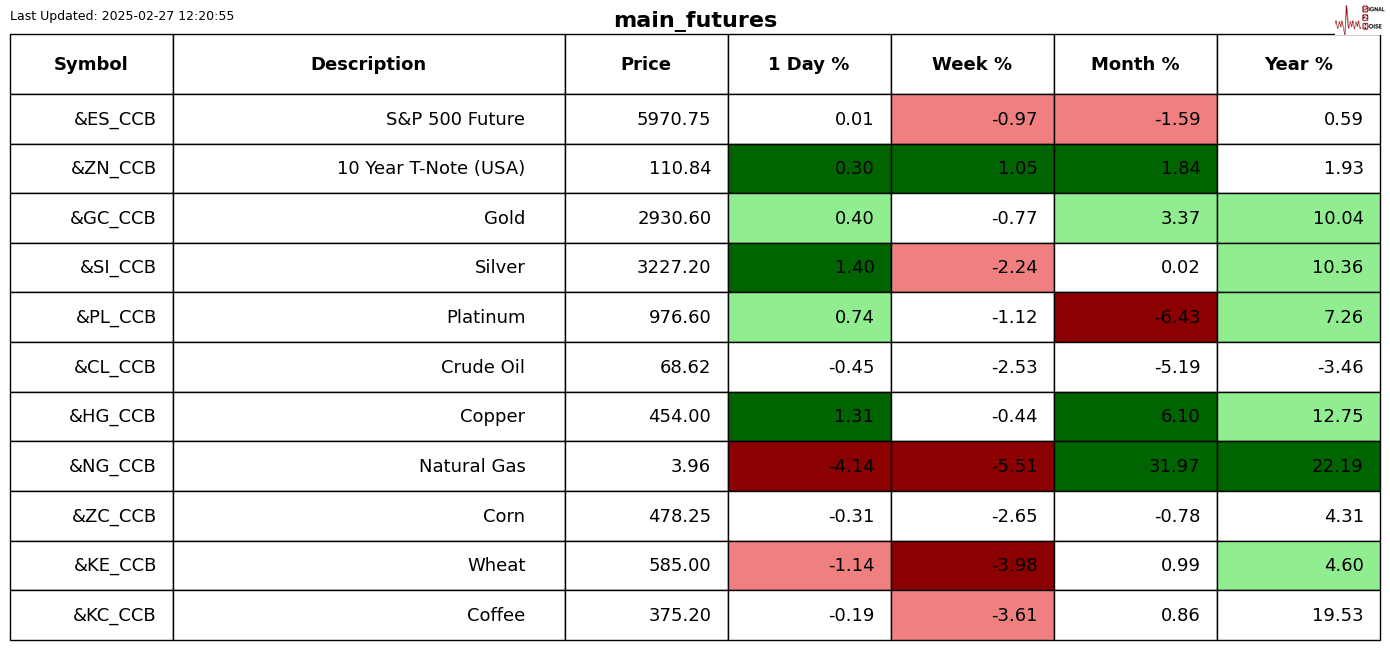

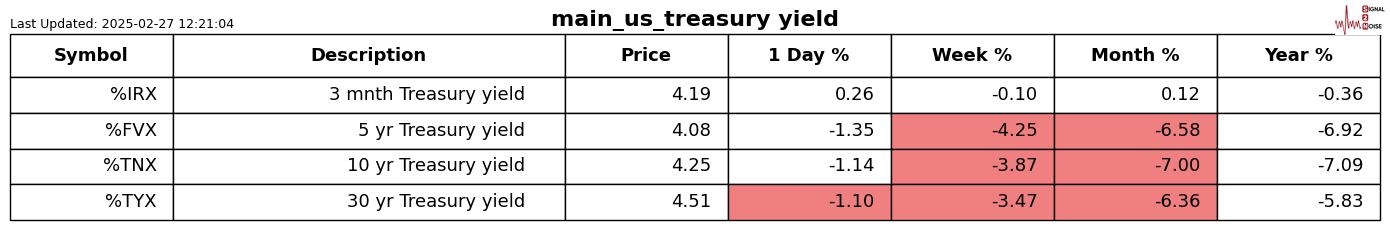

Do not be distracted by the latest strength in the bond market. The market is discounting the savings from DOGE and getting way ahead of itself. We have seen this movie many times before with 2 of the best actors at over-promising, Trump and Musk. What was unusual yesterday was the move of the MOVE (bond volatility) Index while bond yields dropped (strengthened). The disconnect over the last few months with bond volaitility dissappearing while bonds weakened is likely to start normalising.

In case you missed it, admit you missed it. Reverse Repo balances are below $100 billion, on their way to zero. We need to dig in and talk monetary policy one of these days.

S2N screener alerts

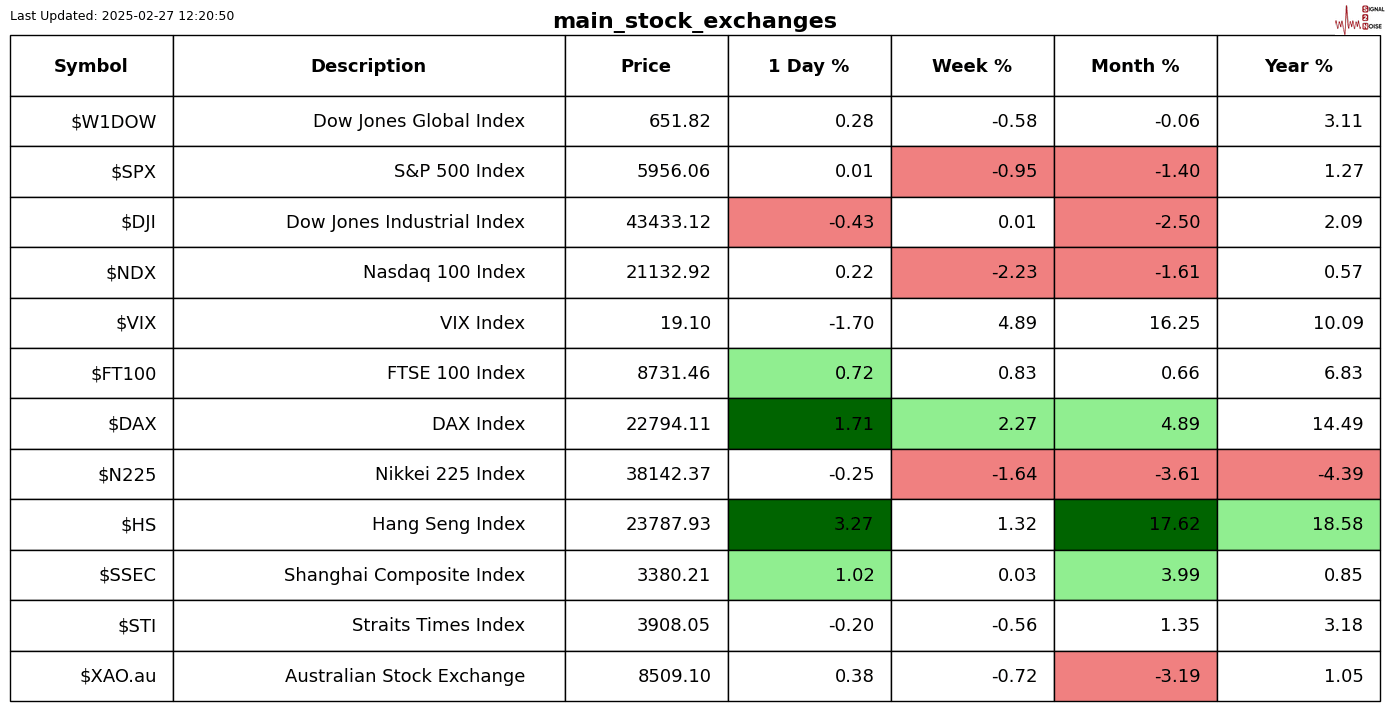

The Hang Seng enjoyed a new ATH which of course automatically means a new 52 week high.

Performance review

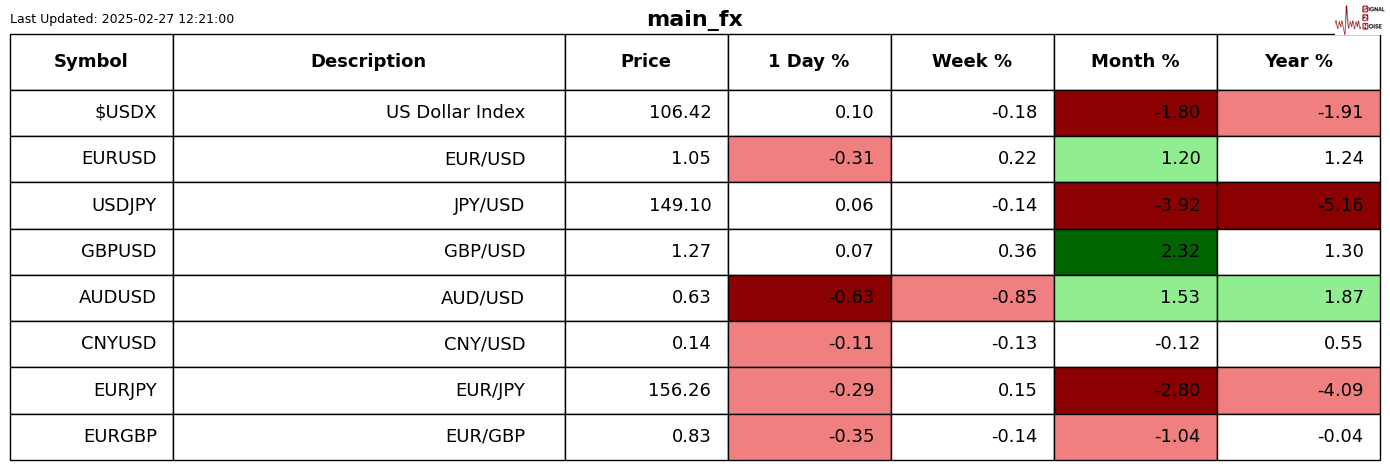

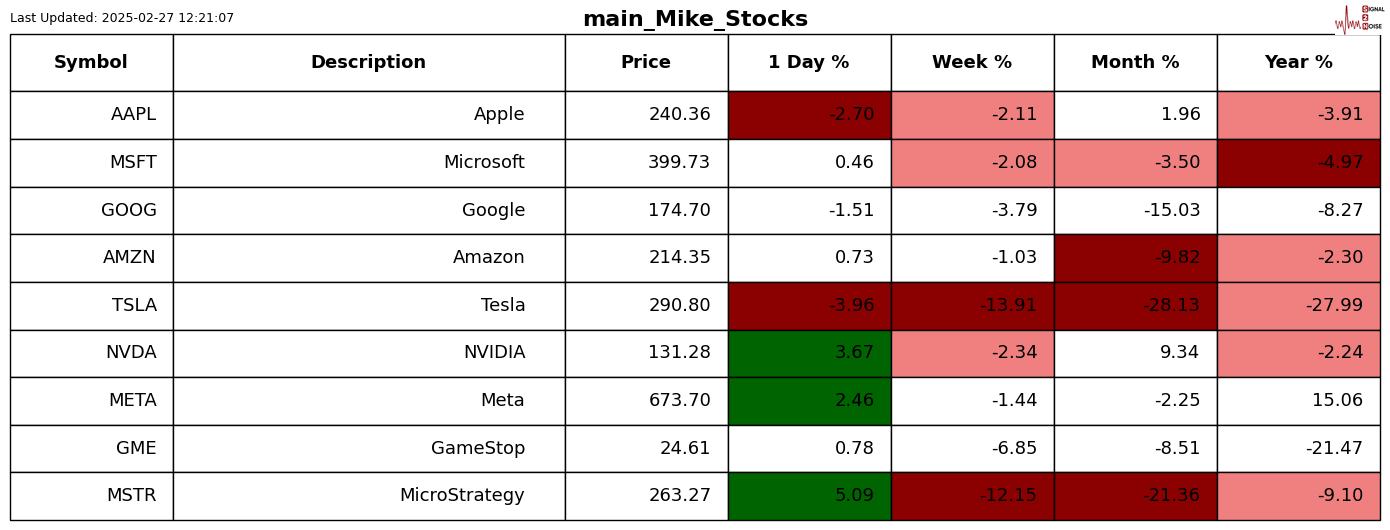

For those who are new to the letter, the shading is Z-Score adjusted so that only moves bigger than usual for the symbol are highlighted.

Chart gallery

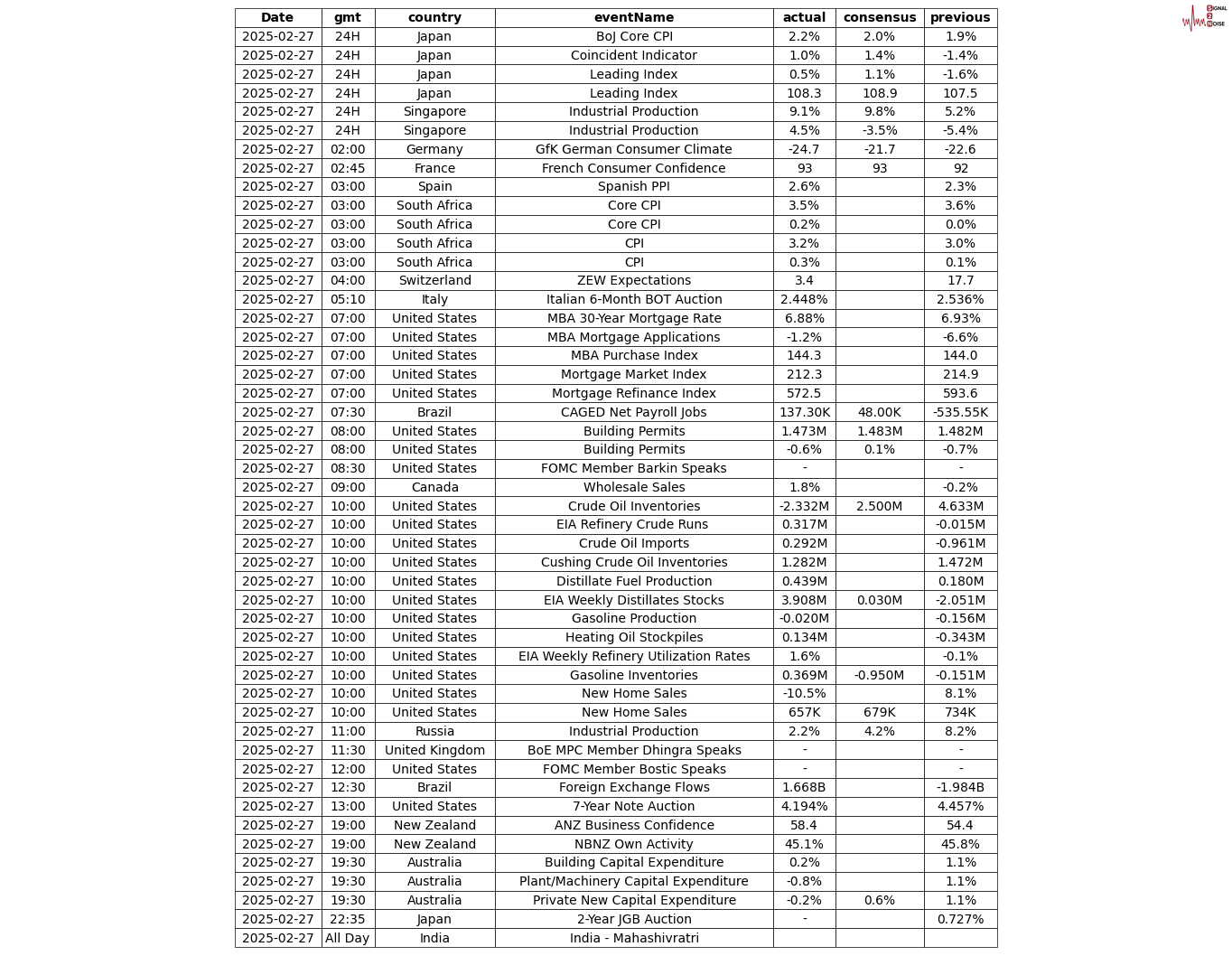

News today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.