- It seems that major global market players are shifting their views in favor of Bitcoin.

- Many institutional investors are looking at Bitcoin as a viable long-term investment.

JPMorgan is an American multinational investment bank that used to have very negative views of Bitcoin and the cryptocurrency market. However, it seems that in the past year, their stance has changed and they have gone as far as stating that Bitcoin will pose a threat to gold.

Institutional money pours into Bitcoin

The rise of cryptocurrencies in the financial sector seems to be great enough for institutional players to notice. JPMorgan Chase & Co has recently stated that gold will be suffering because of Bitcoin as money is being shifted towards the digital asset.

The adoption of bitcoin by institutional investors has only begun, while for gold its adoption by institutional investors is very advanced

After several significant investments by Square Inc and other companies like Stone Ridge, MicroStrategy seems to be the latest one to join the bandwagon offering $550 million in convertible notes with net proceeds to buy Bitcoin.

In a press release on Wednesday, the company announced that the notes will be unsecured senior obligations of MicroStrategy and will have an interest rate of 0.75% per annum.

The notes are being offered and sold to qualified institutional buyers pursuant to Rule 144A under the Securities Act. The offer and sale of the notes and the shares of MicroStrategy’s class A common stock issuable upon conversion of the notes, if any, have not been and will not be registered under the Securities Act or the securities laws of any other jurisdiction, and the notes and any such shares may not be offered or sold in the United States absent registration or an applicable exemption from such registration requirements. The offering of the notes is being made only by means of a private offering memorandum.

In a World Gone Digital, #Bitcoin May Surpass #Gold -- The past year has been a stepping stone for Bitcoin into the mainstream of investment portfolios and for the digital evolution of money, which should keep the benchmark crypto on an upward price trajectory in 2021. pic.twitter.com/7kmAecbrdR

— Mike McGlone (@mikemcglone11) December 9, 2020

Mike McGlone, a Senior Commodity Strategist for Bloomberg Intelligence also believes Bitcoin could be on its way to surpass Gold if the world shifts digitally.

Bitcoin price could be rebounding into a new all-time high

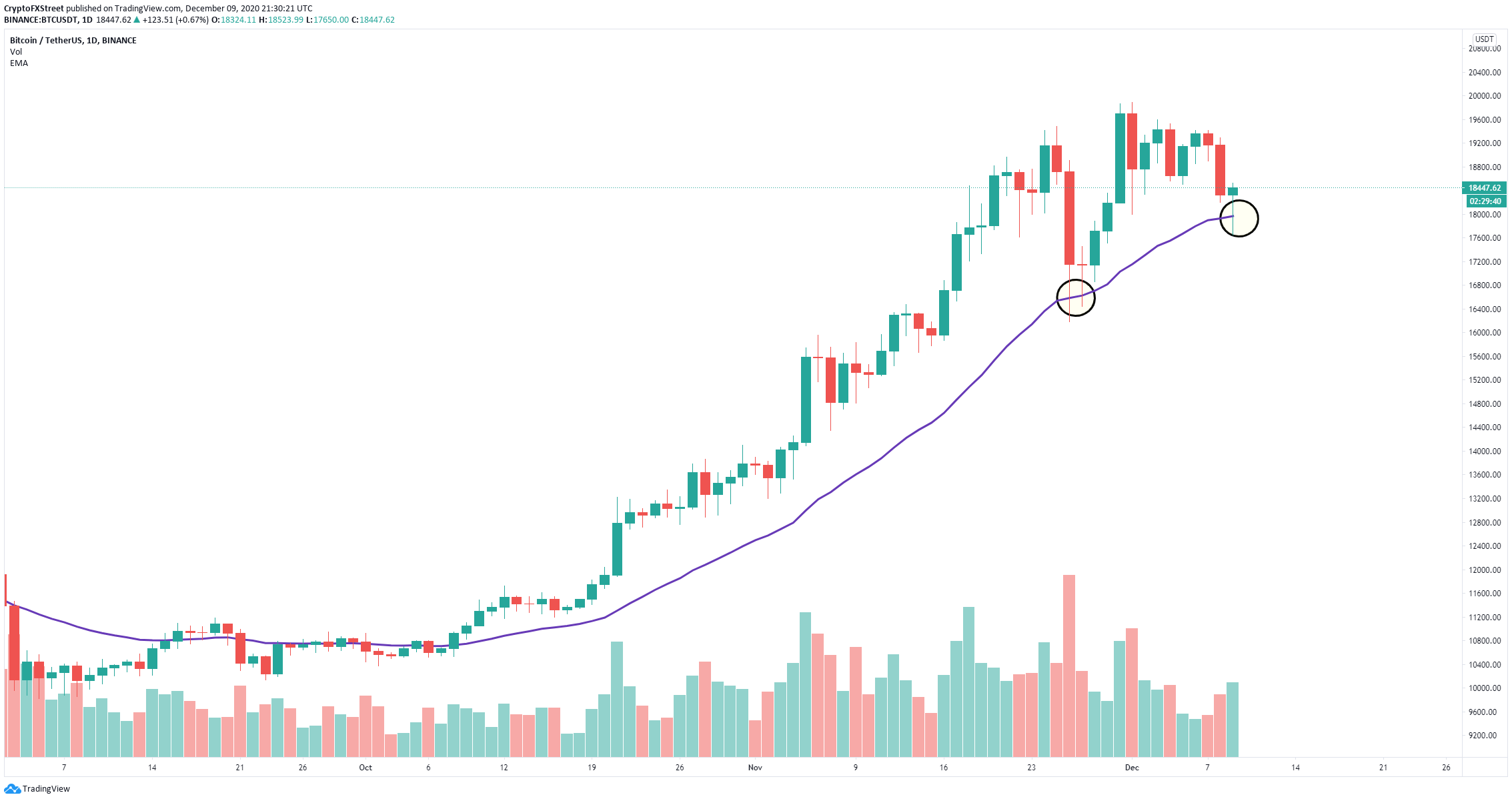

Despite the most recent sell-off, Bitcoin seems to have rebounded quite well and has formed a bullish candlestick on the daily chart after defending a critical support level in the form of the 26-EMA which has held since October 9.

BTC/USD daily chart

On top of that, it seems that Bitcoin’s inflow mean on all exchanges has hit its highest point since March when the price hit the year low. According to the CEO of Cryptoquant, Ki Young Ju, this should be considered bullish in the long-run.

$BTC All Exchanges Inflow Mean(7d MA) hit the eight-month high since March when the price hit the year-low.

— Ki Young Ju 주기영 (@ki_young_ju) December 9, 2020

Very bullish in the long-run.

Thread pic.twitter.com/O00EA5yv4P

Although the announcement by MicroStrategy to buy a significant amount of Bitcoin has increased its buying pressure, there are some concerning news out from Mt.Gox which could potentially release around 150,000 Bitcoin into the market.

In our last article, we have discussed the possibility of Bitcoin’s correction not being over and BTC bears targeting $13,000 before resuming the uptrend.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.