The three questions on financial literacy Bitcoiners flunk: Bank of Canada

“In particular, Canadians who were young, male, employed, had a university degree, high household income and relatively low financial literacy were more likely to own Bitcoin."

A study from the Bank of Canada found that Bitcoiners on average have lower financial literacy than those who don’t own Bitcoin (BTC).

The study was compiled from four years of annual surveys from 2016 to 2020, with the sample sizes ranging anywhere from 1,987 to 3,893 respondents.

The Bank of Canada’s full study is titled “Bitcoin Awareness, Ownership and Use: 2016-20” and was published on April 19. A key conclusion from the study was that:

Bitcoin owners displayed greater knowledge about the Bitcoin network than nonowners, yet they scored lower on questions testing financial literacy.

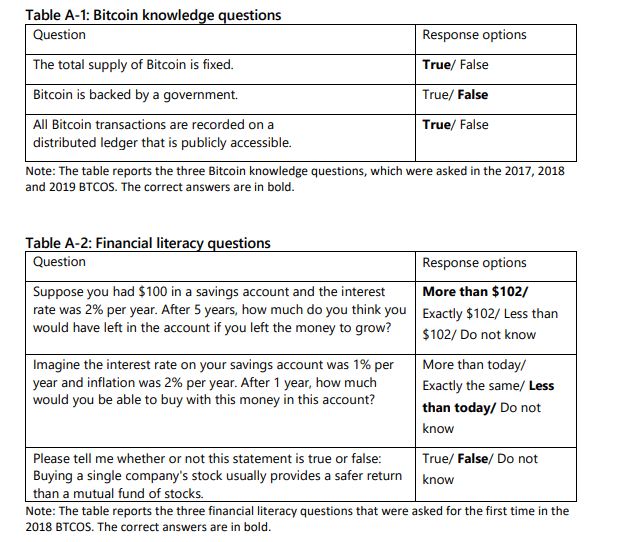

However the financial literacy testing was based on just three multiple choic questions that focused on interest rates, inflation and stock/mutual fund comprehension. The three Bitcoin questions focused on supply, the digital ledger and whether the network is backed by the government or not.

Given the limited number of questions the idea they can accurately gauge someone's financial literacy is arguable. On the other hand, the questions are pretty easy.

The Bank of Canada’s researchers emphasized that the “interaction between financial literacy and participation in the market for crypto assets” is important to explore, as there are many risks associated with the sector that could be potentially avoided via further education.

Bitcoiners

The data found that over the four years, the average Bitcoin hodler fell in the demographic of young males aged between 18-and 34, and men accounted for at least double the number of women each year. The gender gap has been a long-running and widely reported subject in crypto’s short history.

“Overall, marginal effects are consistent with descriptive findings already discussed. We find that the probability of Bitcoin ownership decreases with being female, older and unemployed, but increases with education,” the report reads.

In terms of a specific type of Bitcoin hodler, the report suggests that young educated men who scored low on financial literacy but earned more than $70,000 were the most typical type:

In particular, Canadians who were young, male, employed, had a university degree, high household income and relatively low financial literacy were more likely to own Bitcoin.

Non-bitcoiners

On the other end of the spectrum, those that scored high on financial literacy were “more likely to be aware of Bitcoin but less likely to own it.”

Notably, the reasons offered in the study for not owning Bitcoin that polled the most each year weren’t necessarily anti-Bitcoin, with a lack of understanding and current payment methods being satisfactory being the main answers.

After those two reasons, the next highest reason each year was that respondents didn’t “trust a private currency that is not backed by a government.”

We find that between 2018 and 2020, the level of Bitcoin awareness and ownership among Canadians remained stable: nearly 90% of the population were aware of Bitcoin, while only 5% owned it.

An individual survey from this study dubbed “Cash Alternative Survey” was previously reported on by Cointelegraph, with the report suggesting that Canadians with a lower level of understanding of finance could be twice as likely to invest in crypto.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.