Tezos Price Prediction: XTZ primed to rebound if bulls can defend this crucial support level

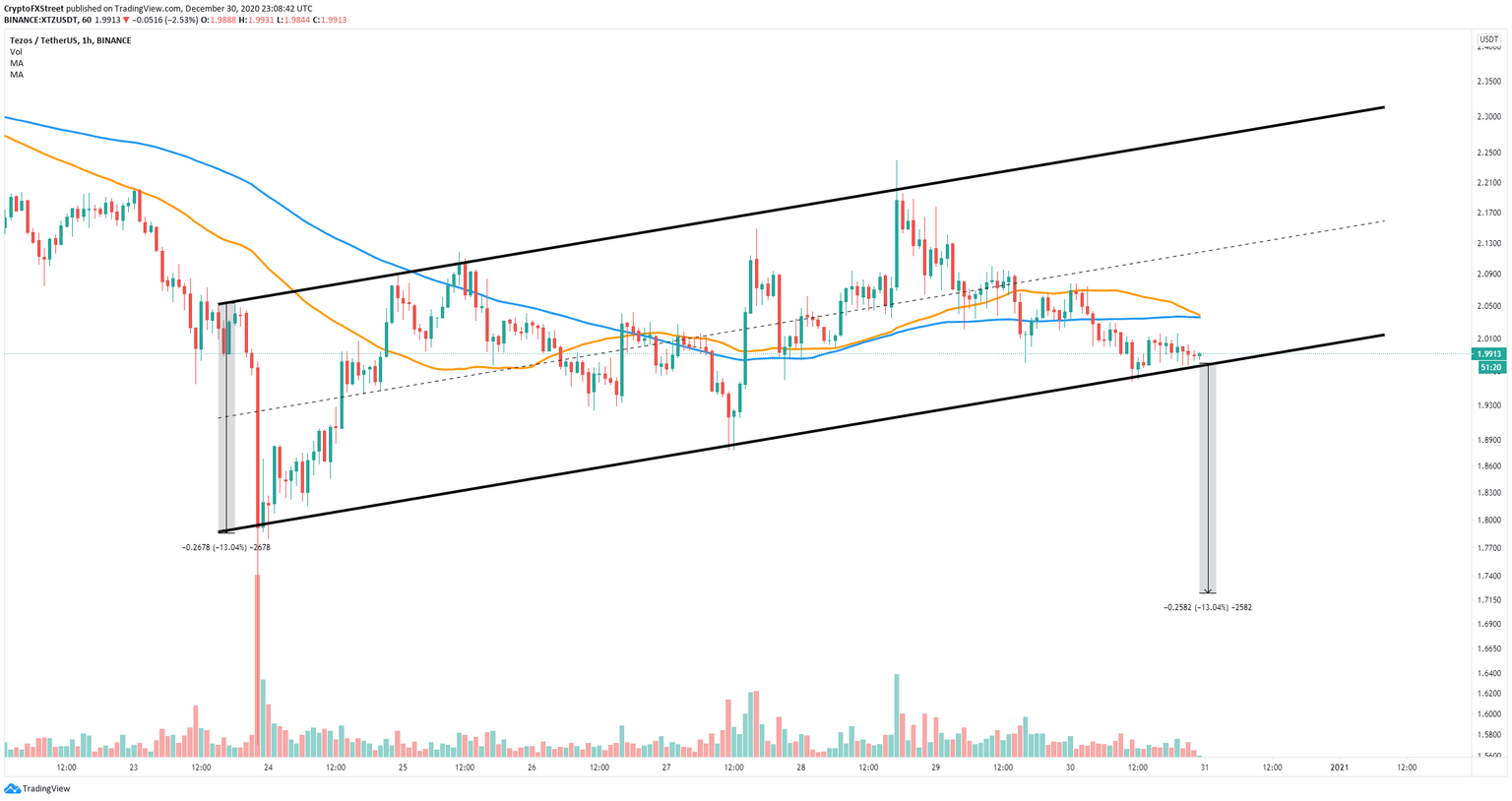

- Tezos price is bounded inside an hourly ascending parallel channel.

- Bulls must absolutely defend thecritical support level at $1.97 to avoid a massive dip.

Tezos has been trading above a crucial support level at $1.97 for the past 10 hours and so far bulls have defended it. The digital asset seems poised for a significant rebound unless the bears take over.

Tezos price could jump towards $2.3 in the near future

Tezos has established an hourly ascending parallel channel and has defended the lower trendline support at $1.97 for the past 10 hours. Bulls need to push XTZ above the 50-SMA and the 100-SMA which coincide at $2.03.

XTZ/USD 1-hour chart

A breakout above both moving averages can quickly push Tezos price towards the middle trendline at $2.15 and eventually towards the high of $2.3. An aggressive bullish trader would enter his position now, expecting the rebound.

XTZ/USD 1-hour chart

However, the trend is in favor of the bears despite the defense of the support level. Tezos price is just above the support at $1.97. A breakdown below this point can drive XTZ down to a low of $1.72, a 13% move that can be calculated using the height of the pattern as a reference point.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.