Tezos Price Prediction: XTZ looks to sweep swing highs before retracing 11%

- Tezos price looks to continue its 16% upswing over the past 24 hours.

- A reversal after the retest of the recent swing high at $4 or $4.17 seems likely.

- If XTZ produces a decisive close above $4.40, it will invalidate the bearish outlook.

Tezos price has been respecting the extremes of the range as it consolidates within it. After a massive leg up, XTZ might be due for a retracement.

Tezos price ponders a correction

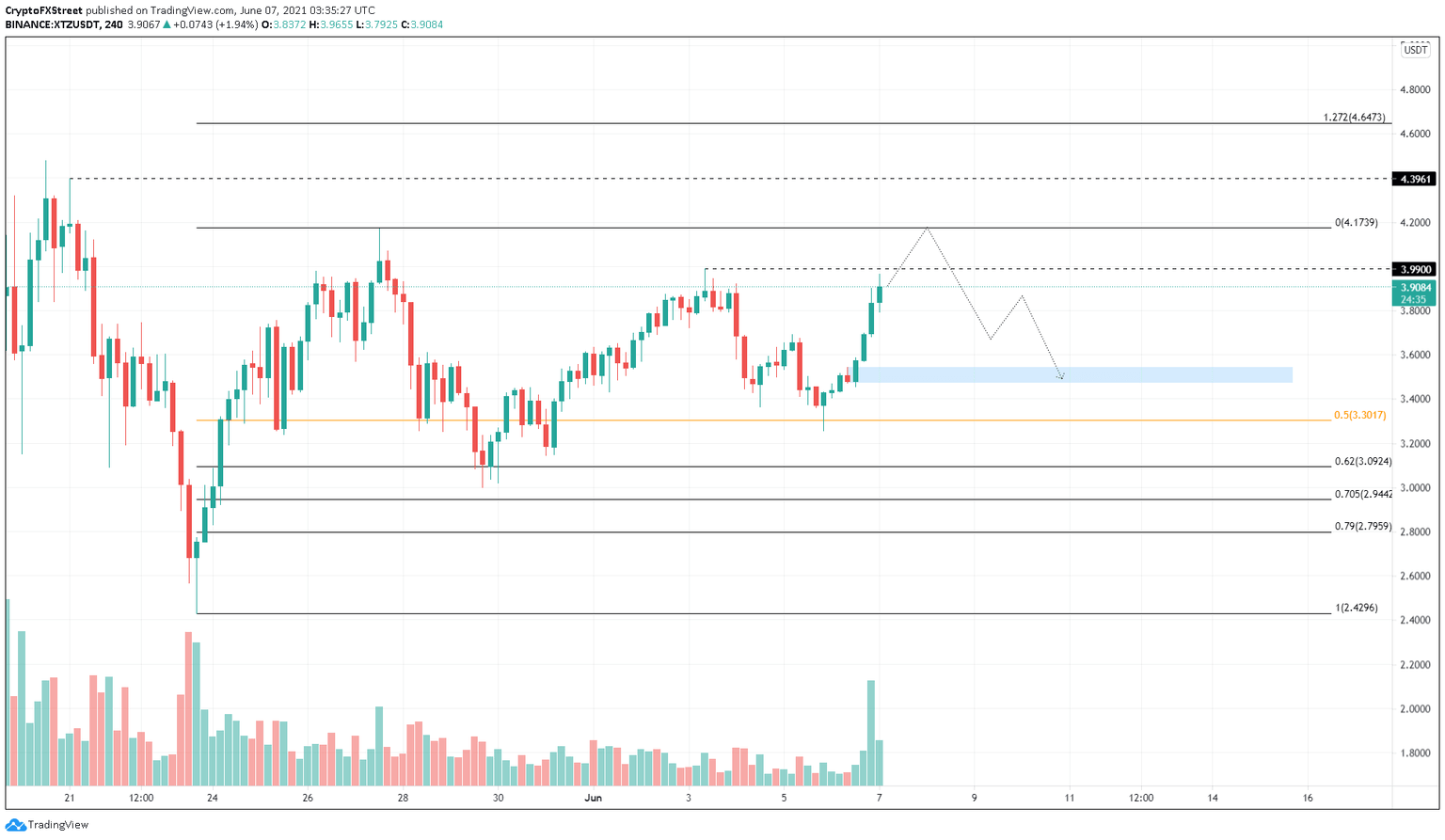

Tezos has witnessed a 16% rally over the past 24 hours to where it currently trades, $3.90. A retest of the recent local top at $4 seems plausible. However, investors should also consider a sweep of the range high at $4.17.

Tezos price is likely to begin its correction toward the demand zone extending from $3.47 to $3.54 after it retests either of the above-mentioned levels.

If the sellers have extra oomph, this downswing could extend up to the 50% Fibonacci retracement level at $3.30.

Under extremely bearish conditions, a retest of the 70.5% Fibonacci retracement level at $2.94 seems likely.

XTZ/USDT 4-hour chart

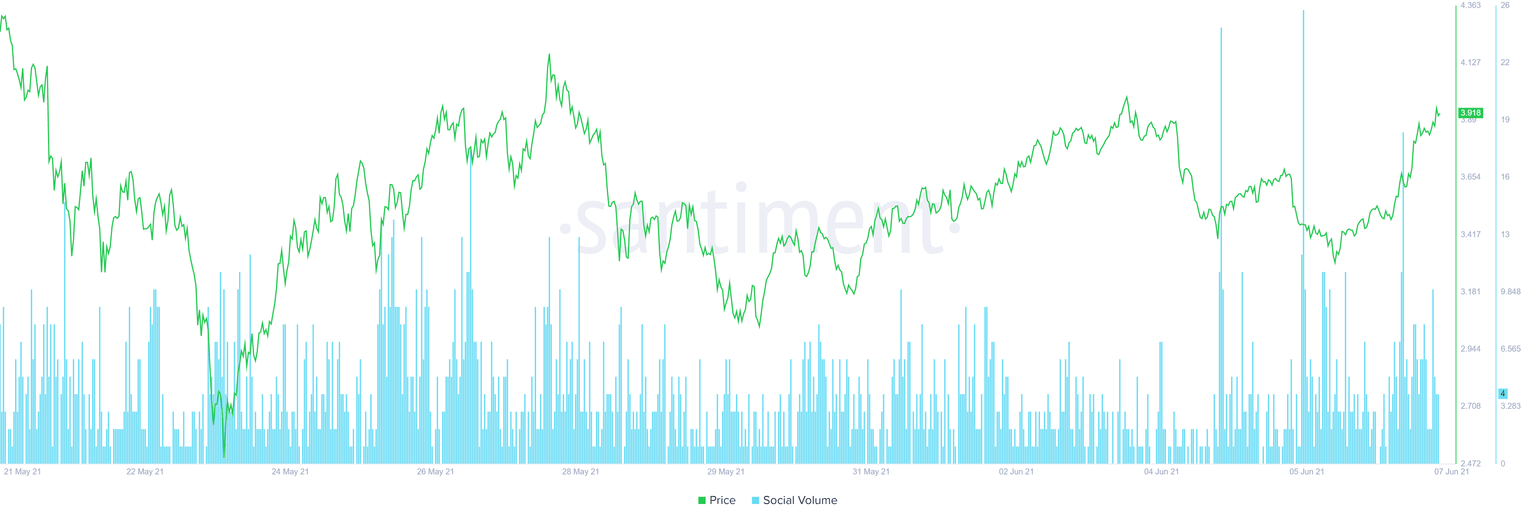

Interestingly, the social volume for Tezos price saw a massive uptick on June 6. Typically, a spike in this metric coincides with local tops. Therefore, the bearish narrative is backed by a surge in social volume, suggesting that investors could start booking profits, leading to a downswing.

XTZ social volume chart

If the buyers manage to push past the range high at $4.17 and produce a decisive 4-hour candlestick close above $4.40, it would invalidate the bearish thesis explained above. In such a case, Tezos price might retest the range high and start an upswing that could extend up to the 127.2% Fibonacci extension level at $4.65.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.