Tezos Price Prediction: XTZ flips significant hurdle, eyes 40% advance

- Tezos price rallied exponentially like most altcoins, clearing a crucial resistance level at $5.18.

- The MRI’s sell signal seems to be taking effect, leading to a 15% retracement.

- A resurgence of buying pressure could propel XTZ by 40% to $7.24.

Tezos price showed no exhaustion as it rallied from July 22. After flipping a major hurdle into a support barrier, XTZ eyes to continue this uptrend.

Tezos price anticipates further gains

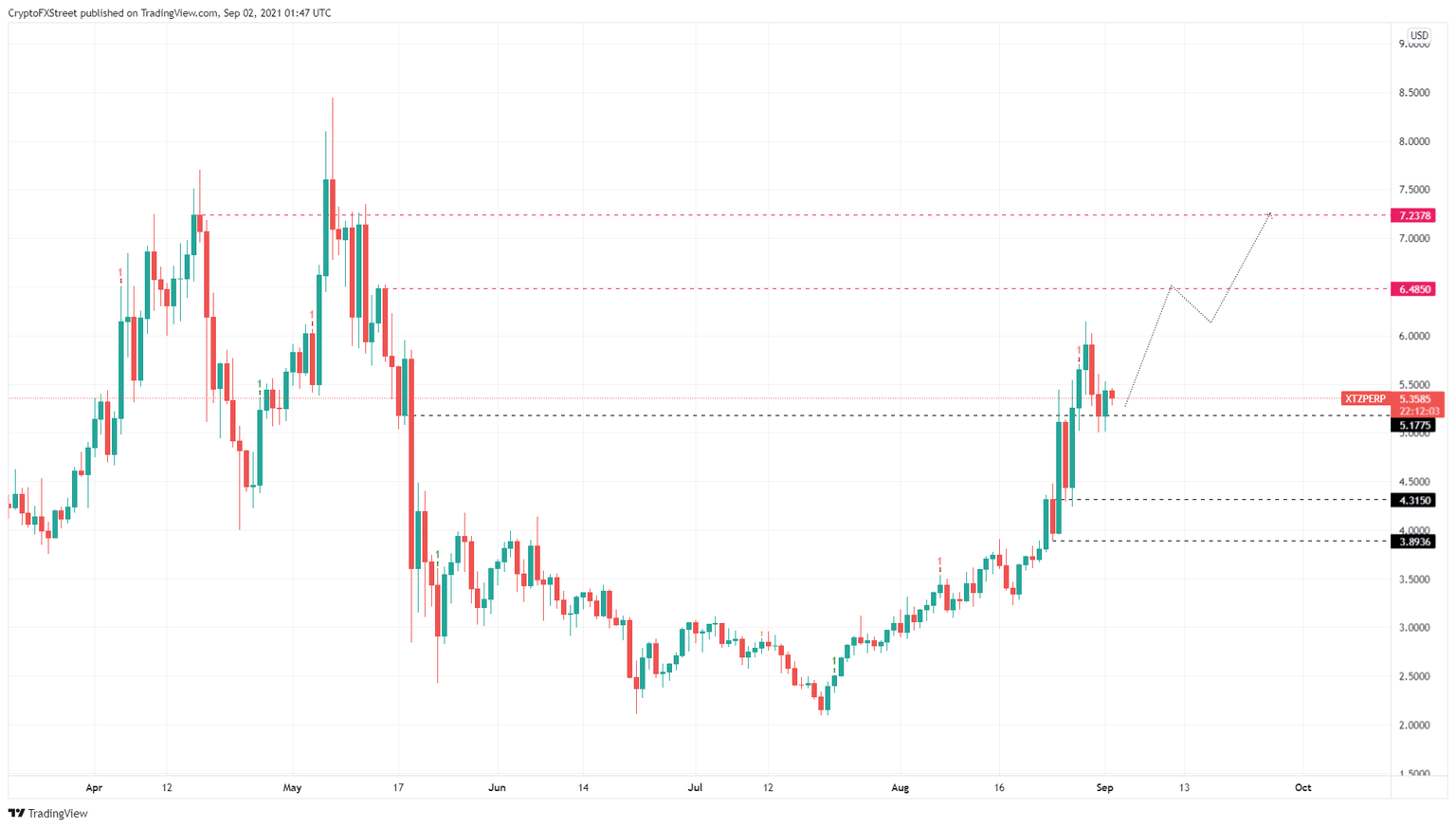

Tezos price rallied roughly 42% from August 26 to August 29, setting up a local top at $6.14. During this uptrend, XTZ flipped the $5.18 resistance barrier into a support floor, while the Momentum Reversal Indicator (MRI) flashed a sell signal in the form of a red ‘one’ candlestick.

This technical formation forecasts a one-to-four candlestick correction. Although the selling did not occur immediately, it led to a 15% downswing, which is currently hovering above the $5.18 support level.

Investors can expect the altcoins, including Tezos, to kick-start their uptrend soon. In which case, XTZ could climb 25% to tag the first supply barrier at $6.49. A decisive close above this level will open the path to $7.24, which constitutes a 40% upswing from $5.18.

XTZ/USDT 1-day chart

While a further upswing above $7.24 is possible, it is unlikely as investors might book profit leading to a minor retracement. On the other hand, if XTZ price fails to hold above $5.18, it will suggest that the sellers or market participants are not done booking profits yet.

Such a development could lead to a retracement to $4.32. If the buyers fail to keep Tezos price above this level, it will invalidate the bullish thesis. In some cases, XTZ might head to $3.90.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.