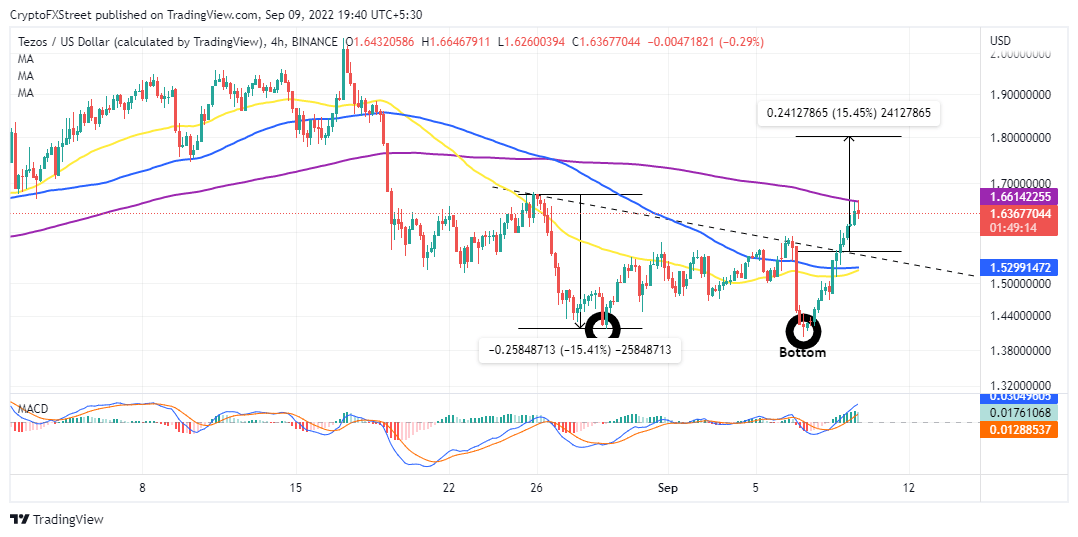

Tezos Price Prediction: Double bottom pattern inspires 15% move in XTZ price

- A double bottom pattern guides Tezos price on a recovery journey eyeing $1.80.

- Weighted social sentiment remains bearish as XTZ price climbs to $1.66.

- The 100-day SMA stands in the way of Tezos price achieving its bullish potential to $1.80.

Tezos price is capitalizing on a relief Bitcoin price rally above $21,000 to activate a desired bullish outcome to $1.80. This end-of-the-week jump comes less than a week before the much-anticipated Ethereum Merge. Investors expect the second-largest cryptocurrency's software upgrade to positively influence prices in the market.

XTZ price jumps after $1.42 support holds

Tezos price breached a significant support range between $1.50 and $1.60 twice in two weeks – forming a double bottom pattern. As crypto prices generally moved up on Friday, Tezos price confirmed the governing chart pattern by cracking through the pattern's neckline.

A double bottom pattern usually signals a potentially massive trend reversal. The chart illustrates that XTZ price is projected to climb 15.41% to tag $1.80.

XTZ/USD four-hour chart

The Moving Average Convergence Divergence’s (MACD) bullish position on the four-hour timeframe reinforces Tezos price’s bullish outlook. The move from support at $1.42 to the prevailing price at $1.66 ascribes to a buy signal sent when the 12-day Exponential Moving Average (EMA) crossed above the 26-day EMA.

Tezos Social Weighted Sentiment

Santiment's Social Weighted Sentiment (total) reveals that Tezos’s mood remains bearish, notwithstanding the upswing. Usually, the price moves opposite to the crowd's expectation. With Tezos price sentiment at -1.18%, odds may favor an extended bullish move.

On the other hand, traders must wait for another uptrend confirmation at the 200-day Simple Moving Average (SMA) before going in on XTZ to avoid falling into bull traps. Conservative investors should consider exiting from their positions at the current price, but the most bullish can wait for the trend to mature at $1.80.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%20%5B18.08.32%2C%2009%20Sep%2C%202022%5D-637983348312094113.png&w=1536&q=95)