Tezos price prediction: A return to $1.20 is unavoidable

- Tezos price drops over 2% intraday and pares back losses for the day, only minutes before Fed chair Powell issues his speech.

- XTZ price could see a bull trap forming if the initial reaction sees price action pop and quickly deteriorate.

- Expect the fallout of this big event to cause ripples into next week.

Tezos (XTZ) price action is on the cusp of printing some violent swings as Fed chair Powell preparesto make one of his biggest speeches for the year. With investors looking for clues on what to do, the initial reaction will probably be a dovish one with a pop above a big technical hurdle. Only then will there be a substantial paring back of the gains, potentially with a nuclear implosion that will continue for days.

XTZ price set to sink into the ground

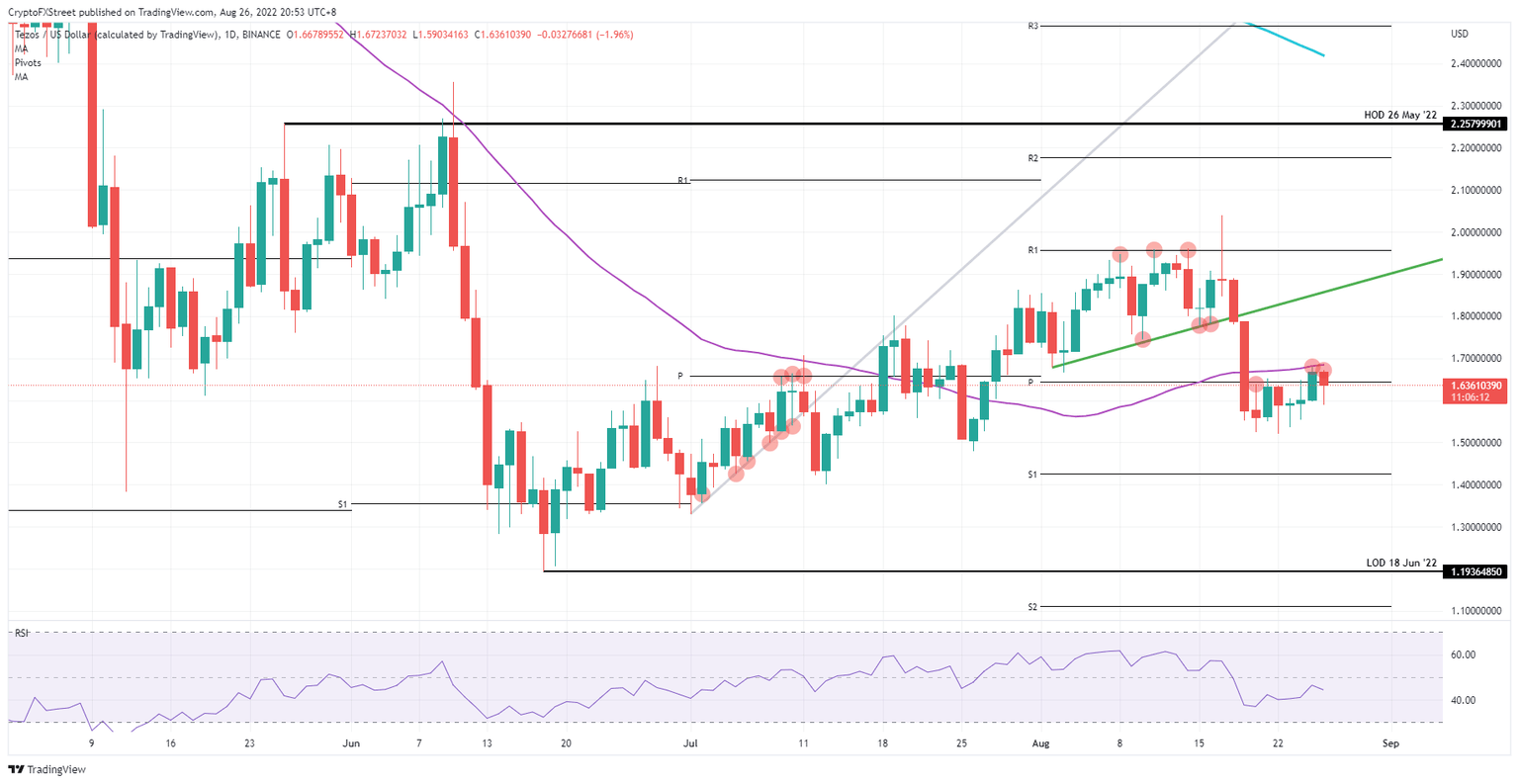

Tezos price action is undergoing a firm rejection after bulls tried to break above the 55-day Simple Moving Average, near $1.70, on Thursday. Instead, a fade got triggered throughout the day that could see losses deepen even further. A counter-cyclical move is more than likely as the headlines from Fed Powell’s speech come out. Some might be seen as very positive and could trigger an instant rally higher, even a break above the 55-day SMA towards $1.80.

XTZ price could then easily deflate and fall back below the same 55-day SMA if headlines, once more, paint a whole other picture of how the Fed will fight the current inflation issues. The risk could be that the trapped bulls get taken down towards the low of June 18, 2022 for a test, near $1.20. That would be when Powell finishes his speech and leaves investors either clueless or dampens their mood for any short-term relief, if the Fed looks likely to continue its harsh language for at least the rest of 2022.

XTZ/USD Daily chart

The turnout could also be quite positive, with investors seeing their hopes confirmed with some relief nearby. Stocks may rally immediately, bond prices could rise (rates fall), the dollar might weaken, and cryptocurrencies could go exponentially higher. That multiplier is present in cryptocurrencies because two big tailwinds could emerge in such a scenario, caused by equities rallying and the dollar weakening, making it a double whammy for cryptos. XTZ price could then pop towards $2.00 and try to close on a daily basis above that level before the weekend.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.