Tezos price initiates bullish counter-attack, as Ukraine books a victory vs Russia

- Tezos price jumps over 1% in European trading and is set to continue the rally in the US session.

- XTZ price jumps on the back of positive news from Ukraine gaining massive territory from Russia.

- Bulls are booking a technical victory on the trading charts reflecting the psychological victory on the battlefield.

Tezos (XTZ) price is set to jump another 1% or more, and is set to book a sixth straight gain in a row, making it the most profitable rally since June. The euphoria comes from news Ukraine gained several important cities and regions against a sudden breakdown in Russian offences. Should the positive mood continue, expect to see another leg higher in Tezos by opposing up towards $1.90.

XTZ price plants flag above technical area

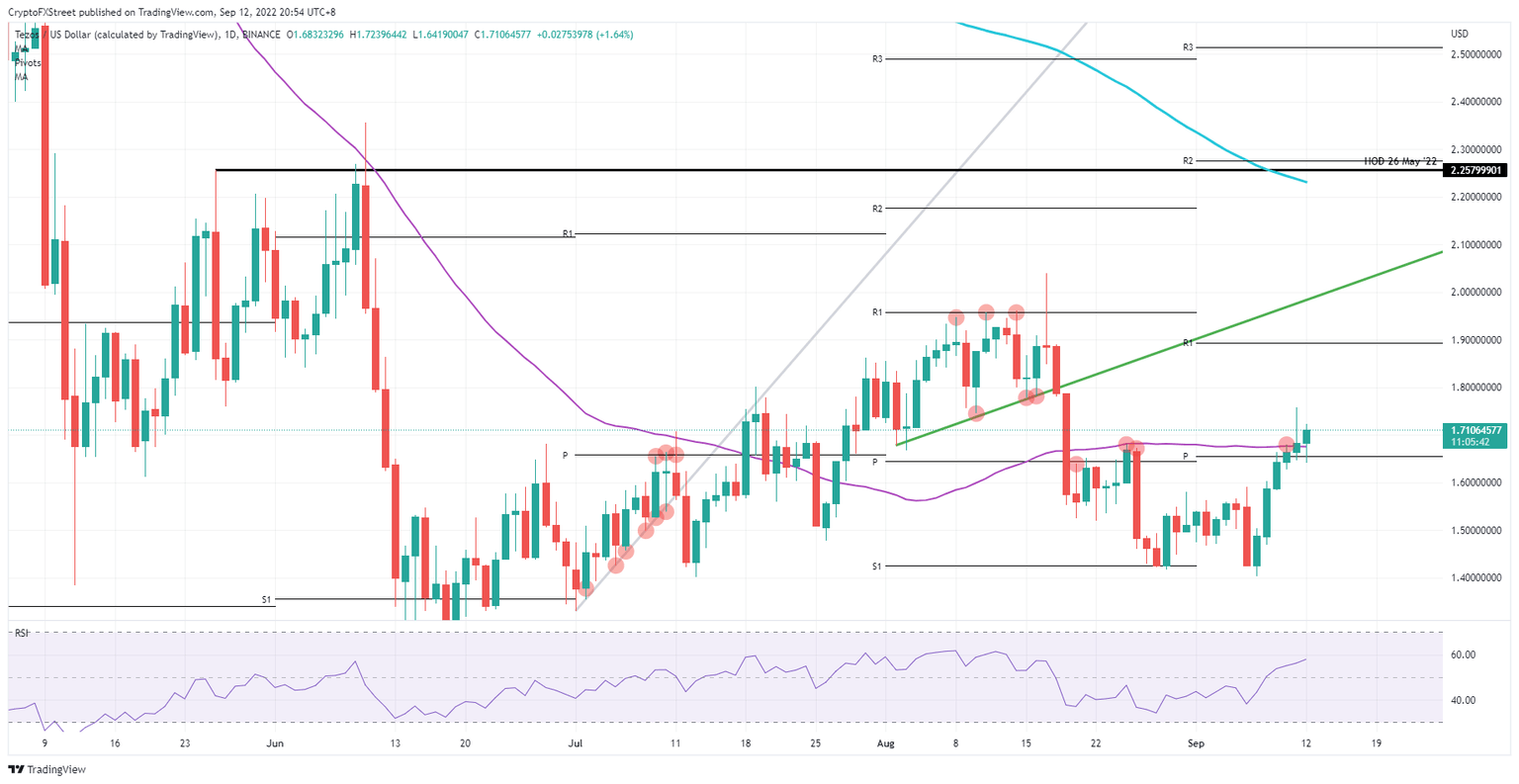

Tezos price sees bulls succeeding in their trading plan as Monday saw a daily open above the important 55-day Simple Moving Average (SMA) and monthly pivot around $1.66. With that key move and continuation upwards, the area looks to be firmly secured by bulls. Another rally looks granted and will depend on the support from the aforementioned two levels.

XTZ price has already slipped back below the monthly pivot and the 55-day SMA in early trading; but saw quick reaction as price was pushed back up quite quickly. The fact that both supports have done their job means that plenty of bulls rushed in to buy and provide support at these levels. Expect to see another leg higher, probably towards $1.90, where the monthly R1 resides. A similar pattern would be needed with a daily close above and a positive opening to keep this rally going – but for now, 11% gains look possible for this week.

XTZ/USD Daily chart

Risk to the downside comes from Russia resorting to blunt weaponry, like nuclear weapons. A defeat is something Russia does not foresee happening, thus, it will try to reach a result by any means necessary. If it does the unthinkable and uses nuclear weapons expect to see markets being rattled and Tezos price action collapse like a failed yellow pudding. In such a scenario, price action would quickly print below the monthly pivot and look for support near $1.60 first, and next $1.40.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.