Tezos price gearing up for a move towards $2.3 if bulls hold critical support

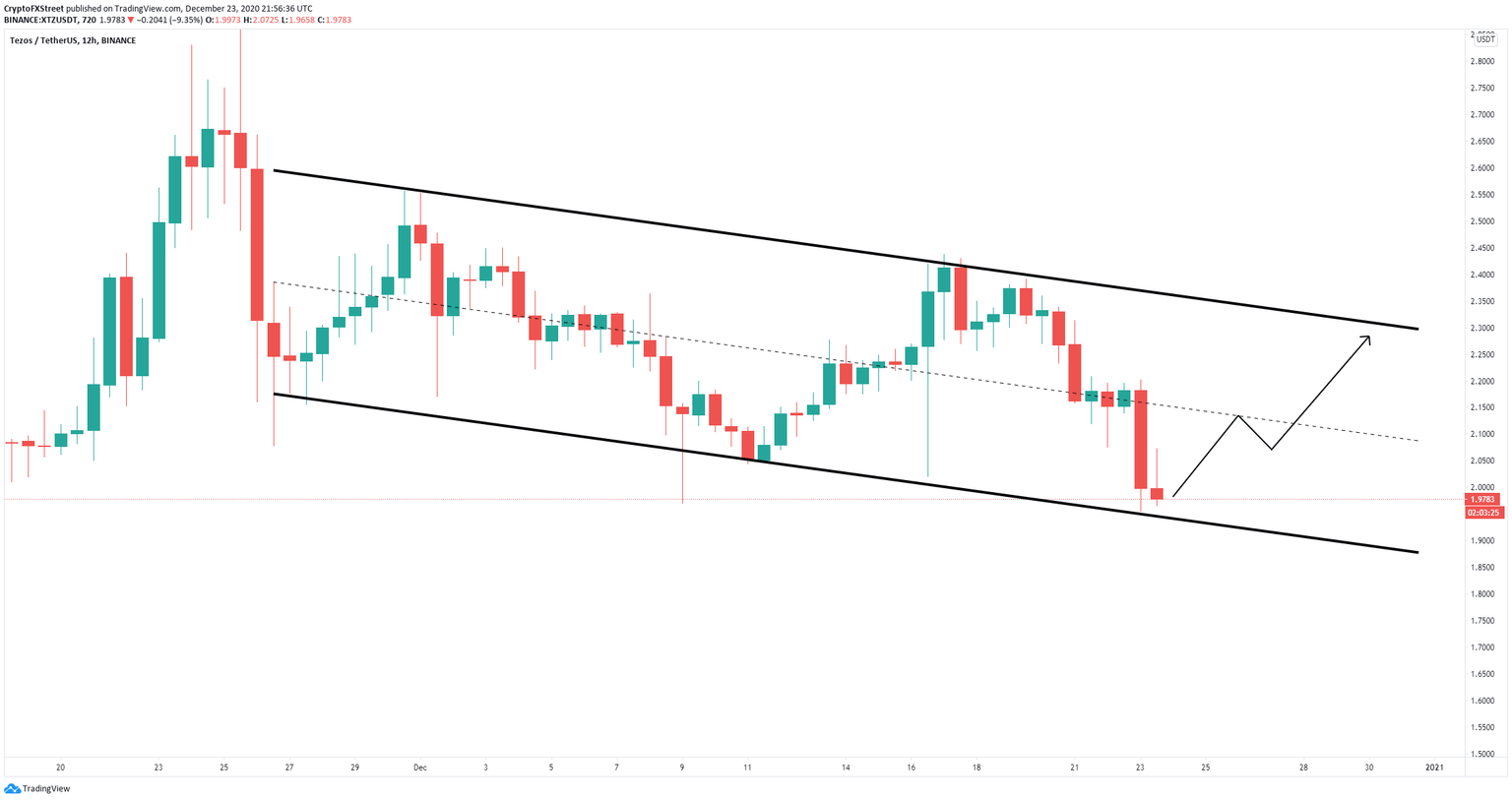

- Tezos price remains contained inside a descending parallel channel on the 12-hour chart.

- Bulls have just defended the lower trendline support and aim for a rebound.

Tezos has been under consolidation since its high of $2.96 on November 25. The digital asset currently trades at $1.97. Bulls try to defend a critical support level at $1.9 which should push Tezos price towards $2.3.

Tezos price is bearish but there is hope

On the 12-hour chart, Tezos has established a descending parallel channel and bulls have just defended the lower trendline support. If the digital asset can successfully close above $1.9, it could jump towards the middle of the pattern at $2.1 before a small retrace followed by a final move towards the upper boundary at $2.3.

XTZ/USD 12-hour chart

Although XTZ could be gearing up for a rebound, bears remain in control of the 12-hour chart which is in a downtrend. They have managed to push Tezos price below the 100-SMA and the 50-SMA, turning both into resistance points.

XTZ/USD 12-hour chart

The next critical support level is $1.9 which is the lower trendline of the descending parallel channel. A breakdown below this point will drive XTZ towards a low of $1.6, a 16% move, calculated using the height of the pattern as a reference point.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.