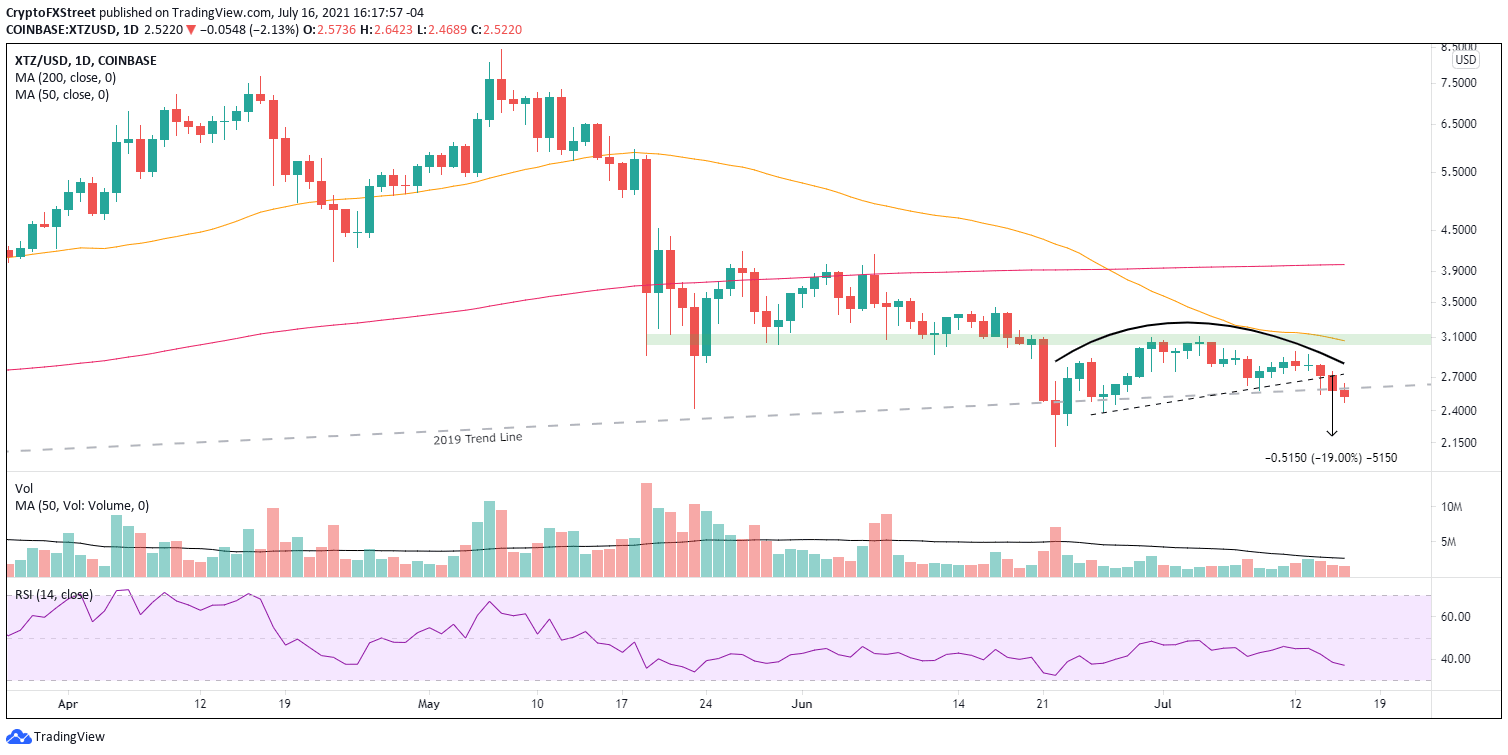

Tezos Price Forecast: XTZ downside limited to $2.11

- Tezos price struggles to remain above the 2019 ascending trend line.

- XTZ triggered a head-and-shoulders pattern yesterday with a close below the neckline at $2.70.

- The May 23 low of $2.42 is the only immediate support for the altcoin if selling accelerates.

Tezos price closed yesterday with decisiveness, breaking the neckline of a head-and-shoulders pattern and the 2019 ascending trend line. The price action has shifted the focus to bearish XTZ outcomes, including a sweep of the June 22 low.

Tezos price is a passenger, not the driver of the bus

Tezos price is currently down -11% for the week, pushing the digital asset close to the May 23 low of $2.42 after triggering a head-and-shoulders topping pattern that had been in development since June 23. Simultaneously, the double-digit weekly decline has overcome the critical support offered by the 2019 ascending trend line at $2.60. It must be said that the break of the trend line does not guarantee lower XTZ prices, but it is the second time since June, diminishing the strength of the support.

The measured move of the head-and-shoulders pattern is 19% from the neckline, placing Tezos price at $2.19. It would be a 13% decline from the current price, but it would not best the June 22 low $2.11. However, if a final push of selling invades the cryptocurrency complex, inevitably, XTZ will at least sweep the June 22 low, yielding a 16% loss from the current price. A failure to hold $2.11 would expose Tezos price to a more significant decline that would not strike formidable support until the December 23 low of $1.60.

To reverse the projection offered by the head-and-shoulders pattern, Tezos price needs to trade above the right shoulder high of $2.95, thereby voiding the topping formation. Additional XTZ upside will be challenged by the 50-day simple moving average (SMA) at $3.06 and the high of the head at $3.11. The $3.11 level is reinforced by price congestion going back to May.

XTZ/USD daily chart

XTZ is not a market-leading cryptocurrency that dictates trends. Instead, Tezos price tends to track the movements of the crypto majors, occasionally propped up by a positive fundamental development such as the recent McLaren partnership. Thus, if the cryptocurrency chill continues, Tezos price will be tempted to explore lower prices or, at best, wrestle with the 2019 ascending trend line now at $2.59.

Only a trade above the high of the right shoulder will confirm a better outlook for the blockchain platform.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.