Tezos Price Analysis: XTZ thrust overcoming major resistance

- Tezos price may close today with the best 3-day gain since inception.

- Highest daily volume since February 12.

- Relative Strength Index (RSI) is not overbought in the short or long-term.

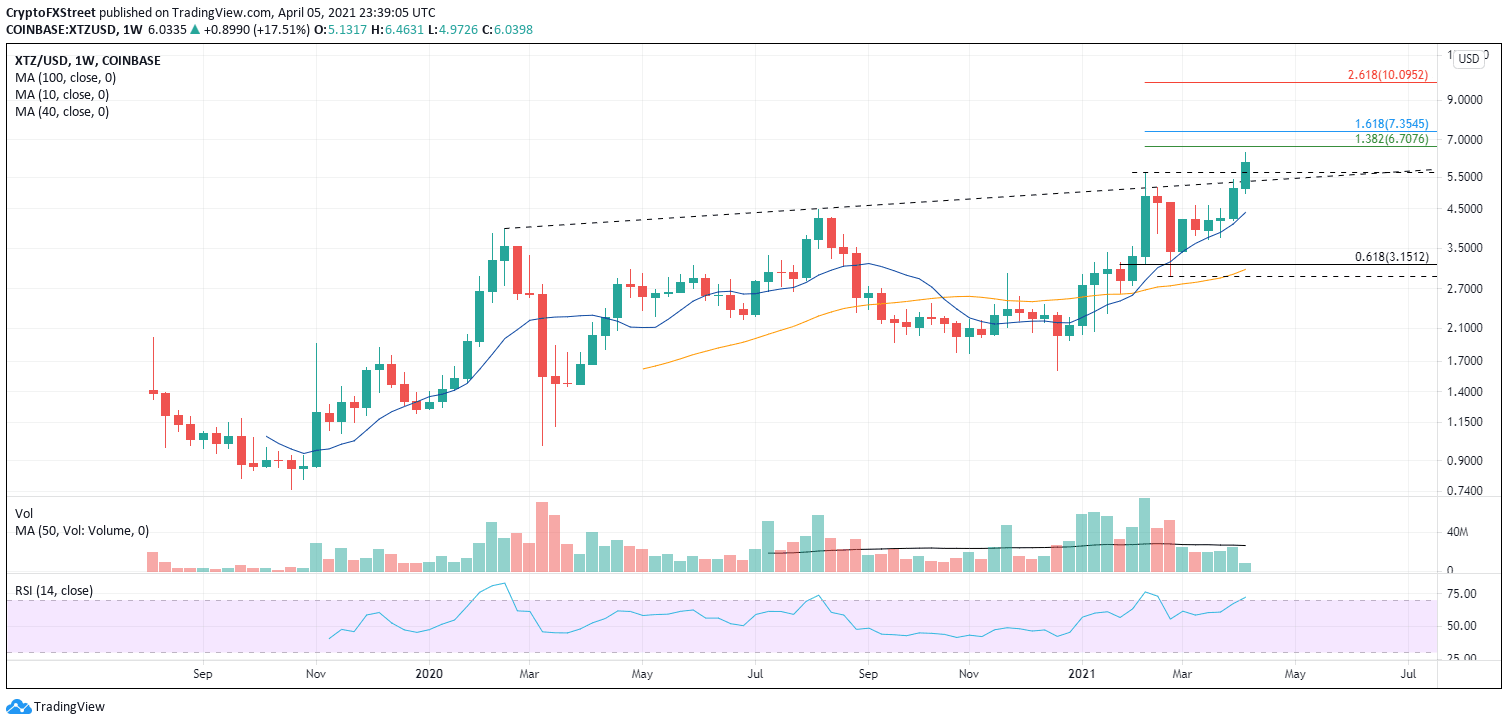

Tezos price has exploded to the upside today on the highest daily volume since February 13, and it is clearing the topside trendline that halted the February rally. Today’s rally has taken XTZ within 4% of the 1.382 Fibonacci extension of the February bear market.

Tezos price must close the week above $5.66

To give some perspective. Over the last nine days, XTZ has gained 60% and overcome the topside trendline on the second try after failing on April 2-3. As well, it has gained 28.00% over the last three days. Despite the sharp advance, the altcoin is not showing an extreme overbought condition on the daily or weekly charts, leaving ample room for the rally to continue.

Near-term upside targets are the 1.382 extension level at $6.70, followed closely by the 1.618 extension level at $7.35.

A weekly close at or near the high for the week may unlock a blow-off move that will carry XTZ beyond the 2.618 extension level at $10.09 and potentially to the 3.618 extension level at $12.84 before a consolidation or significant top.

As with all new highs, there is an inevitable rush to secure profits, but it is important to note that XTZ needs to close this week above the February high at $5.66. A failure to do so will put pressure on the breakout and raise the odds that it was not a trend event.

XTZ/USD weekly chart

Immediate support for the Proof-of-Stake coin is $5.66, followed by the topside trendline at $5.37. A break below will once again put the 10-week simple moving average (SMA) in the sightlines at $4.39 and then the 0.618 retracement level of the rally from December 2020 low at $3.15.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.