Tether’s transparency and business structure raises $118B FTX-like concerns

Tether’s lack of third-party audits is raising investor concerns about a potential FTX-like liquidity crisis from the $118 billion stablecoin giant.

Investor concerns are mounting around Tether, the issuer of the world’s largest stablecoin USD₮ (USDT $1.00).

Cyber Capital founder Justin Bons, who shared his concerns about Tether being a potentially bigger scam than FTX, catalyzed the latest wave of concerns.

Bons wrote in a Sept. 14 X post:

[Tether is] one of the biggest existential threats to crypto as a whole. As we have to trust they hold $118B in collateral without proof! Even after the CFTC fined Tether for lying about their reserves in 2021.

In 2021, the United States Commodities and Futures Trading Commission (CFTC) fined Tether a $41 million civil monetary penalty for lying about USDT being fully backed by reserves.

Concerns over the stablecoin giant’s influence over the crypto space grew louder recently after data revealed that Tether’s market share surpassed 75% of the entire stablecoin market after a 20% increase over the past two years.

A hypothetical Tether implosion would be banking-driven, unlike the FTX collapse

Part of the concerns are fueled by one of the industry’s most notorious black swan events, the collapse of the FTX exchange, which led to $8.9 billion in lost user funds.

While FTX’s collapse was due to its inability to honor mass customer withdrawals of $6 billion within three days, a hypothetical Tether implosion would be related to its banking partners, according to Sean Lee, the co-founder of IDA Finance.

Lee told Cointelegraph:

Bear market or not, the possibility of Tether imploding is more about its structural connectivity to its underlying assets and banking rails, not so much market movement. Otherwise, USDT would’ve suffered during the last bear market, but instead, it was actually [USD Coin] USDC that depegged due to their reliance on Silicon Valley Bank and Signature Bank.

In May 2022, Tether honored over $16.7 billion worth of USDT customer withdrawals within 10 days without any issues.

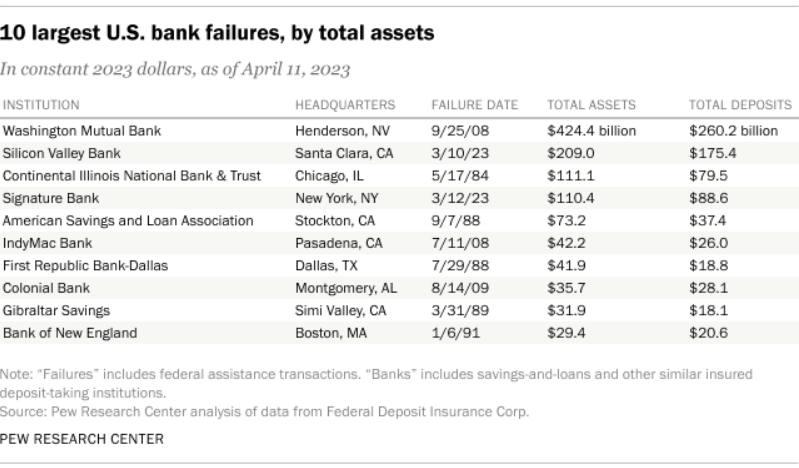

In contrast, Washington Mutual Bank could not honor $16.5 billion worth of withdrawals within 10 days, which led to what became known as the biggest banking failure in the US in September 2008.

Largest US bank failures. Source: Pew Research Center

Others believe that Tether is too big to fail. Notably, Anndy Lian, author and intergovernmental blockchain expert, doesn’t expect Tether to face issues but warned that generally, large centralized entities could pose a risk for the cryptocurrency space:

Cryptocurrencies were originally designed to operate without central control, promoting transparency, security, and user autonomy. However, Tether, as a centralized stablecoin issuer, holds significant influence over the crypto market due to its widespread use for trading and liquidity.

Cointelegraph has approached Tether for comment.

Tether’s business structure and transparency raise concerns

On Sept. 8, Tether invested $100 million in Adecoagro, acquiring a 9.8% stake in the Latin American agricultural giant.

This latest investment gave us the first disclosure into Tether’s governance structure, according to Cyber Capital’s Bons, who wrote:

The board of Tether Holdings only has 2 members; Giancarlo & Ludovicos. This implies that the USDT reserves are still not segregated in 2024 & these two have absolute control!

IDA Finance’s co-founder, Lee, was also concerned about Tether’s lack of transparency. He wrote:

Tether is structured as a business and their insistence on not providing the level of detailed transparency that ensures real trust from the community and institutional players is indeed concerning.

Despite Tether boasting over $118 billion worth of reserves in its second quarter “independent attestations conducted by BDO,” Cyber Capital’s Bons claims that Tether has yet to submit its reserves for a third-party audit:

However, an ‘Auditor’s Report’ or an ‘Accountant Report’ is not a formal audit at all! Despite the claims, Tether has never submitted its alleged reserves to a real unrestricted, third-party audit!

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.