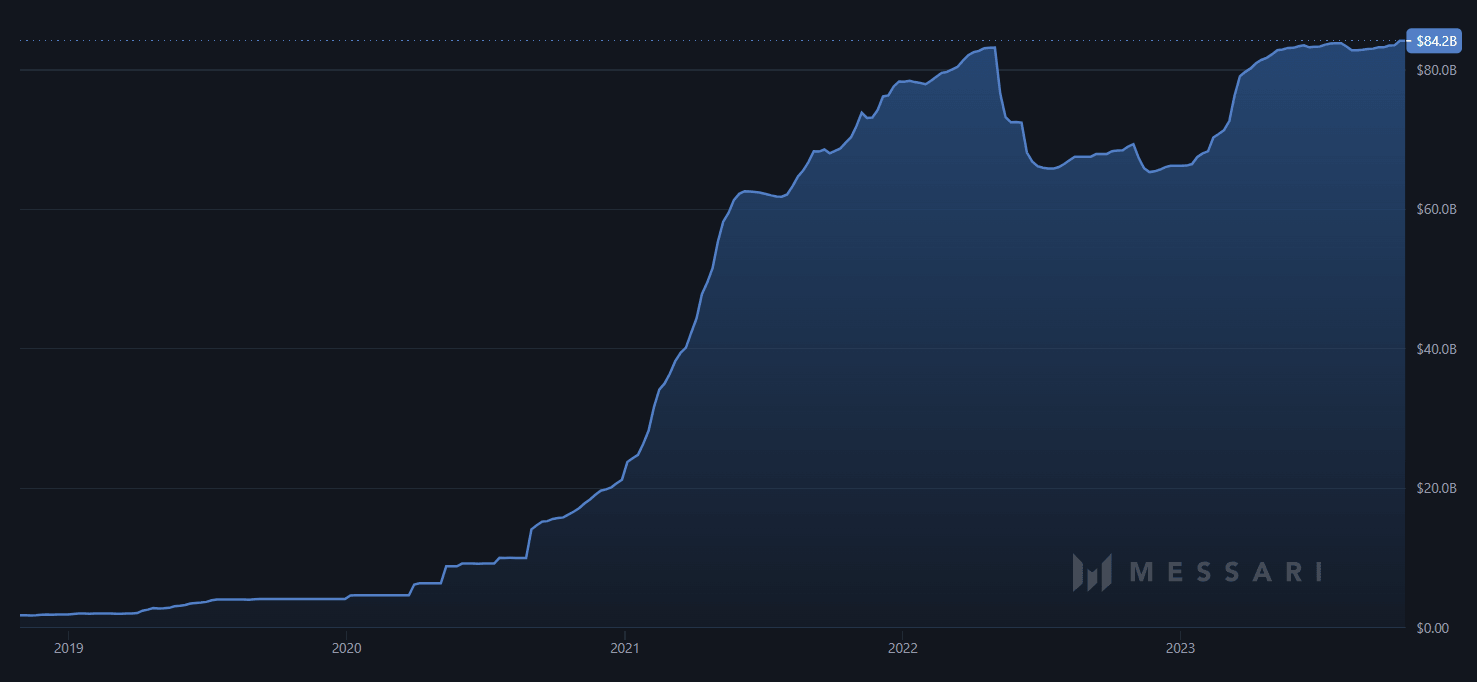

Tether's circulating market cap surpasses $84 billion despite quiet crypto market

- Tether's circulating market cap exceeded $84 billion this week, marking a record high.

- Despite the Bitcoin spot ETF-induced rally calming down, the stablecoin market remains steady.

- In December, Tether will welcome new CEO who supports audits for the largest stablecoin player.

Tether's (USDT) circulating market capitalization surged past $84 billion this week with the top stablecoin holding above the mark on Wednesday. The rise came following positive sentiments caused by the anticipation of a Bitcoin spot ETF. The last week also spurred volatility owing to a price rise followed by the liquidation of short positions in the derivatives market.

Tether saw increased interest

Investors could have turned to Tether, the largest stablecoin, to introduce liquidity into the crypto market while avoiding price fluctuations. Tether is largely used as a trading pair for cryptocurrencies and growing interest in it can potentially signify future interest in other digital assets.

The development also comes ahead of the official appointment of a new CEO in December by Tether Holdings. Paolo Ardoino, an Italian software engineer, will take the top office in public view.

Notably, the Tether team has been known to maintain a low public profile, while Ardoino has engaged with the media. In an interview with Bloomberg, Ardoino has expressed Tether's intention to commence real-time publication of its reserve data from next year. In another interview with CNBC, Ardoino voiced support for undergoing a full audit process. He also stressed that the absence of audits for stablecoins, including Tether , is not attributable to a lack of willingness on the part of issuers.

84B $USDt

— Paolo Ardoino (@paoloardoino) October 23, 2023

It appears that Tether is trying to create an image reversal by enhancing transparency amid growing regulatory scrutiny.

Tether focuses on transparency

This month, Tether also underlined in its blog that it has frozen 32 wallet addresses that were suspected of being linked to illegal activities, specifically related to terrorism and warfare in Israel and Ukraine.

Tether was under the radar last month before The Wall Street Journal reported that Tether increased its lending services to $5.5 billion this year after specifying last year that it would stop offering loans.

In the meantime, controversial crypto influencer WhaleWire speculated on X that Tether injected an unprecedented amount of unbacked dollars into the market and used it to purchase Bitcoin, which allegedly was the real reason for the price hike in the first place.

At the time of writing, CoinMarketCap pins the total stablecoin market cap at over $124 billion with a daily trading volume of $52.8 billion.

Author

Shraddha Sharma

FXStreet

With an educational background in Investment Banking and Finance, Shraddha has about four years of experience as a financial journalist, covering business, markets, and cryptocurrencies.