Stablecoin issuer Tether didn’t provide a definitive answer on whether or not it would cease support for the Tron network after its rival Circle ceased minting its stablecoin on the blockchain on Tuesday.

“Tether tokens are issued on several blockchains, which are simply transport layers for such tokens,” Tether said in a statement to Cointelegraph when asked for comment about Circle and whether Tether was considering a similar move.

“Tether retains the ability to freeze transactions on each directly supported transport layer to accomplish its compliance duties. Nevertheless Tether actively monitors the safety of each one of the supported transport layers to ensure the highest standards to our community,” the firm said.

Tether (USDT $1.00) is the largest stablecoin with a market capitalization of $97.7 billion, and Circle’s USD Coin (USDC $1.00) trails at $28 billion, according to CoinGecko data.

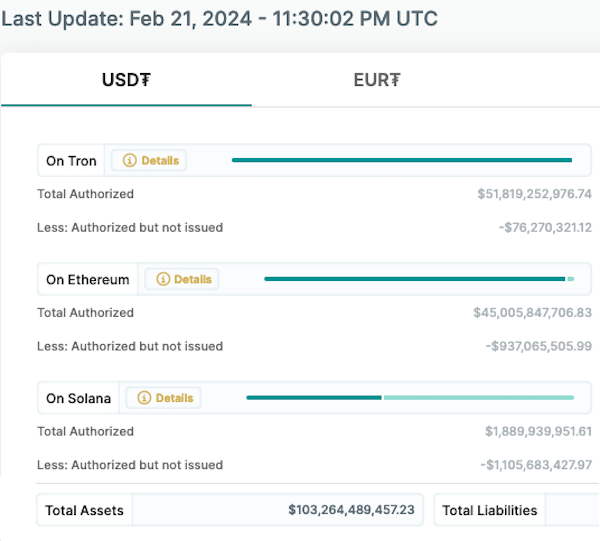

The Tron network is home to over 51.8 billion USDT — over half of the nearly 101 billion USDT tokens issued across multiple blockchains, according to Tether’s transparency report dated Feb. 21.

An additional nearly $76.2 million is set aside to provide near-term liquidity for the token on the Tron network.

A screenshot of Tether’s USDT transparency report cropped to show only USDT’s top three blockchains and its total assets. Source: Tether

Tether's comments came in response to an announcement from Circle on Feb. 20, with the firm revealing it was immediately ending the minting of USDC on Tron and would gradually phase out support for the network, saying the decision aligns with “efforts to ensure that USDC remains trusted, transparent and safe.”

Last month, a United Nations report said “USDT on the Tron blockchain has become a preferred choice” for cyber fraud and money launders in Southeast Asia due to the “ease, anonymity, and low fees of its transactions.”

Tether rebuffed the report, saying the UN ignored USDT’s traceability and the firm’s record of law enforcement collaboration.

It highlighted that it froze over $300 million worth of USDT used in crime “within the last few months,” including $225 million worth frozen in November 2023 as part of a United States probe into a Southeast Asian human trafficking syndicate.

Ethics watchdog group Campaign for Accountability wrote to the United States Congress in November alleging Tron “has been named in multiple international law enforcement actions involving billions of dollars in transactions by alleged organized crime groups and sanctioned entities.”

The U.S. Securities and Exchange Commission sued the Tron Foundation and founder Justin Sun in March 2023, alleging they offered unregistered securities and conducted manipulative trading, which Sun denies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Crypto trading volume declines further, signaling waning trader enthusiasm and market momentum

The total crypto market capitalization lost $1.01 trillion since January, while Santiment data shows that crypto-wide trading volume has dropped since February’s peak. For a healthier and more sustainable recovery, bulls look for rising prices accompanied by increasing volumes; until trading activity picks up, cautious market sentiment is likely to prevail.

BNB price tops $570 as Binance receives $2 billion investment from Dubai

BNB price rose as high as $574 on Thursday as markets reacted to news that Binance received major investments from an Abu Dhabi based firm. Derivative markets analysis shows how BNB traders are repositioning amid the latest swings in market sentiment.

PEPE price outperforming DOGE and SHIB as US CPI boosts Crypto markets

PEPE price crossed the $0.00007 for the first time this week as markets reacted to positive macro market signals. Early insights show crypto traders are displaying high risk appetite at the onset of the current market rally. Could this sustain PEPE price uptrend along with the rest of the memecoin market.

XRP records slight gains as Ripple's battle with SEC nears end

Ripple's XRP recorded a 2% gain on Wednesday following rumors of the company nearing an agreement with the Securities & Exchange Commission (SEC) to end their four-year legal battle.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin price extends its decline on Friday, falling over 5% so far this week. BTC uncertainty and volatility spikes liquidated $1.67 billion as the first-ever White House Crypto Summit takes place on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.