- Santiment data shows that Tether’s on-chain activity has risen rapidly, with over 143,000 daily transfers.

- The USDT Network growth metric also increased, indicating greater blockchain usage.

- Tracy Jin, COO of MEXC, told FXStreet that lifting OCC restrictions for banks on dealing with stablecoins in the US lowers barriers for new market participants.

Tether (USDT) stablecoin on-chain activity has rapidly risen, with over 143,000 daily transfers, surging to a 6-month high. Moreover, the USDT Network growth metric increases, indicating greater blockchain usage. In an exclusive interview, Tracy Jin, COO of MEXC, told FXStreet that lifting OCC restrictions for banks dealing with stablecoins in the US lowers barriers for new market participants.

On-chain activity hints at a market recovery

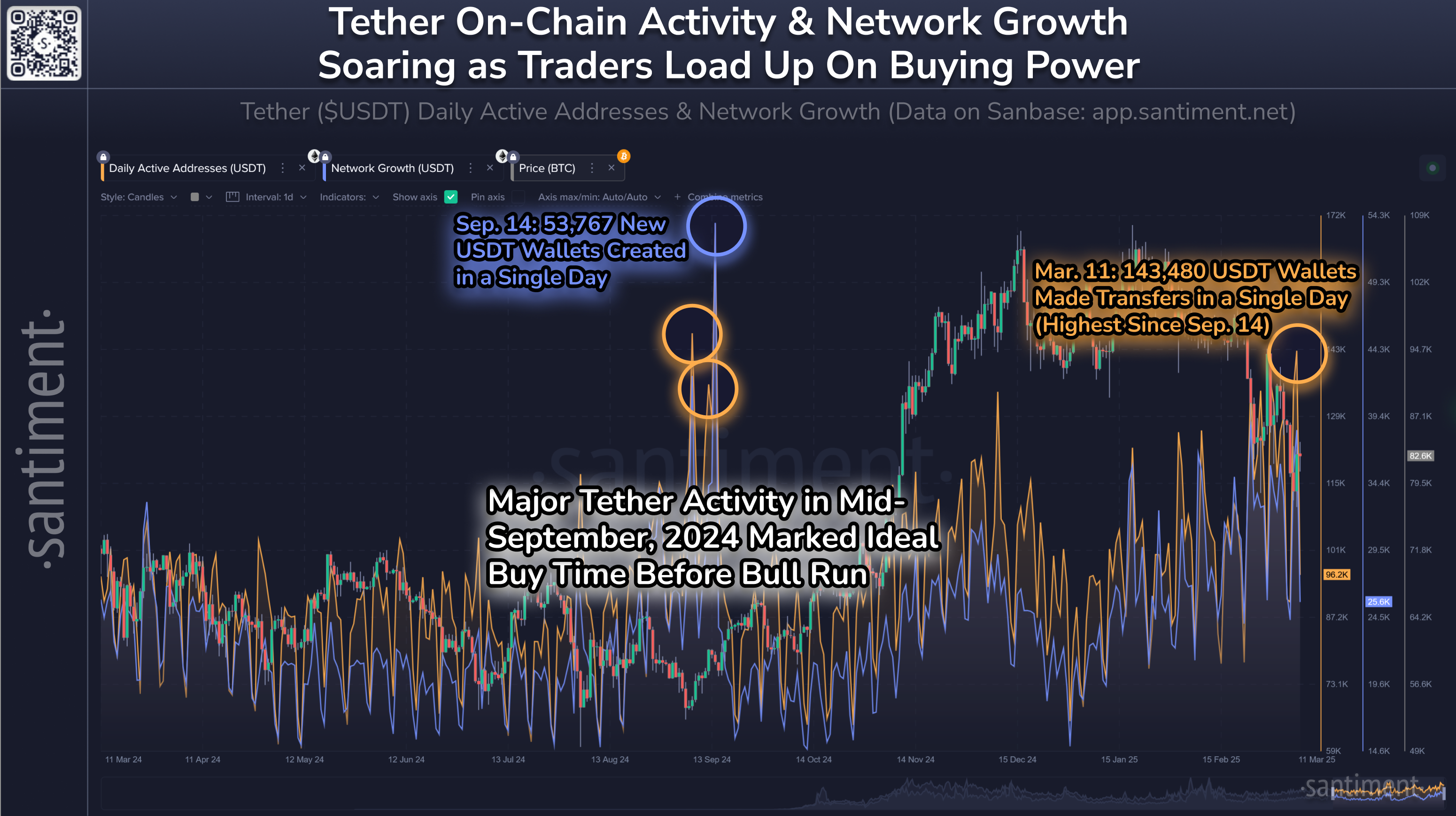

Santiment data shows that Tether on-chain activity has rapidly risen; its daily active addresses reached 143,480 on Tuesday, surging its 6-month high. Moreover, its Network growth metric also increases, indicating greater blockchain usage.

Historically, traders are generally preparing to buy when USDT & other stablecoin activity spikes during price drops, as seen in the chart during mid-September 2024. During that period, the on-chain activity in USDT spiked, followed by its price rally. Similarly, the recent activity could add buy pressure and aid in crypto prices recovering.

USDT on-chain activity chart. Source: Santiment

In an exclusive interview, Tracy Jin, COO of crypto exchange MEXC, told FXStreet, “Lifting OCC restrictions for banks on dealing with stablecoins in the US lowers barriers for new market participants.

Jin continued that the US Treasury’s statement on the gradual integration of stablecoins into the financial system may drive demand for the US dollar and provide greater stability for institutional and retail investors. Moreover, the official recognition of USDT on regulated exchanges in Thailand expands access to capital in a country where 40% of cryptocurrency trades already involve this stablecoin, potentially fueling further growth in Asia, coinciding with the approval of USDC in Japan.

“The market may witness an outflow of capital from risky assets, including Bitcoin and altcoins, which is consistent with the current bearish trend. Given the recent $3.5 billion outflow from Bitcoin ETFs, the stablecoin’s capitalization growth confirms that institutional investors are temporarily taking a pessimistic stance. However, if there are no positive macroeconomic or regulatory factors in the coming weeks, a further decline in the crypto market is possible, and the growth of stablecoins will become an indicator of capital leaving the digital life conditions,” Jin told FXStreet.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.