Massive volatility on crypto markets has been always associated with an uptick on stablecoin markets, a Tether exec noted.

Tether (USDT), the world’s largest stablecoin by market capitalization, continues to grow despite record-breaking cryptocurrency outflows triggered by Elon Musk’s Bitcoin (BTC) criticism.

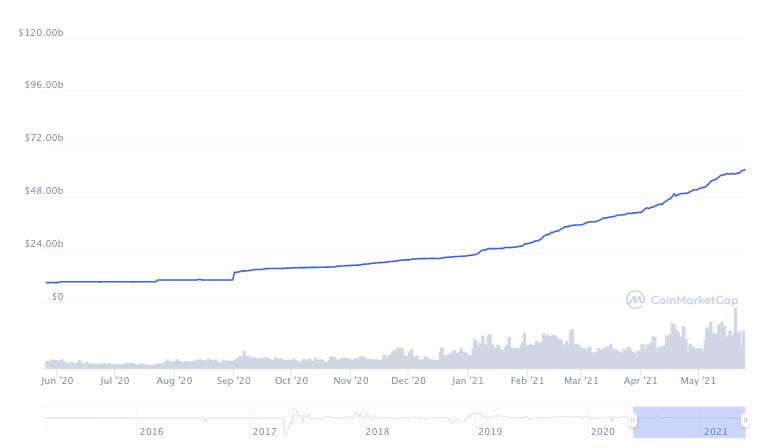

On Monday, Tether’s market cap hit $60 billion for the first time in history, marking another milestone of the stablecoin’s growth. According to data from Tether Transparency, USDT market value amounts to $60.4 billion at the time of writing, up over 580% from one year ago.

Tether's new market cap record follows a series of newly minted USDT tokens at Tether Treasury. According to data from blockchain analytics service Whale Alert, at least 6 billion new Tether USDT tokens have been minted at the treasury over the past 30 days, with the latest batch of 1 billion USDT minted on May 24. According to an announcement by Tether, institutional and corporate demand is the main driver of Tether's continued growth.

USDT repeatedly broke new market cap milestones over the past two months, adding $10 billion each month.

Tether market cap one-year chart. Source: CoinMarketCap

Tether broke into the top three cryptocurrencies by market cap alongside Bitcoin (BTC) and Ether (ETH) and has been gaining ground as the third biggest cryptocurrency by market cap over the past few days, flipping Binance Coin (BNB) on May 23.

Tether’s continued growth follows massive crypto volatility as the market shed $1 trillion from its mid-May high above $2.5 trillion. Bitcoin, which became a $1 trillion asset earlier this year, lost over $400 billion in the latest market crash, with its market cap sitting above $720 billion at the time of writing.

Tether CTO Paolo Ardoino emphasized that periods of enormous crypto volatility have been often associated with stablecoin growth:

“During these extreme episodes, we’ve historically seen an uptick in stablecoin activity, made evident by Tether’s recent US$60 billion milestone as demand continues to grow. Events like these even support the ecosystem’s strength and help everyone refocus back to building rather than the distraction of token price gains.”

Founded in 2014, Tether USDT is a major stablecoin pegged at a 1:1 exchange ratio with the United States dollar. As the world’s largest stablecoin, Tether currently represents 60% of the $100 billion combined stablecoin capitalization, according to data from CoinGecko. USDT’s biggest rival, USD Coin (USDC), is ranked the eighth largest cryptocurrency by market value, with a market cap of $20 billion.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Crypto Today: Metaplanet raises $10M to buy BTC, ETH price moves below $1,600 as Tron gains signals panic

The cryptocurrency aggregate market capitalization stabilized around $2.7 trillion on Wednesday, with Bitcoin’s $84,000 support momentarily anchoring the market against external bearish discourses.

Chainlink active addresses drop as whale selling spikes, could LINK crash below $10?

Chainlink active addresses slide dramatically to 3,200 from February’s peak of 9,400. The downtrend in network activity coincides with increasing selling activity among whales with between 10 million and 100 million LINK.

Bitcoin stabilizes around $83,000 as China opens trade talks with President Trump’s administration

Bitcoin is stabilizing around $83,500 at the time of writing on Wednesday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. A breakout of this strong level would indicate a bullish trend ahead.

Binance Chain completes $914M BNB token burn, hinting at a potential rally

Binance Chain has finalized its programmed 31st quarterly BNB token burn, potentially setting the stage for the world’s fifth-largest cryptocurrency, with a market capitalization of $81.45 billion, to rally in the coming weeks.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.