Tether denies claims of USDT issuance halt, as Bitcoin bears search for reasons behind crypto crash

- There have been reports of stablecoin Tether not being issued in the past two months, leading to the plunge in Bitcoin price.

- JPMorgan analysts believe that a loss of confidence in Tether could lead to catastrophic consequences for the entire crypto market.

- Tether CTO Paolo Ardoino denied these claims and added that USDT is still being issued, with over 100 million minted less than a week ago.

Tether has reportedly seen a stunt in its meteoric rise at the end of May, just as the leading cryptocurrency’s price has just hit a new all-time high. While regulatory pressure around digital assets has been increasing worldwide, the stablecoin giant has also allegedly faced a probe by the United States Department of Justice (DOJ). Speculation has arisen over how this could affect the price of Bitcoin, but the market has given a non-reaction to the news.

Over half of Bitcoin trades are underpinned by Tether

There has long been speculation that Tether is not backed by actual dollars and that the issuers of the stablecoin have been pumping up the price of digital assets by minting coins out of thin air.

In an attempt to put these doubts to rest, the stablecoin issuer has started to release an assurance report in late March to verify that the coins are fully backed. At the time, Tether shared a quarterly statement to show that it had over $35.28 billion to back its assets and that the firm is dedicated to being transparent in the future.

In late July, Bloomberg reported that the US DOJ was investigating banks in the country and the backers of USDT. The Justice Department is allegedly seeking to discover the extent of the knowledge US banks had of Tether’s business – using USDT to purchase other cryptocurrencies, including Bitcoin and Ether.

The probe focuses on whether the firm hid transactions linked to cryptocurrencies from its banking partners from years ago when Tether was still new. According to Bloomberg, this case could be one of the most significant developments in the American government’s crackdown on digital assets.

Tether responded to the Bloomberg article, saying that they were repackaging “stale claims as news,” however, the stablecoin issuer did not deny any pending charges.

In addition, Bloomberg stated that the impact could affect cryptocurrency exchanges that allow the trading between the Bitcoin and Tether pair. USDT in circulation is worth around $62 billion and underpin over half of all BTC trades.

So far, the market has not seen a reaction to the news. However, Tether’s growth has reportedly seen a halt since the end of May.

JPMorgan analysts warn that a loss of confidence in Tether could lead to a “severe liquidity shock to the broader cryptocurrency market.”

Tether audit expected in the coming months

On August 1, Tether’s chief technical officer (CTO), Paolo Ardoino, stated that the reports of USDT not being issued for two consecutive months have been false. He added that the stablecoin has continued to be minted, pointing to transaction information with 100 million being issued less than a week ago.

General Counsel Stuart Hoegner aims to put the concerns surrounding Tether to rest and said on CNBC that an audit could arrive in the coming months.

Another significant obstacle Tether seemed to have been facing is its reputation within the digital asset community. While Bitcoin price has been correcting in the past two months, bearish sentiment loomed, and traders are looking for a reason. Noelle Acheson, head of market insights at Genesis Global Trading, said that Tether’s vulnerabilities are part of the discussion due to “fear, uncertainty and doubt (FUD).”

Tether’s major competitor continues to grow

USDC is comparably more directly overseen by the regulators in the United States, and the growth of the Circle-backed stablecoin has seen continuous growth while USDT stagnated.

Circle recently announced a plan to get listed through a SPAC and also revealed that USDC would be expanded to another ten blockchains beyond Ethereum.

Although Circle’s stablecoin market capitalization still has a long way to go before catching up with that of Tether, USDC has been taking the lead in the decentralized finance sector. Over half of USDC supply has been locked in smart contracts, compared to Tether with just 20%.

Bitcoin price could see 7% dip before next leg up

Bitcoin price, although largely unmoved by the Tether probe, could still see a correction of around 7% before seeing another rally.

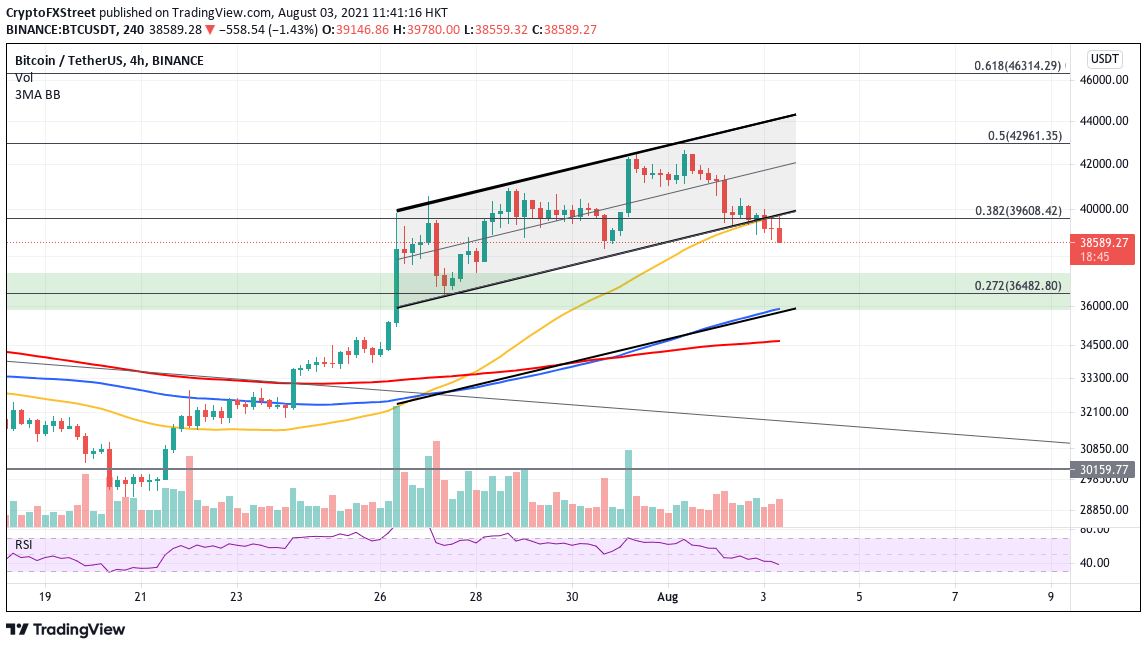

On the 4-hour chart, Bitcoin price has formed an ascending parallel channel but has since sliced below the lower boundary of the chart pattern, which suggests that it is now vulnerable to a move to the downside.

BTC/USDT 4-hour chart

The measured move for the leading cryptocurrency is 7%, tagging the downside trend line of the lower parallel channel, coinciding with the 100 four-hour Simple Moving Average (SMA) and the lower boundary of the demand barrier at $35,913.

However, this target would only materialize if BTC loses the upper boundary of the demand zone at $37,302 as support.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.