Tesla ditches Bitcoin as payment but may accept Dogecoin instead

- Dogecoin price plunged by over 25% in the past 24 hours, reaching a low of $0.38.

- DOGE fell in tandem with the rest of the crypto market following Elon Musk's announcement that Tesla is suspending vehicle purchases using Bitcoin.

- The meme-coin could be awaiting a recovery if Tesla decides to accept DOGE as payment instead.

Dogecoin price seems to be driven by Elon Musk. His appearance on "Saturday Night Live" disappointed investors, leading to a sell-off. Now, Musk could ditch Bitcoin and allow Tesla and SpaceX to accept payments in DOGE instead.

Tesla halts Bitcoin payments

Elon Musk has been pumping and dumping DOGE prices for over the past few months. Indeed, his recent appearance on "Saturday Night Live" served as a "sell the news" even for many investors. Dogecoin dropped by almost 50% since then to hit a low of $0.38.

The top cryptocurrencies by market capitalization also experienced a steep correction after Musk announced on Twitter that Tesla would no longer accept Bitcoin as payment for its vehicles. The billionaire entrepreneur cited effects on the environment due to fossil fuels for BTC mining and transactions.

Even though Tesla has ditched Bitcoin as payment, it is also not looking to sell any BTC on its balance sheet. It only plans to use the leading cryptocurrency as a medium of exchange once mining transitions to more sustainable energy. Musk said:

We are also looking at other cryptocurrencies that use less than 1% of Bitcoin/s energy/transaction.

Interestingly enough, Musk posted a poll on Twitter asking his audience whether or not Tesla should accept Dogecoin as a form of payment. The move coincides with SpaceX's decision to enable DOGE payments for a mission to the moon in 2022.

On-chain analyst Willy Woo pointed out:

Elon asks the community whether DOGE (proof of work coin, secured by energy) should be accepted by Tesla, and in the very next tweet announces Tesla is no longer accepting BTC due to energy reasons. Tell us what's really going on.

Dogecoin price on the spotlight

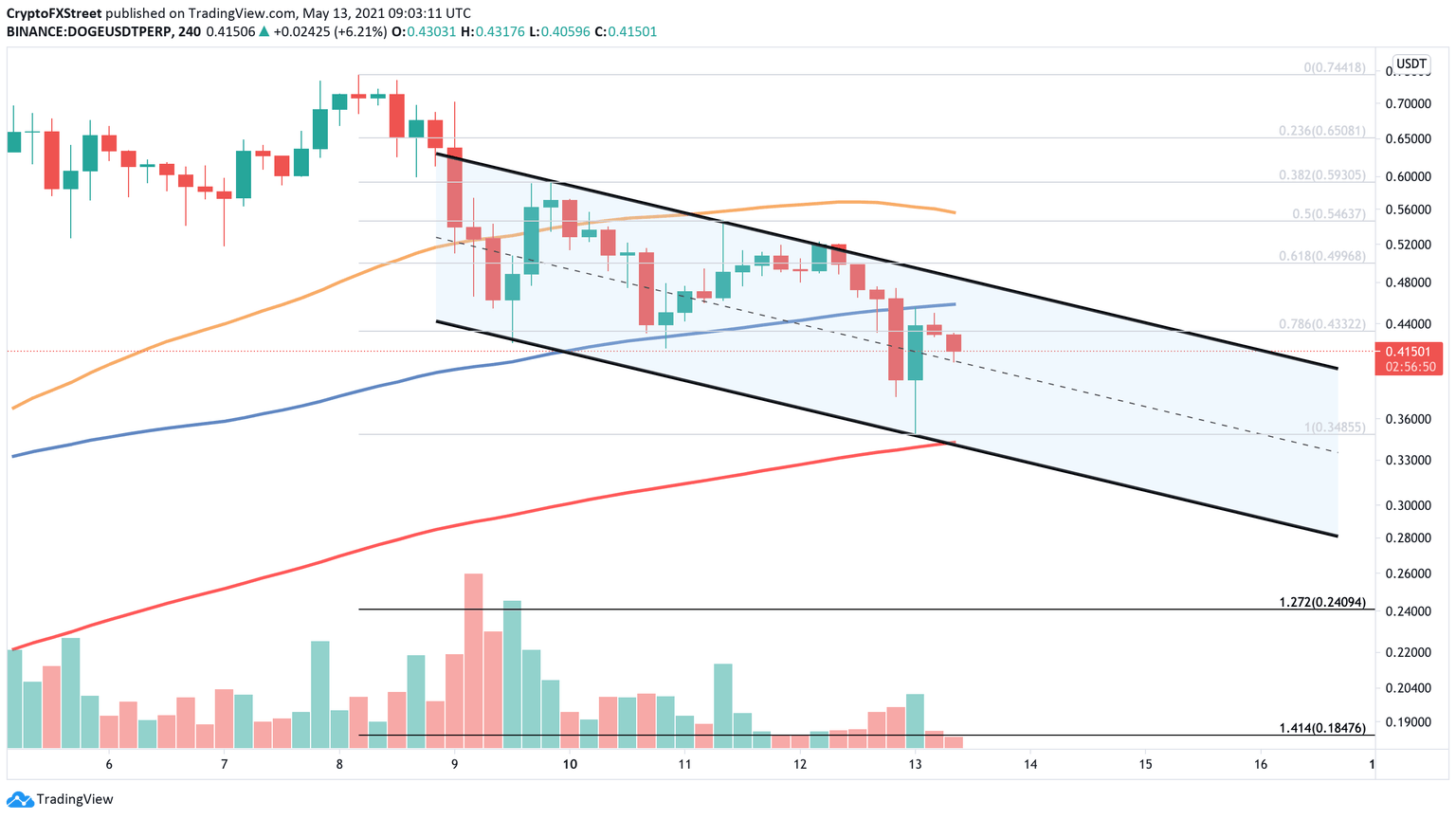

Speculation mounts around Dogecoin since Tesla could soon accept this cryptocurrency as a form of payment instead of Bitcoin. While the news may be bullish, DOGE price seems to be trading within a descending parallel channel on its 4-hour chart.

Dogecoin price must hold above the channel's lower boundary and the 200 four-hour moving average at $0.35 to keep speculators optimistic.

Failing to do so could see the meme-coin drop by another 30% to 46% toward the 127.2% or 141.4% Fibonacci retracement levels. These crucial areas of support sit at $0.24 and $0.18, respectively.

DOGE/USDt 4-hour chart

On the flip side, slicing through the channel's upper boundary and the 100 four-hour moving average at $0.47 may signify that Dogecoin price is poised to recover.

If DOGE manages to regain $0.47 as support, it would have to break through the 50 four-hour moving average at $0.56 to be able to march toward new all-time highs. It seems like the bullish scenario would depend on whether or not Tesla decides to accept Dogecoin as payment for its products.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.