Cross-chain integrations and the growing popularity of Terra’s UST stablecoin are just a few of the factors behind LUNA’s recent rally to a new all-time high.

Stablecoins are an integral part of the the centralized crypto sector and the decentralized finance (DeFi) ecosystems that have sprung up over the course of the past few years because they provide the liquidity needed for traders to easily swap into different assets. They also serve as a shelter against strong downside swings like the 25% correction seen on Dec. 3.

One project with a stablecoin component that has seen its price surge to a new all-time highs despite the wider market pullback is Terra (LUNA), a multi-sector blockchain protocol aimed at building a global payments system through the use of a fiat-pegged stablecoin called TerraUSD (UST).

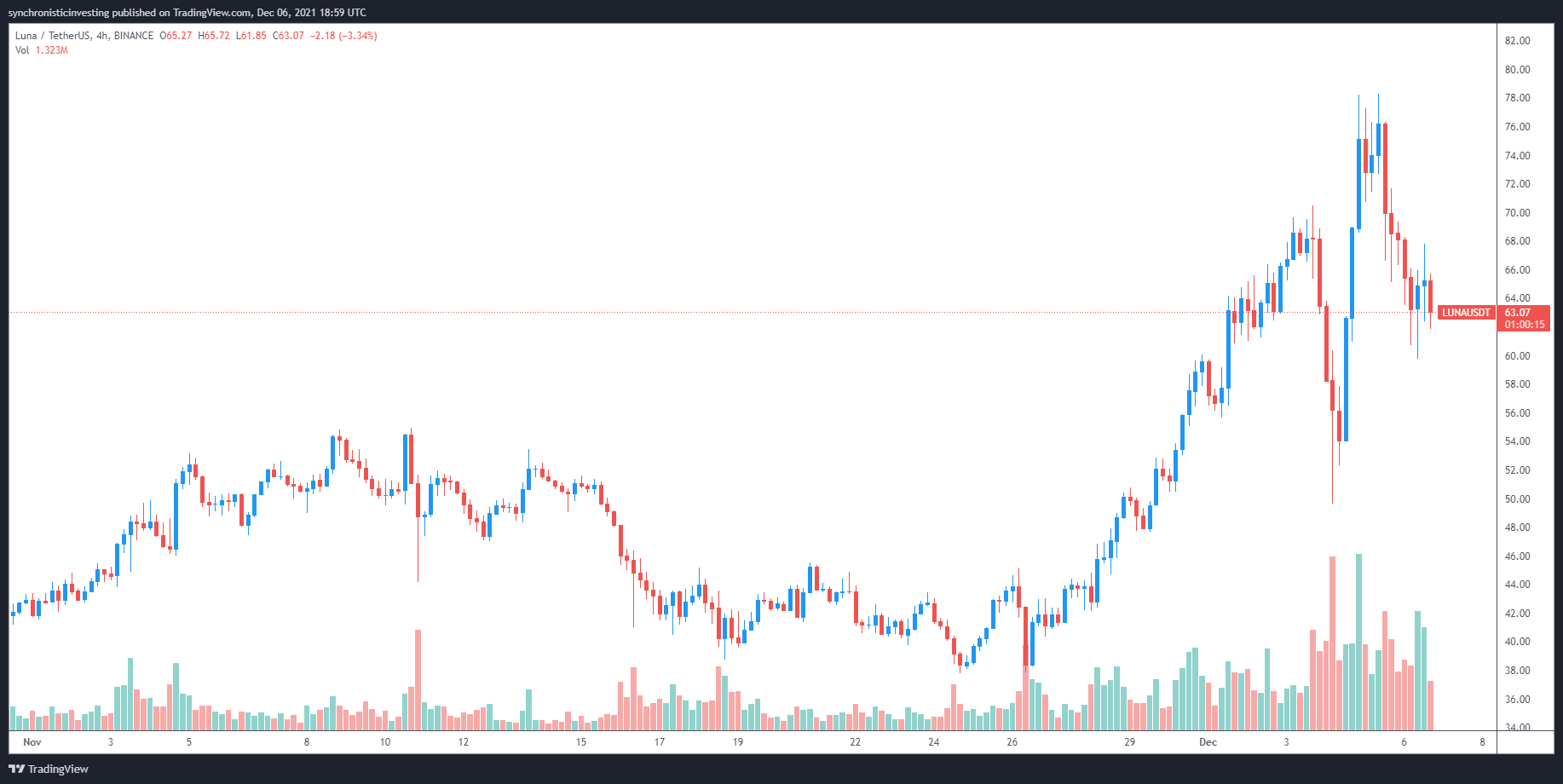

Data from Cointelegraph Markets Pro and TradingView shows since hitting a low of $37.86 on Nov. 26, the price of LUNA has surged 106% to a new all-time high at $78.43 on Dec. 5 as its 24-hour trading volume spiked to a record $5.66 billion.

LUNA/USDT 4-hour chart. Source: TradingView

Three reasons for the breakout in LUNA price include the increasing supply of UST, a series of new cross-chain integrations for the Terra ecosystem and a surging total value locked (TVL) on the Terra network.

UST supply hits a new all-time high

One of the main drivers behind the strength seen in LUNA has been the rapid growth of the circulating supply of UST, which is now the largest algorithmically-backed stablecoin in the market and the fourth-ranked stablecoin with a market cap of $8.221 billion.

Crypto proponents in favor of decentralized stablecoin options have embraced the use of UST in comparison to its more centralized counterparts USD Coin (USDC), Tether (USDT) and Binance USD (BUSD).

Crypto project @terra_money ( $LUNA ) has surged 50% in the last week to hit a new all-time high even with bitcoin down 5%

— Zack Guzmán (,) (@zGuz) December 2, 2021

Its algorithmically-backed stablecoin $UST has become the largest of its kind and keeps picking up Web3 adoption as THE DeFi dollar

Why that is huge ⬇️ 1/X pic.twitter.com/LSUeA9HgO6

As the popularity of UST grows, many in the field have begun referring to it as ‘The DeFi dollar’ because it embodies the ethos of decentralization and is slowly spreading across the multi-chain DeFi landscape.

Cross-chain integrations

LUNA is also available across a few cross-chain bridges, making it easier for LUNA holders to invest their in DeFi ecosystems on Ethereum (ETH), Solana (SOL), Fantom (FTM) and Polygon (MATIC)

In just 6 weeks, users have sent t$185mm+ of $UST and $LUNA through the @wormholecrypto . Top destination? @solana ☀️… Read more here on the proliferation of $UST, powered by @flipsidecrypto bounty program {⛓,} https://t.co/9nWww3dBin

— jack (@forgash_) December 4, 2021

Total value locked on Terra hits an all-time high

Increasing use of LUNA and UST pushed the total value locked on the Terra blockchain to a new all-time high at $14.36 billion on Dec. 5th and LUNA price hit a record-high on the same day.

Total value locked on the Terra network. Source: Defi Llama

The rapid rise in TVL has resulted in Terra becoming the third-ranked blockchain network in terms of TVL after it surpassed Solana, which has $12.08 billion in value locked on its protocol, while the top-ranked Ethereum network boasts a TVL of $164.72 billion and the Binance Smart Chain has $22.4 billion in value locked on its blockchain.

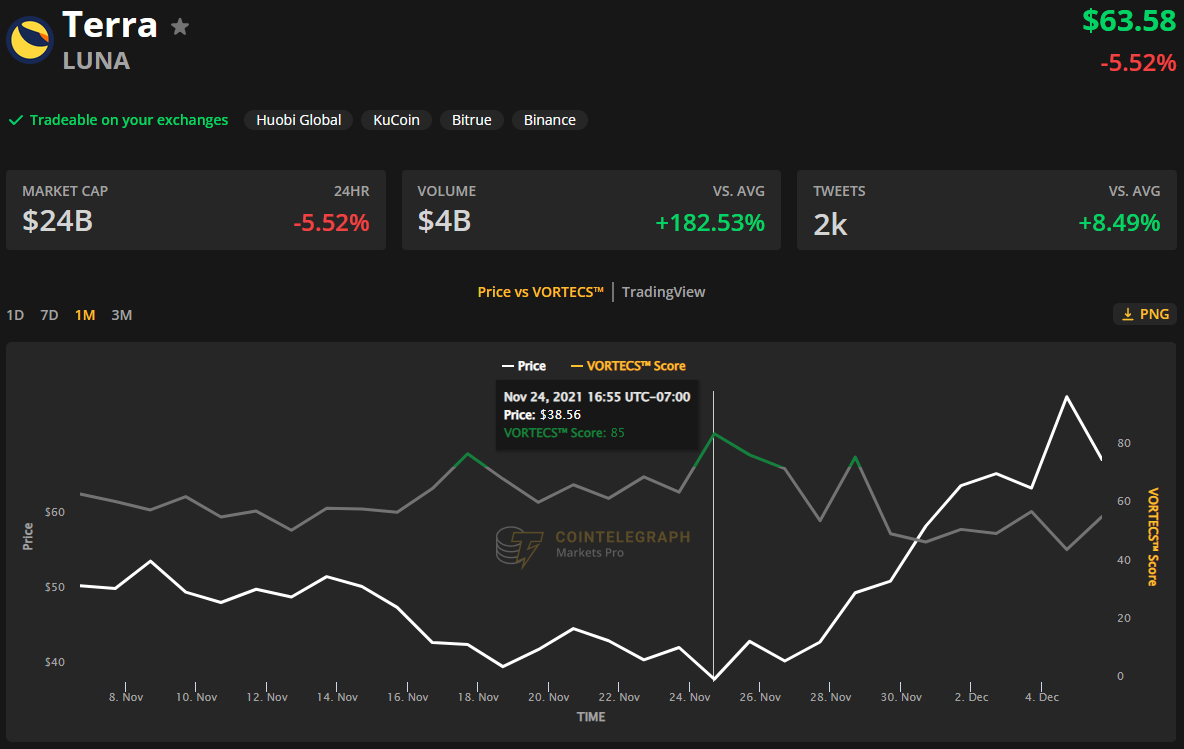

VORTECS™ data from Cointelegraph Markets Pro began to detect a bullish outlook for LUNA on Nov. 24, prior to the recent price rise.

The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historical and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

VORTECS™ Score (green) vs. CHZ price. Source: Cointelegraph Markets Pro

As seen in the chart above, the VORTECS™ Score for LUNA began to pick up on Nov. 24 and reached a high of 85 around the same time as the price began to increase 106% over the next eleven days.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.