Terra's Luna Classic price takes retail bulls to the butcher, here's how low LUNC could fall

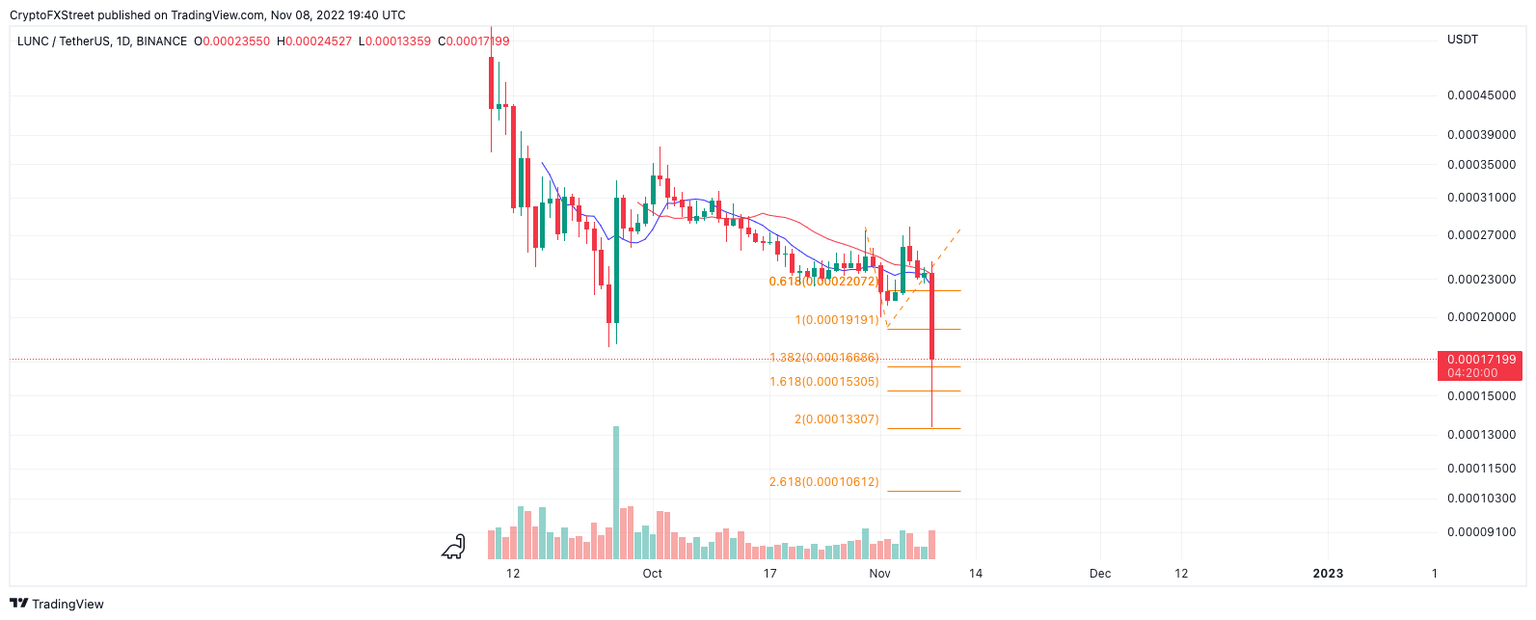

- Terra's LUNC price has lost 24% of its value in the last 24 hours.

- A sweep of the lows could wreak havoc on the future of LUNC.

- Invalidation of the downtrend move is a breach above $0.00022073.

Terra's Luna Classic price is witnessing a devastating market decline. Now that new yearly lows have been established for the LUNC token, the downtrend targets extreme levels below. Key levels have been identified to gauge Luna Classic's potential landing ground.

Luna Classic price falls sharply

Terra's Luna Classic price started the second week of November on a bad foot. On November 8, the digital currency experienced a jaw-dropping 25% decline and counting. The penny-from-Eiffel-style decline has breached the previous swing low established in September 2022 and now has zero levels of support to trust in below. As US midterm elections continue to bring in negative market sentiment around all digital assets, things could continue to get worse for the LUNC token in the days to come.

LUNCUSDT 4-hour chart

Invalidation of the bearish thesis could arise if the bulls reconquer the recent swing high at $0.0022073. In doing so, an additional uptrend move could occur targeting $0.00027000 liquidity levels. Such a move would result in a 50% increase from the current Luna classic price.

Here's how Bitcoin's moves could affect LUNA Classic price

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.