Terra Price Prediction: LUNA needs to overcome this barrier for new all-time high at $40

- Terra price has been trying to recuperate from losses after September 7 crash.

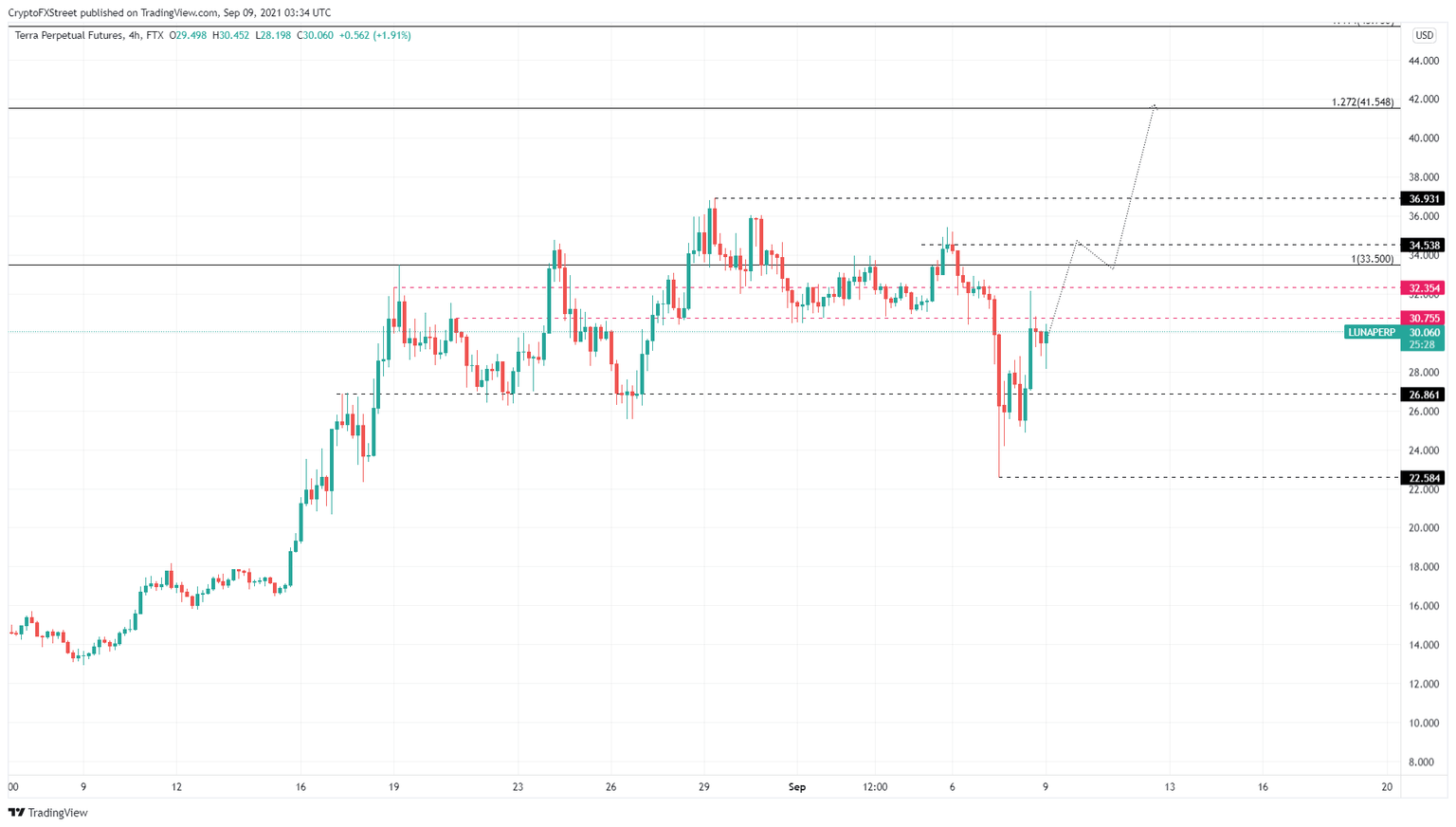

- LUNA needs to clear the $33.50 resistance level to have a chance of retesting the all-time high.

- A breakdown below $26.86 will invalidate the bullish thesis and trigger a downswing.

Terra price witnessed a massive dip after the September 7 crash, which undid half the gains seen over the past month. However, this crash was cut short due to buying pressure. Now, a recovery seems to be in progress.

Terra price eyes new all-time highs

Terra price dropped roughly 35% between September 6 and September 7. Almost half of the sell-off is already recovered due to the uptrend, and more seems to be on its way. While this is bullish, LUNA needs to produce a decisive 4-hour candlestick close above two barriers at $30.76 and $32.35 to face a stiff resistance level at $33.50.

If the bulls want to retest the all-time high at $36.93, the said barrier at $33.50 needs to be flipped into a support floor. This development will open up the space for LUNA bulls to not only retest the current all-time high but set up a new one.

A potential spike in buying pressure at $36.93 will push Terra price up by 12% to a new all-time high at $41.55.

LUNA/USDT 4-hour chart

Terra price has its work cut out for it. The bulls need to clear the $33.50 resistance level to have any chances of rising higher. However, failure to do so might result in a downswing to $26.86 support levels.

If this key demand barrier is breached with a 4-hour candlestick close below it, the bullish thesis will face invalidation. In such a case, LUNA might revisit the September 7 swing low at $22.58.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.