Terra price prediction: Is a dislocation between LUNA and the dollar about to happen?

- Terra price action is increasing intraday as market dynamics are shifting this Wednesday.

- LUNA price is set to pop higher as its price action starts to look decoupled from the US dollar.

- Expect to see a possible jump back to $0.0000115 in case $0.0000110 gets broken.

Terra (LUNA) price is set to jump massively on a technical breakdown in the correlation between LUNA price and the dollar. Usually the Terra price is inversely correlated with the dollar but at the moment the dollar index is up for the day and LUNA price action is gaining as well. With several central banks intervening and trying to break the strongness of the dollar, cryptocurrencies could see some more tailwinds emerge that should see LUNA price action push higher.

LUNA price set to jump 15%

Terra price action is a picture that could point to a big game changer in cryptocurrencies. During the European trading session, although the dollar index is stronger, the dollar itself is not up in all of its major pairs. Next to the yen and the yuan, for example, the dollar is weakening as several central banks are starting intervention to break the back of the greenback’s strength. This coordinated attack is triggering a decoupling in cryptocurrencies against the dollar, as LUNA price action jumps while the DXY gains points.

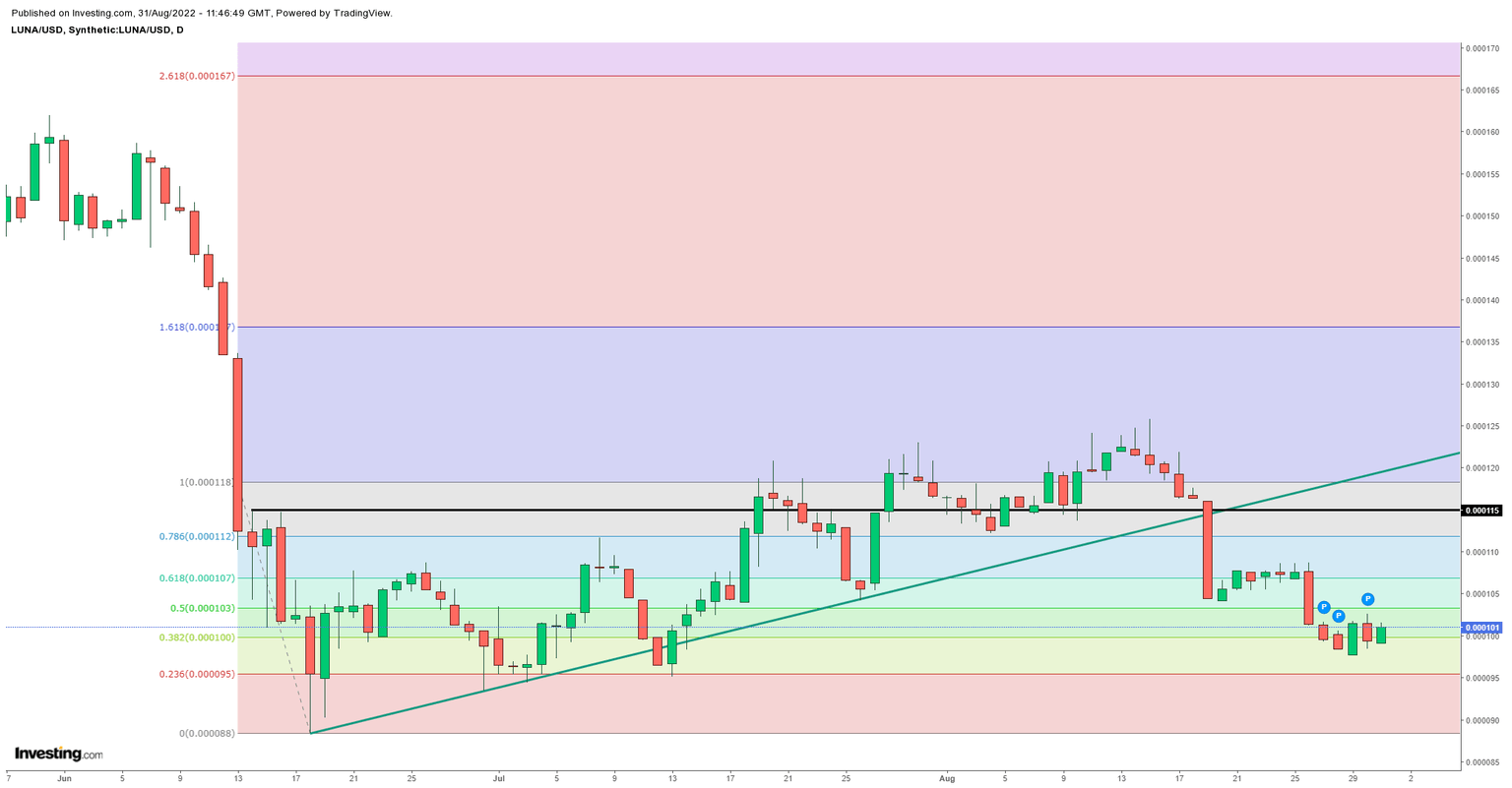

LUNA price could be set to move up quite rapidly as traders plot the Fibonacci levels and target them as possible profit taking and entry points. It would probably be best to go long either now or on a break above $0.000103, at the 50% Fibonacci level. From there, traders will want to strap in for the rally up towards $0.000115, which looks to be a given to be hit on the back of this big dislocation from the dollar.

LUNA/USD Daily chart

Risk to the downside, of course, comes with that same dollar strength as the dislocation from its usual correlation might be short-lived. In case the dollar reaffirms its grip on all major pairs, as well as cryptocurrencies, expect to see those pairs catch up on the counter move during the dislocated portion, which means more room to go to the downside. That would mean for Terra price, for example, a quick push back below $0.000100 towards $0.000095 or even $0.000088.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.