Terra Luna Classic volume slumps 20%, Terraform Labs Chris Amani replaces Do Kwon as CEO

- Terra Luna Classic trading volume is down 20% over the last 24 hours, bringing total monthly losses to 6%.

- The pessimism in the LUNC market comes as the COO steps up to replace Do Kwon, denying users a clean slate.

- Chris Amani comes in as interim CEO to help execute the firm's vision for Terra's role within the broader Web3 ecosystem.

Terra Luna Classic (LUNC) price is trading with a bearish bias, an action heavily attributed to recent developments within the Terraform Labs ecosystem. Based on recent reports, the firm has a new CEO after outgoing executive Do Kwon was sentenced in Montenegro.

Also Read: LUNC community calls for Binance CEO’s leadership as Terra Luna Classic price falls 25%

Terra Luna Classic trading volume slumps as new CEO steps in

Terra Luna Classic (LUNC) price is down 6% over the last month with a declining investor hype, as indicated by the 20% drop in LUNC trading volume over the last 24 hours. The pessimism comes from former CEO Do Kwon receiving his sentence in Montenegro to serve a four-month jail term in southeastern Europe. The minuscule sentencing has disappointed LUNC community members as it points to crypto-bad actors having it easy in the legal system.

so let me get this straight:

— Pepe Larp (@PepeLarp) July 19, 2023

-do kwon isn’t sentenced to life in prison (he has 4 months in montenegro but will likely flee after that)

-su and kyle are both free and scamming people again

wtf

Meanwhile, Terraform Labs has promoted former COO and CFO Chris Amani as Director and interim CEO, marking another concern for LUNC community members who anticipated a clean slate.

#Terraform Labs Names Chris Amani as New CEO Amid Do Kwon's Legal Challenges#Terraform Labs has announced the appointment of Chris Amani as its new CEO, as Do Kwon, the former CEO, is currently serving a prison sentence in Montenegro.https://t.co/Z2GB73j44i

— MyCryptoParadise.com (@iCryptoParadise) July 20, 2023

Even so, Amani boasts a strong professional tenure, having served as CEO of business software startup Humanity. He joined Terraform Labs in December 2021 and has since committed to developing applications with real utility. The firm now has a lean team of 40 staff in its employee registry, 15 of whom are diehards, having stuck with the firm since before the May 2022 crisis.

Do Kwon had relinquished his CEO role in March before his arrest in Montenegro's Podgorica Airport, citing the need to focus on legal matters. In case you missed it, he was headed to Dubai, but falsified travel documents brought him to the authority's radar, causing his arrest after months of pursuit.

While both the US and South Korea have called for Kwon's repatriation so that he is arraigned in these countries, Montenegro has not complied, given that the country lacks a direct extradition treaty with either.

Do Kwon, who faces many charges ranging from tax fraud and investor deception to racketeering and forgery, still owns up to 92% of shares at Terraform Labs. Despite the tense legal battle facing the crypto billionaire, the firm has committed to reinventing itself.

We have 3 projects on the shelf, close to complete, looking for teams to finish off and launch on Terra. If you have a team to take one and want to learn more, let @mc_ust know.

— Chris Amani (@fleece_cannon) July 20, 2023

Terra Luna Classic price forecast as interim CEO takes the wheel

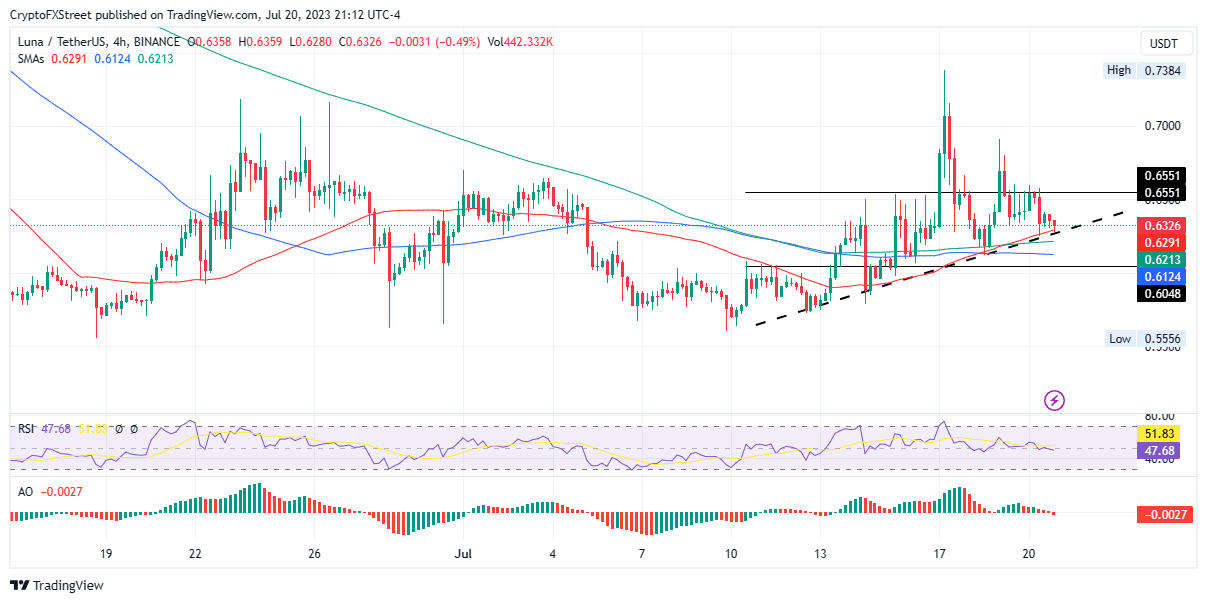

Terra Luna Classic (LUNC) price is testing the crucial support confluence offered by the ascending trendline and the 50-day Exponential Moving Average (EMA) at $0.629. This exposes LUNC to the risk of an extended slump if the support breaks.

Two momentum indicators, the Relative Strength Index (RSI) and the Awesome Oscillator (AO), support the downside. For one, the RSI is tipping south to show falling momentum, while the AO is in the negative zone to establish a bearish foothold of Terra Luna Classic price.

A decisive break below the lower boundary could see Terra Luna Classic price break below the 100- and 200-day EMA at $0.612 and $0.621, respectively, to pivot at the $0.604 buyer congestion zone, levels last tested around mid-July.

LUNC/USDT 4-hour chart

Conversely, if buying pressure increases, Terra Luna Classic price could sustain above the ascending trendline to tag the $0.655 resistance level. A decisive flip of this supplier congestion zone into support would increase the odds of a continued uptrend.

However, the bullish thesis would be confirmed upon a strong 4-hour close above the psychological $0.682 level.

Like this article? Help us with some feedback by answering this survey:

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.