Terra hits new record in total value locked ahead of 10% of LUNA supply burn

- Terra money ecosystem got its first play-to-earn game Flokiverse that offers passive income to players.

- Over 100 projects are lined up for launch on the Terra network, a new wave of TeFi.

- Proposal 128, to initiate IBC on Terra, has passed; DeFi interchain highways for Cosmos ecosystem have arrived.

The Terra network has key updates lined up and expects over 100 projects on the blockchain. Proponents refer to the new projects as TeFi and share a bullish outlook on LUNA.

Terra boosts interoperability with Cosmos ecosystem, increases UST utility

Terra's Inter-Blockchain Communication (IBC) is now live. Protocol 128 allows sovereign chains to communicate with each other and enables interoperability with blockchains like Cosmos. Proponents expect the company's stablecoin UST to witness a spike in utility and on-chain activity as it powers the transfer of tokens between blockchains that adopt the protocol.

Ahead of IBC's launch, Terra hit a key milestone by welcoming Wormhole to its network. The Wormhole cross-chain bridge enables Terra's native assets to be transferred to Binance Smart Chain, Ethereum and Solana. The supply of UST is likely to expand and adjust to the growing cross-chain environments and asset interchange in the network.

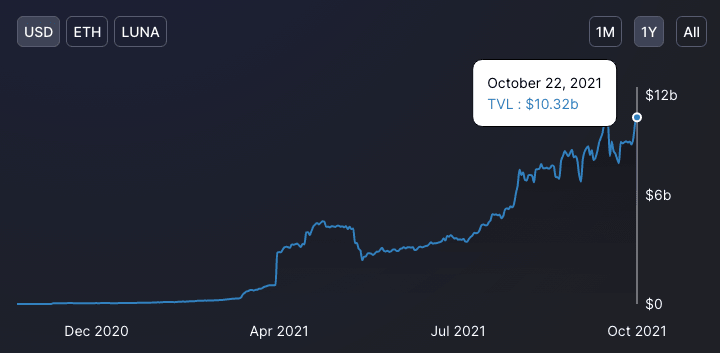

Total value locked on Terra has hit a high of $10.32 billion based on data from decentralized finance data aggregator "DeFi Llama." The top 4 protocols on the network, Anchor, Lido, Mirror and Terraswap, contributed $9.62 billion and together, accounting for 93% of Terra's TVL.

Total value locked in Terra.

Terra ecosystem's metaverse has its first play-to-earn game, "Flokiverse." The game is based on an NFT-as-a-subscription-model.

The game features 1020 planets, and the players are expected to earn by renting the planets to other players. With the rise in popularity of passive income generation through play-to-earn games, Flokiverse is set to further boost Terra network's TVL.

Interestingly, Do Kwon, Founder and CEO of Terraform Labs, revealed that proposal 44 would be upheld for burning 90 million LUNA (nearly 10% of the supply) in the community pool next week. The shortage in LUNA supply is likely to trigger a rally in the altcoin's price.

Next week, we will uphold @terra_money signal prop 44 and initiate a proposal to burn 90M Luna in the community pool to mint $UST for Ozone.

— Do Kwon (@stablekwon) October 22, 2021

This will reduce Luna total supply by 90M, and increase $UST supply by roughly 3-4 billion. pic.twitter.com/Wahn9IWNoK

@Taner_Crypto, a cryptocurrency analyst and YouTuber, has evaluated the LUNA price trend. He predicted that the altcoin would hit a new all-time high if it survives the retracement at $45.19.

The all important .702 retracement comes in at $45.19 for $LUNA

— Taner (@Taner_Crypto) October 22, 2021

If we can get an hourly close above this, we should get sent to new ATH's pretty quick. Exciting times for $LUNA pic.twitter.com/uGLrqlKDrF

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.