Terra Classic (LUNC) has been one of the crypto market’s standout performers this week, with the token’s price up over 14%.

Although LUNC is still 99.9% below its 2022 all-time high, some traders speculate that the token could be on the brink of an extended bull run.

However, many in the crypto market are still opting to steer clear of Terra Classic – instead focusing on other penny cryptocurrencies that could provide a pathway to higher returns.

Troubled Terra Classic shows signs of potential resurgence

At the time of writing, Terra Classic’s price is hovering around the $0.000064 level, with daily trading volume up 164% in the past 24 hours.

This puts LUNC in 47th place in CoinMarketCap’s list of the most-traded cryptocurrencies – an impressive feat considering the token’s troubled history.

As the original native token of the Terra blockchain, LUNC was previously used to maintain the price stability of several stablecoins, including the ill-fated UST.

However, as most investors know, UST lost its peg to the US dollar in May 2022, which resulted in the collapse of LUNC.

This led the Terra community to split the blockchain into two chains, with the old chain rebranded as Terra Classic and retaining the LUNC token.

Notably, one key difference is that the Terra Classic chain no longer uses algorithmic stablecoins, but instead relies on collateralized stablecoins.

With this context in mind, it’s difficult to say what’s next for LUNC, considering it now has to compete with the new Terra chain, which uses the LUNA token and has more developer support.

Additionally, LUNC is in a constant battle to restore the confidence of the broader crypto market, given that the vast majority of investors lost trust in its stability following 2022’s crash.

LUNC even has to contend with regulatory scrutiny, with the SEC and other organizations looking to implement new laws that could further impact the token’s standing in the market.

Despite these challenges, the uptick in trading volume and price suggests some interest in LUNC may still exist.

Moreover, with the Terra Classic Telegram channel containing over 79,000 members, it’s evident that a substantial community is still intrigued by the project’s future – which could be a critical factor in LUNC’s potential to rebound.

Which other Penny cryptos should investors watch?

With Terra Classic’s future still highly uncertain, many investors are seeking alternative penny cryptos with clearer price prospects.

Two emerging contenders in this regard are TG.Casino and Meme Kombat – both in the midst of limited-time presale phases.

Brand-new GambleFi Token TG.Casino aims to revolutionize gambling through telegram integration

TG.Casino (TGC) is a new and innovative project that aims to revolutionize the world of crypto gambling by using the power of Telegram messenger.

The casino is fully licensed by Gaming Curacao, with its smart contract audited by Coinsult, providing a security level often lacking in the gambling space.

One of TG.Casino’s key selling points is its no-KYC approach, meaning users can instantly deposit and begin gaming anonymously, with no need for lengthy checks or registration processes.

The casino also offers a massive number of slot machines, table games, live dealers, and sports betting markets for users to enjoy.

Underpinning the entire TG.Casino ecosystem is TGC, the platform’s native token.

By holding TGC, users can stake their tokens and earn high yields, which currently exceed 1,860% per year – although this figure will drop as more tokens are pledged.

As outlined in TG.Casino’s whitepaper, the casino will also buy back TGC tokens using a portion of its profits, and these tokens will then be burned, reducing the total supply of TGC and increasing the value of the remaining tokens.

The presale of TGC only began on September 21, yet it has already raised over $230,000 in early investment.

With TGC tokens on offer for just $0.125, many believe this penny crypto could be primed for colossal growth once listed on exchanges later this year.

Trending Meme Kombat platform offers unique staking & P2E rewards

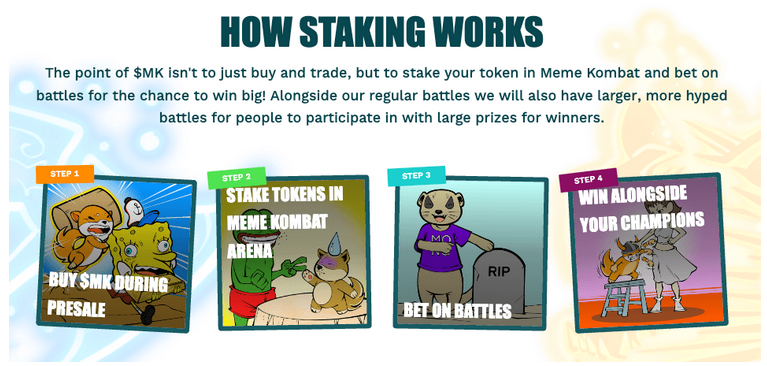

Another penny crypto that investors are watching is Meme Kombat (MK), a brand-new project looking to combine the appeal of meme coins with the groundbreaking technology of blockchain gaming.

By using the power of the Ethereum network, Meme Kombat aims to create an engaging gaming experience, with users able to bet on AI-powered battles between well-known meme characters like Wojak and Pepe the Frog.

Wagers are placed using MK, Meme Kombat’s native token, which can also be staked to earn high APYs.

According to Meme Kombat’s staking dashboard, the staking yield is currently set at 112% per year, with users able to stake and wager their MK tokens simultaneously – providing two sources of potential income.

Importantly, Meme Kombat’s development team is led by Matt Whiteman, who is fully doxxed and has extensive experience within the Web3 space.

Meme Kombat has also passed a thorough Coinsult audit, with no issues reported in the smart contract’s code.

Since the Meme Kombat presale started last week, the project has raised over $110,000 - and with MK tokens priced at just $1.667, it's positioning itself to be a breakout star in the crypto gaming space.

This is a sponsored post. The opinions expressed in this article are those of the author and do not necessarily reflect the views of FXStreet. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts.

ETF News provides quality insights in the form of financial guides and video tutorials on buying and investing in stocks. We compare the top providers and provide detailed insight into their product offerings. We do not advise or recommend any provider but want to enable our readers to make informed decisions and trade on their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss for your capital. Up to 67 % of retail investor accounts lose money trading with the brokers compared on this website. Please make sure you fully understand the risks and seek independent advice. By continuing to use this website, you agree to our Privacy Policy.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.